What is Bitcoin and should you invest in it?

I’m answering both of those questions today, in plain English!

My goal is to help retirement investors make an informed decision about investing in Bitcoin.

So if you want to learn about this asset class and decide if it’s a good fit for your portfolio, this post is for you.

What is Bitcoin?

Bitcoin is a crypto-currency used by online firms and big businesses worldwide.

One of the biggest advantages of Bitcoin is that the currency can quickly and easily cross international borders.

For the purposes of investing, Bitcoin is similar to any other currency (or commodity) investment.

This means, when it comes to your investment return, Bitcoin faces the same uphill battle as investing in:

- Gold

- Agricultural products

- Fine art

- Oil

In other words, at any given time, Bitcoin is worth whatever the market says it’s worth. While this isn’t a problem in itself, investing in Bitcoin does pose some specific challenges.

Investing in Bitcoin: Two Challenges You’ll Face

As sexy as investing in Bitcoin sounds – and despite the recent run-up in price – there are at least two fundamental problems with investing in Bitcoin right now.

Problem #1: You May Lose Money After Inflation (Negative Real Returns)

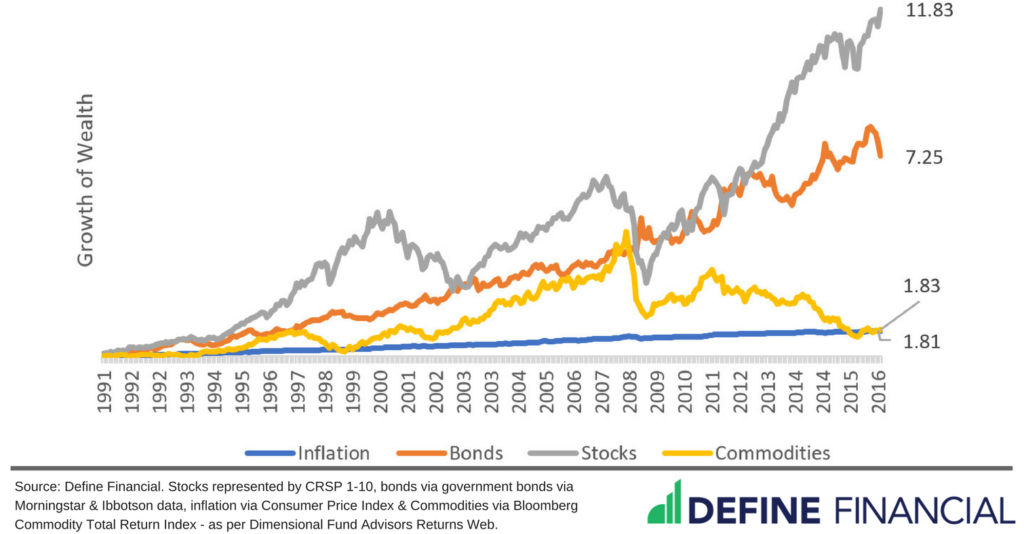

When you invest in Bitcoin (or gold, or the price of oil, or other commodities, or any other currency, or fine art), you are betting the farm on price appreciation alone. Or rather, you’re betting that the price of Bitcoin will go up compared to the U.S. dollar. What this means is, Bitcoin is different from more conventional investments like stocks, bonds, and real estate. That’s because conventional investments offer the chance to generate cash.

As an example, stocks are a slice of business ownership. Businesses exist to earn a profit. As an owner of that business, you are entitled to a slice of that profit.

That profit can either be re-invested into the business (to increase the value of the business) or paid to investors as a dividend. Either way, a stock generates cash – ultimately enriching those who own stock.

The same is true for bonds. Bonds spit out cash (usually twice a year). With a bond, you (usually) get back your original investment plus interest.

The same applies to real estate. Rental property can appreciate (or depreciate in price). But, either way, rental property exists with the goal of generating cash for the investors – cash above and beyond the costs to maintain the property.

Unfortunately, that’s not the case for Bitcoin, gold, “Forex,” commodities, or fine art. These sorts of investments do not generate cash. Instead, investors can only hope they increase with the price of inflation.

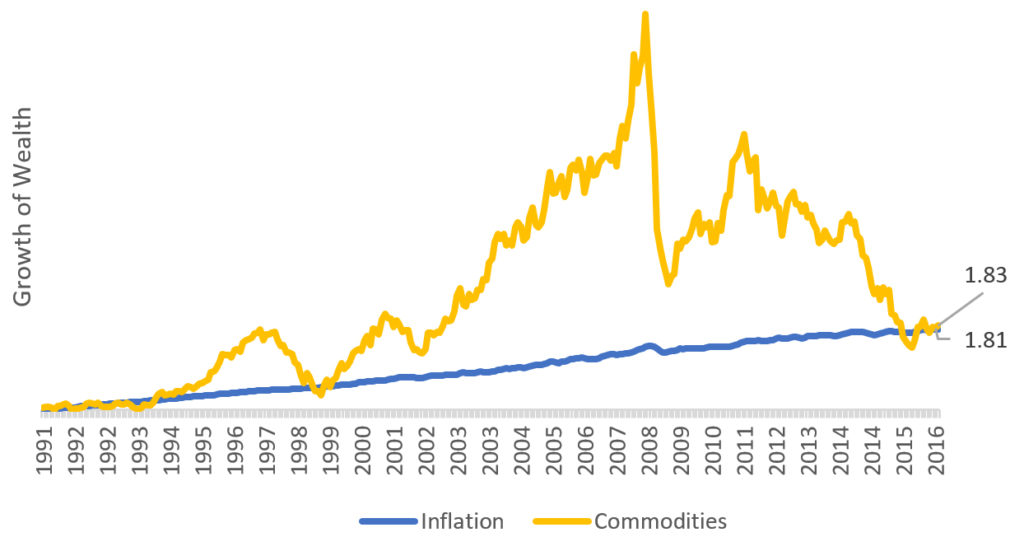

Despite their volatility, commodities do not outpace inflation. And that’s before fees!

Not only must your investment appreciate at the rate of inflation, but it must also go above and beyond inflation to make up for the transaction costs. Trust me when I say this is rarely the case. Most commodities increase at the rate of inflation. Further, currency doesn’t increase in value at all – because that’s exactly what inflation is – a decrease in the value of currency!

On average, economies grow. A growing economy can raise the demand for goods and services. This can cause prices for said goods and services to increase. Moreover, entities issuing currency usually ‘print’ more currency. This devalues that currency, requiring more of the same currency to be required for the same good or service.

These two factors – a growing economy and the printing of more money – can cause inflation. Therefore, an investment in currency, by its nature, should not be able to grow with inflation. So, not only does your investment in currency lose money because of inflation, but your investment also loses from the bid/ask spread – the price of buying into a different currency.

Bitcoin proponents make the case that Bitcoin will indeed grow above inflation. Proponents of Bitcoin claim that it is a “deflationary currency.” And so far, that looks to be the case. Of course, with only a short timeline since Bitcoin has been around, it may be hard to make that case definitively. This is unlike stocks, which have been around for centuries.

In short, Bitcoin and similar investments are at a big disadvantage when it comes to generating an investment return. Bitcoin doesn’t generate cash like stocks, bonds, and rental real estate does – and it has the added challenge of never even being able to keep up with inflation!

Problem #2: Mean Reversion

Mean reversion is a fancy way of saying:

what goes up, must come down – and vice versa

All investments are subject to mean reversion, and Bitcoin is no exception. Mean reversion itself isn’t a bad thing, but it’s still worth noting when it comes to investing in Bitcoin specifically.

As mentioned and shown in the graph above, commodities provide an investment return at the just about the rate of inflation – before fees. Moreover, commodities depend upon price appreciation alone to provide an investment return. This is because commodities do not generate cash.

Past performance is no guarantee of future returns.

So, if you are going to get an investment return from Bitcoin, you don’t want to be buying at a market top. However, recent run-ups in price suggest that it’s possible we are at the top of the Bitcoin market – or, at least on the way.

Pro Tip: Invest as Much Money as You Can Stand to Lose

The creator of Ethereum, Vitalik Buterin:

Reminder: cryptocurrencies are still a new and hyper-volatile asset class, and could drop to near-zero at any time. Don’t put in more money than you can afford to lose. If you’re trying to figure out where to store your life savings, traditional assets are still your safest bet.

— Vitalik Buterin (@VitalikButerin) February 17, 2018

Try thinking of investing in Bitcoin as you would buy a lottery ticket. It only costs a dollar, but you could win big. However, as historically shown with commodities, the odds are good that you’re going to lose money compared to a low-cost diversified investment.

Most of the time, you’ll be a lot better off if you choose a long-term investment strategy that isn’t quite so volatile. You should also diversify as much as you can; this way, you won’t lose your shirt if one particular investment falls apart.

If you choose to throw your money into Bitcoin in spite of this advice, just know you’re doing so at your peril. The best thing you can do is limit your investment to an amount you can afford to lose, then brace yourself for a long and bumpy ride.

A Final Warning on Cryptocurrency: Look Out for Security Holes

Yes, Bitcoin is a volatile investment that may very likely be a bubble. For that reason, you could lose most (all?) of your investment. But, in addition to Bitcoin being a risky investment for all the reasons that investments can be risky (i.e. volatility), Bitcoin and other cryptocurrencies suffer from additional security challenges that traditional investments (such as plain vanilla stocks and bonds) do not.

Instead of the usual investment risk of your principal decreasing in value, with cryptocurrencies, you may lose your crypto assets entirely. In addition to price volatility, investors in crypto assets have lost money because of:

If you want to learn more about the security risk of investing in Bitcoin, check out this podcast.