In the world of money management, financial advisors are apt to use all sorts of over-the-top jargon.

They could use everyday terms to explain what they mean, but that’s usually boring.

I’m going to do something different and tell you that boring money management is usually the best money management. Why?

Because you’ll make more money that way.

| Financial Advisor | # of Clients | Minimum Fee | Expertise | Services |

|---|---|---|---|---|

| Define Financial | 101 | $12,000 | Aged 50+ (Retired or Nearing Retirement) |

|

| Next Gen Financial Planning | 185 | $1,800 | Gen X & Gen Y | |

| Stone Steps Financial | 113 | $7,500 | Families, Professionals, and Entreprenuers |

Key Takeaways

-

Boring financial habits like saving, budgeting, and investing in index funds are often the most effective

-

Exciting investments usually carry more risk and often lead to worse outcomes

-

A steady and simple approach to money is the best way to build long-term wealth

Why Boring Is So Good For You

Financial advisors love to use fancy terms, but most of the time, it can be explained in more everyday language.

I’ll spare you by not listing every piece of jargon here, but I do want to talk about one term.

The word of the day is correlation.

Wait! Don’t close your browser just yet! Correlation isn’t as complex a word as the character count would suggest. Correlation simply means that two things move together.

Imagine a couple who is holding hands. The couple is strolling through a park. These two people are walking together, side-by-side. When one goes left, the other goes left; when one turns right, the other turns right. The two people move together. Their movement is correlated.

Here are other examples of correlation:

- Exercise and health

- Savings rates and wealth

- Success in life and the ability to delay gratification

When two things are correlated, they’re intertwined. When one goes one way, the other follows.

And there tends to be a strong correlation between how good for you something is, and how boring it is. It’s a pretty important point, so allow me to say it again in a different font:

Boring = Good for You

I’m sorry to say it, but it’s true. Boring is good for you.

A healthy diet can be the perfect example of this. Cutting out dessert and eating more broccoli is not fun (if you don’t enjoy it). But, it will help you control your weight and reduce the chances you’ll get diabetes, cancer, heart disease, and any number of other ills.

Now, let’s flip it around; let’s look at some exciting stuff to see the opposite effect.

Banana splits for dinner? That sounds pretty fun! Sign me up. Is it good for you? Of course not!

Being Boring With Your Money Builds Wealth

When it comes to boring is good for you, there’s no place more important than your money. Don’t believe me? Consider:

- Saving money is pretty darn boring – it’s much more fun to spend it.

- Tracking your spending might be about as much fun as watching paint dry. But it’s insanely good for your wealth. After all, tracking your spending is the best way to reach all your financial goals.

- Maxing out your 401(k) is good for your future (and also one of the easiest ways to save money), but it certainly leaves you with less cash for the weekend.

Exciting Investment? Run Far Away!

And of course, the idea that boring is good for you applies to investing. Putting your cash into a low-cost, plain vanilla index fund and forgetting about it is boring. That’s undeniable.

But boring investing is one of the best ways to build wealth. Index funds may not excite you. But, index funds let you earn stock market investment returns over time — all while avoiding hefty fees.

- Investing in individual stocks can be extremely exciting, right? Unfortunately, it has been proven time and again that individual investors typically do not beat the market. If your investments are exciting, they’re not really investments. You’re probably just gambling.

- Take BitCoin. Remember how much excitement was building as the value of a single Bitcoin surged up to $20,000? Now Bitcoin is on the verge of being worthless.

- Anything on Mad Money is hilariously entertaining. But, a (boring) scientific analysis shows that Jim Cramer is similarly hilariously bad at investing.

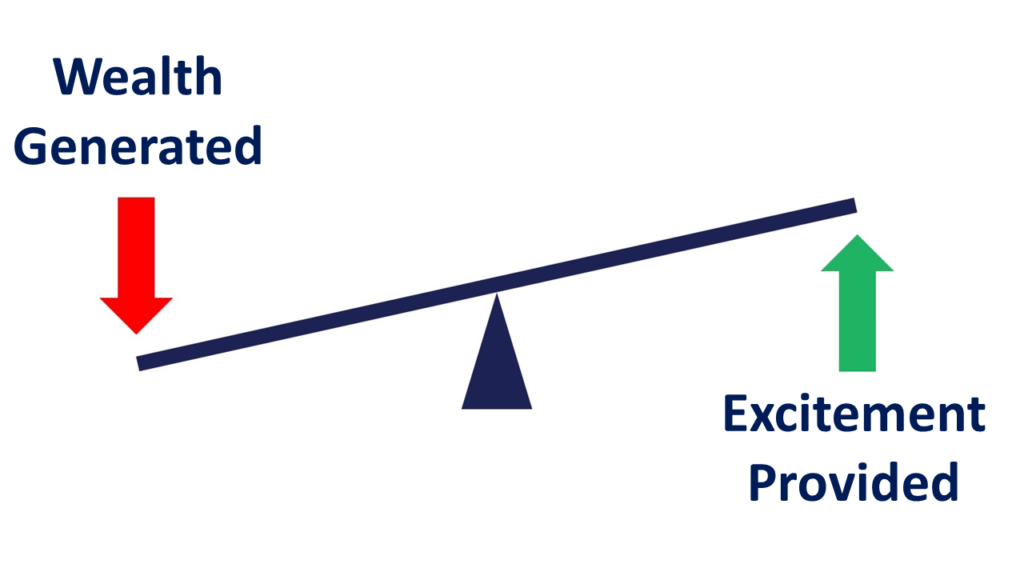

In short, the more exciting an investment is, the worse it probably is for you, and the farther you should stay away from it.

The Bottom Line: Boring Finances Win Every Time

When it comes to money, there’s a strong correlation (relationship) between actions that put you to sleep but also improve your life.

In order for you to actually succeed in reaching your financial goals, you need to come up with a very boring game plan:

- Track your expenses.

- Save more money.

- Stick with low-cost investments that you hold forever.

If you need some excitement in your life, there are plenty of ways to build in some drama without wrecking your finances.

Take up skydiving, get your scuba diving certification, or learn how to command a sailboat on your own.

Take chances with your personal life, but keep your finances on the boring side. Over time, your future self will thank you.