Retirement Planning

Retirement Planning

Our retirement planning services help you reach your goals without the risk of running out of money.

We want to give you confidence and clarity so you can spend time doing the things that are most important to you.

Our retirement planning process includes:

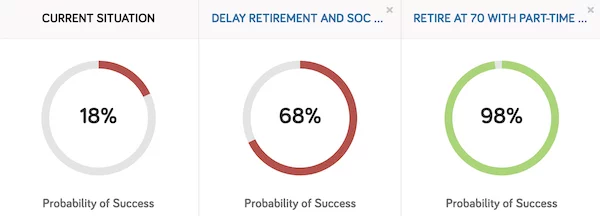

- Improving and tracking the success rate of your plan

- Turning your retirement savings into a reliable paycheck

- Developing a cohesive investment strategy to reduce risk and improve returns

- Ongoing tax planning to reduce your tax bill

- Aligning all the moving parts of your financial life to create a successful retirement

A retirement plan is a living and breathing document. We use an advanced financial planning software to build your plan, track its success rate, adjust for life's unknowns, and communicate the results with you in plain English.

👉 Want to learn more about how we create retirement plans? Click here to get your Free Retirement Assessment.