If you’re retired or planning to retire in the next decade, Congress recently made decisions that directly affect you and your financial future.

On July 4th, 2025, lawmakers passed the “One Big Beautiful Bill Act”—an 870-page economic package that touches nearly every aspect of your financial life:

- Income Taxes

- Social Security

- Medicare

- Estate Planning

- Small Business Taxes

- And Much More!

This legislation has sparked intense debate, but as Certified Financial Planners, our role is to cut through the noise and clearly outline how these changes affect your hard-earned money.

If you’re like most people and have better things to do than read 870 pages of Congressional jargon, we’ve got you covered!

Key Takeaways

-

The bill extends Trump-era tax cuts, raises standard deductions, and adds a new “Senior Bonus Deduction” for retirees age 65 and older.

-

Social Security remains taxable, while SALT deduction limits are temporarily increased and still subject to income phase-outs.

-

Medicare enrollees still cannot contribute to HSAs, and estate tax exemptions are expanded, reshaping long-term planning strategies.

1.) Tax Cuts and Higher Standard Deductions Are Extended (At Least for Now)

In 2017, the Tax Cuts and Jobs Act (TCJA) lowered federal income tax rates across the board.

However, these tax cuts were not permanent and were set to expire at the end of 2025.

The One Big Beautiful Bill (OBBB) just removed the expiration date and extended the reduced tax brackets and higher standard deductions.

While the reduced tax brackets will remain the same, the standard deduction has been increased slightly for 2025.

2026 Standard Deductions

As a refresher, the standard deduction is the amount of money the government allows you to subtract from your income before calculating the tax you owe. This lowers your taxable income, which means you’ll pay less in taxes.

Here are the updated standard deduction amounts for 2025, depending on your filing status:

- Married Filing Jointly: $32,200

- Single: $16,100

- Head of Household: $24,150

The One Big Beautiful Bill states that these tax cuts (and others) are “permanent,” but this only means that altering them will require a future administration and an act of Congress.

2.) Social Security Remains Taxable

President Trump has long discussed eliminating taxes on Social Security benefits.

However, the One Big Beautiful Bill did not eliminate taxes on your Social Security benefits as many had hoped.

The IRS will continue to use the same formula it has used for the past 40 years to determine how much of your Social Security income is taxable. And, unfortunately, the income thresholds have not been adjusted for inflation throughout the entire period.

Depending on your income, anywhere from 0% up to 85% of your Social Security benefits can still be taxable.

While the Social Security taxability formula remains unchanged, the One Big Beautiful Bill attempts to help offset the continued tax on Social Security benefits by introducing a new “Senior Bonus Deduction.”

3.) “Senior Bonus Deduction” of $6,000 (Age 65+)

The new “Senior Bonus Deduction” of $6,000 per person is available to taxpayers aged 65 and older, effective for the 2025 tax year.

This bonus deduction is in addition to the 2026 standard deduction and the existing age 65+ additional deduction that were available prior to the passing of the One Big Beautiful Bill.

And what makes it really unique is that you can apply it whether you take the standard deduction or itemize your deductions.

To keep the math simple, the two hypothetical examples below assume the taxpayer(s) is taking the standard deduction.

Example #1 – Married Filing Jointly (Age 65):

- 2026 standard deduction: $32,200

- Existing age 65+ additional standard deduction: $3,300

- NEW age 65+ “senior bonus” deduction: $12,000

- Total standard deduction age 65+ in 2026 = $47,500

Example #2 – Single (Age 65):

- 2026 standard deduction: $16,100

- Existing age 65+ additional standard deduction: $2,050

- NEW age 65+ “senior bonus” deduction: $6,000

- Total standard deduction age 65+ in 2025 = $24,150

The “Senior Bonus Deduction” will be available until 2028 and is not a permanent feature of the bill.

This means you have four years to take advantage of this deduction, creating some unique financial opportunities.

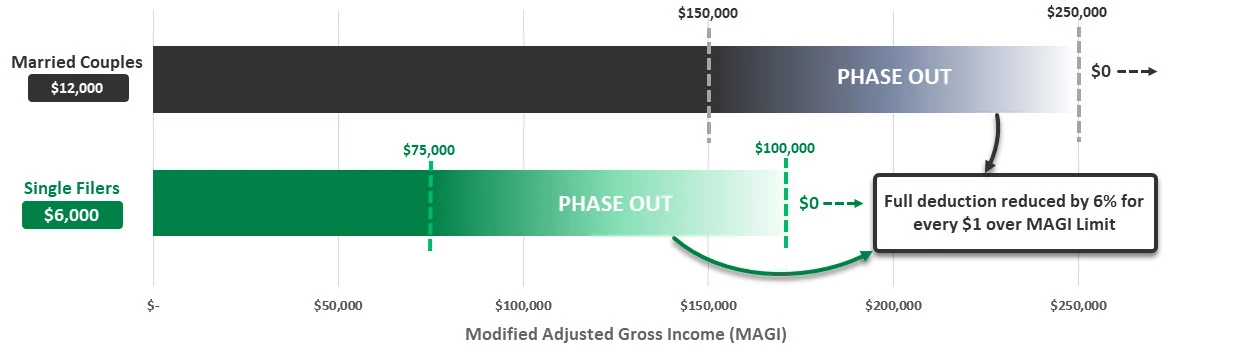

Lastly, this new bonus deduction phases out at $150,000 of Modified Adjusted Gross Income (MAGI) for joint filers and $75,000 for single filers.

It is reduced by 6 cents per dollar over the phase-out limit and is completely eliminated if MAGI exceeds $250,000 for joint filers and $175,000 for single filers.

4.) SALT Cap Temporarily Increased (With a Catch)

The SALT deduction stands for “State and Local Tax” deduction.

It allows taxpayers to lower their federal taxes by deducting some of the money they paid for state and local taxes, such as property or income taxes.

Prior to the Big Beautiful Bill, the SALT deduction was capped at $10,000, which provided little benefit for individuals in high-tax states.

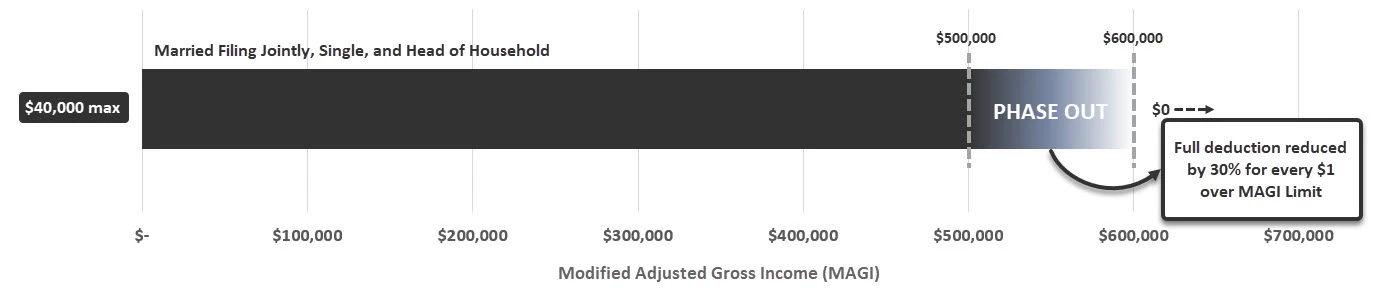

Starting in 2026, the SALT deduction cap will temporarily increase to $40,400 for those with Modified Adjusted Gross Income (MAGI) below $500,000.

If your MAGI exceeds the $500,000 threshold in 2026, the SALT deduction will gradually phase out until it is reduced back down to the original $10,000 cap. Specifically, it is reduced by 30% for every one dollar over the $500,000 MAGI threshold.

Lastly, this SALT cap increase is set to end after 2029 and is not permanent. In 2030, it will revert to the $10,000 cap unless a future Congress takes action.

5.) No HSA Contributions for Medicare Enrollees

The House version of the bill proposed a long-awaited change to allow individuals on Medicare Part A to continue contributing to Health Savings Accounts (HSAs).

Unfortunately, this provision was removed in the final version of the bill.

That means once an individual enrolls in Medicare, they’re unable to fund an HSA, even if they’re still working and covered by an employer’s high-deductible health plan (HDHP).

However, there is one workaround to highlight:

A working spouse who is not yet eligible for Medicare and is also covered by a HDHP is eligible to make a family contribution (2026: $8,750) and an age 55+ catch-up contribution to an HSA in their name only (2026: $1,000). Catch-up contributions for the Medicare-enrolled spouse are no longer permitted.

Final Thoughts

Congrats! You Just Read 870 Pages of Legalese in 5 Minutes!

The One Big Beautiful Bill Act emerges during a time when it’s challenging to find objective information without politics muddying the picture.

The reality is that ugly politics has been a prevalent theme throughout modern history.

We can either make informed decisions in response to the things within our control, or we can get caught up in the noise that’s hammering our eardrums and eyeballs at every turn.

📚 Extra Credit

Here are a few additional provisions that may be less relevant to those who are retired or nearing retirement.

Mortgage Interest Deduction

If you have a mortgage and itemize your deductions, the mortgage interest deduction remains limited to a principal amount of $750,000. In other words, any interest paid on a principal balance that exceeds the $750,000 threshold is permanently non-deductible, due to the One Big Beautiful Bill.

Retirement Account Rules

There have been discussions in previous Congressional Finance Committee meetings to modify rules governing Roth IRAs, Required Minimum Distributions (RMDs), backdoor Roth strategies, and high-balance retirement accounts.

However, this bill made no changes to the rules governing retirement accounts. That said, future tax bills may still target these topics and more, so we’ll vigilantly be on the lookout.

Charitable Deduction Changes

If You Are Taking the Standard Deduction: Starting in 2026, you can deduct 100% of charitable contributions up to $2,000 (Married Filing Jointly) or $1,000 (Filing Single). Note, this does not reduce your Adjusted Gross Income (AGI).

If You Are Itemizing Deductions: Starting in 2026, your itemized charitable contributions must exceed 0.50% of your AGI to become deductible, much like the 7.50% hurdle for itemizing medical expenses.

Car Loan Interest

A maximum car loan interest deduction of $10,000 is available for all qualifying loans issued between 2025 and 2028.

This deduction only applies to new, personal-use (non-business) cars that are assembled in the US. Lease financing is not eligible.

This new deduction is subject to a phase-out of 20% for every dollar above a Modified Adjusted Gross Income (MAGI) of $200,000 for Married Filing Jointly (MFJ) and $100,000 for Single Filers.

This deduction is eliminated and reduced to $0 at a MAGI of $250,000 (MFJ) and $150,000 (Single).

Estate Tax Exemptions

The federal estate tax exemption has permanently increased, allowing estates to be passed to heirs without incurring federal estate tax.

The new exemption, starting in 2026, will be $15,000,000 per person ($30,000,000 for a joint estate).

Additionally, the joint exemption can be carried over to the surviving spouse.

“No Tax” on Tips and Overtime

Despite the titling and headlines, this provision is actually no FEDERAL INCOME tax on a portion of tips and overtime.

More specifically, we’re talking about $25,000 of tips and $25,000 of overtime. Employees still owe payroll and potential state income taxes on tips and overtime.

The deduction is also phased out between $300,000 – $550,000 (MFJ) and $150,000 – $450,000 (Single).

This deduction applies to “qualified tips,” implying that tips are both voluntary and customary to the industry or position.

More clarification will be released by Congress or the IRS in the coming months.

Pass-Through Entity (PTE) Taxes

Although the SALT deduction cap has increased to $40,400, some taxpayers may still exceed this limit with their SALT deductions.

If that individual owns a pass-through entity (e.g., LLC, S-Corp, etc.), they are still permitted to deduct those state and local taxes on their business entity returns.

“Trump Accounts”

These are essentially IRAs used to accumulate retirement savings for minors. It is a tax-deferred account and is taxed as ordinary income at distribution, generally permitted after age 18.

A federally-funded initial contribution of $1,000 will be made to an investment account in the name of each US child born in 2025-2028. (Kids born before 2025 are eligible for the account but not the federally-funded contribution of $1,000.)

Annual contributions are capped at $5,000 per year until the child reaches the age of 18.

Although well-intentioned, this new savings feature has significant drawbacks: contributions are not tax-deductible, and distributions are treated similarly to those from IRAs rather than benefiting from more favorable capital gains tax rates.

Essentially, gains that would have otherwise been taxed at federal capital gains rates (0%-15%) will be instead subject to federal ordinary income taxes (10%-22%).