Donor-advised funds have become increasingly popular given the new tax laws in 2018.

They have also become one of our favorite tax savings tips that continues to fly under the radar:

Today, we are going to break it all down for you and explain:

- What a Donor-Advised Fund is (in plain English!)

- Why you should consider using a Donor-Advised Fund

- Exactly how they work and the best way to use one

According to Giving USA, Americans gave over $400 billion to charities in 2017 — a new record and an increase of 3 percent over the previous year when adjusting for inflation.

Charitable giving is alive and well in the United States and there’s no better time than now to establish a giving plan for your family.

But, what is the best way to donate to causes you care about?

While there are multiple vehicles you can lean on to support philanthropic giving, we find that donor-advised funds (DAF) tend to be the most efficient and effective giving vehicles.

Donor-advised funds are simple, low-cost, and flexible. They allow donors to maximize the tax benefits of charitable giving while supporting their favorite organizations.

What are Donor-Advised Funds (DAF)?

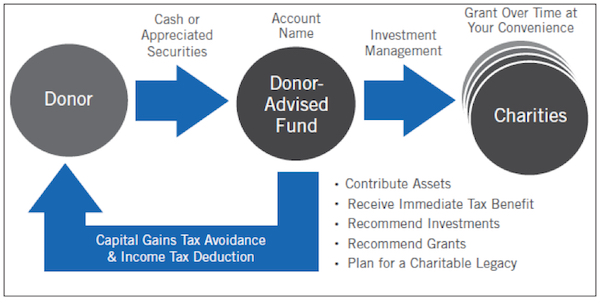

A DAF is simply an account that helps givers manage their charitable contributions.

Through an agreement with a DAF provider, a donor creates a specially named account (e.g., “Smith Family Fund”) to which irrevocable contributions are made.

The donor receives an immediate tax deduction but is not forced to make any grants right away.

They can work with their financial planner to invest and grow the assets and recommend grants to their favorite non-profit, 501(c)(3) organizations at their leisure.

Source: Schwab

Why Use Donor-Advised Funds?

- Simplicity. Unlike a private foundation, the donor is not responsible for hiring attorneys and accountants or maintaining a board of directors. The sponsoring organization that holds the fund takes responsibility for all the expensive administrative work, including filing annual returns and preparing financial statements.

- Tax Efficiency. DAF contributions provide a federal income tax deduction of up to 50 percent of adjusted gross income for cash contributions and up to 30 percent of adjusted gross income for appreciated securities. Along with publicly traded securities, DAF holders can also contribute complex assets such as real estate, limited partnership interests, private C- and S-Corp stock, and other privately held assets.

- Flexibility. DAF holders receive an immediate tax deduction for their contribution but, unlike a private foundation, they are not subject to a legal minimum payout requirement. The flexibility helps donors maximize tax benefits while helping them be more systematic and methodical about their giving.

How a Donor-Advised Fund Works

You can put three different types of assets into a donor-advised fund: cash, appreciated stock, and real estate.

When you make a donation, you receive a tax deduction based on the value of your donation. While any donation can be generous and advantageous for your finances, San Diego tax expert Cheryl Rowling, CPA suggests that appreciated stock is the best way to go when using a donor-advised fund.

Once the money is inside a donor-advised fund, you can invest that money for growth tax-free.

If that $100,000 grows to $200,000, you now have $200,000 to gift to qualified charities of your choice. While you don’t get a tax break for your money growing from $100,000 to $200,000, there certainly is no taxable gain on that growth.

Distributions from a donor-advised fund must be made to qualified charities.

That means your Uncle Phillip’s Popsicle Stand for Needy Carrier Pigeons won’t qualify. However, any recognized 501(c)3 should be on the list of approved charities.

Ways to Use Donor-Advised Funds

The great thing about donor-advised funds is not just their tax advantage, but their flexibility.

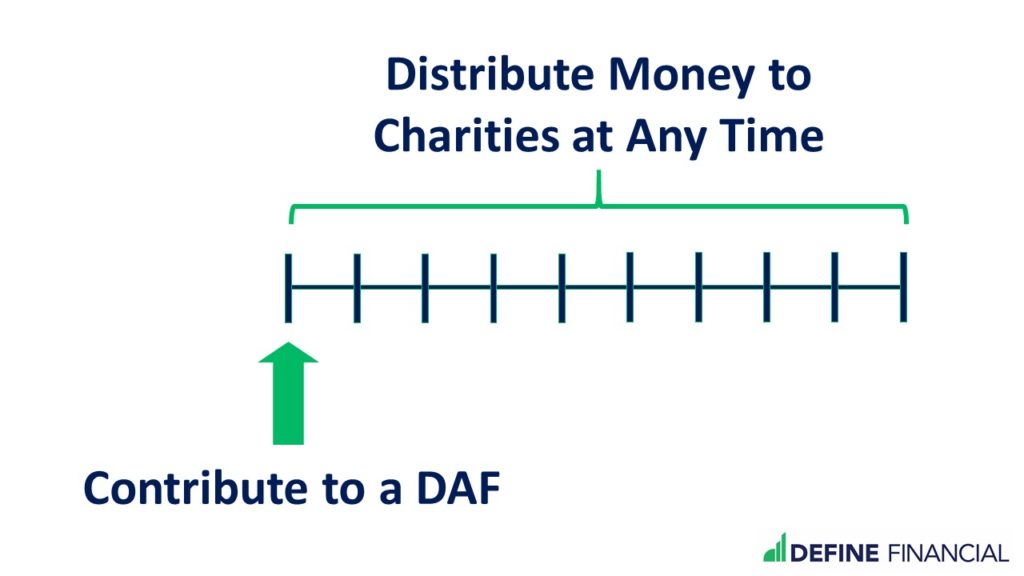

Once you are set up, you can make a contribution to a donor-advised fund in the year that you experience a large taxable event (e.g., now) and decide which charity to donate to later; you don’t have to make an immediate decision about which organization to give the money to — or when to give it.

Donor-Advised Funds offer flexibility for tax planning.

For example, if you want to be charitable but you don’t know what sort of organization inspires you quite yet, you can let the money hang out in a donor-advised fund for a decade (or several) before you distribute it.

Letting your charitable funds grow is a strategy Warren Buffet touts to this day.

His thought process is that he should let his money compound for several decades before giving it to a charity. This is because he’ll be able to give more money if that’s the case.

A donor-advised fund may work well if you want to give money to a charity consistently over a long period of time as opposed to making a one-time donation.

With a donor-advised fund, you can put in a big lump sum at one time, and then make small distributions to your charity of choice over time. Whatever your ideal distribution strategy is, you can accomplish it with a donor-advised fund.

Donor-advised funds can also help you save money on taxes when you receive a large, one-time taxable event.

One-time taxable events include lottery winnings, the sale of a business, or the sale of a rental property. (Windfalls do not include inheritances — as the inheritor does not usually pay tax on gifts received.)

Donor-advised funds can also be a fantastic tool for lowering taxes in retirement, including taxes on required minimum distributions (RMDs) from individual retirement accounts (IRAs).

They can help you lower taxes on business or rental income, too.

San Diego Giving Back

In 2017, Charity Navigator named San Diego as the number one ranked philanthropic city in the U.S.

The rapid growth of vehicles like donor-advised funds has helped San Diego donors increase their charitable contributions and remain at the top of the charts.

Some of the non-profit organizations in San Diego that have been granted to with greater frequency from donor-advised funds include Challenged Athletes, San Diego Humane Society & SPCA, Invisible Children, and the San Diego Library Foundation.

If you haven’t engaged in charitable giving yet, now is a great time to start.

And in doing so, consider the benefits — for you and for future recipients — of a donor-advised fund.