Recently, a new client visited our office. He had a good problem: he had saved too much money!

With most of his money in a traditional IRA account, he was worried about the taxes. He came to us wanting to know how to lower taxes in retirement.

Fortunately, there are many ways to lighten taxes in retirement – all without doing anything illegal or unethical.

How is that the case?

Well, grab a cup of coffee and settle in for our longest blog post ever! If you read on, you’ll learn how to reduce your tax bill in retirement.

Prefer to Listen? Our Podcast Episode on Lowering Taxes in Retirement:

Taxes & Required Minimum Distributions (RMDs) from IRAs

The gentleman from our story was over 73 years old. This is an important detail to know; age 73 (or age 75 if born before 1960) is when Required Minimum Distributions (RMDs) begin.

Required Minimum Distributions!?

Let’s explain what that means. (If you’re already familiar, you can jump ahead to the section where we discuss how to lower taxes in retirement.)

Individual Retirement Arrangement (IRA) Accounts

IRA stands for Individual Retirement Arrangement.

An IRA account is an investment account where your investments grow while receiving fantastic tax treatment.

These IRA investment accounts receive special tax treatment because the U.S. government wants to encourage you to save money for retirement. This special tax treatment allows your investments to grow faster!

Required Minimum Distributions (RMDs) in Retirement

There are rules for taking money out of your IRA account.

First, you cannot withdraw money from this tax-advantaged retirement account before age 59 1/2 without a penalty.

Further, you must begin withdrawing money from a Traditional IRA account after age 73 (or age 75 if born in 1960 or later).

The requirement to withdraw money from a Traditional IRA account once you reach a certain age is called the Required Minimum Distribution (RMD).

Of course, once money leaves your IRA account, you lose the special tax treatment on the funds pulled out. You may also need to pay taxes on money that comes out of the account.

When money comes out of a traditional IRA, you will likely have to pay income taxes in retirement.

If you’ve put a lot of money into your traditional IRA account – and it’s been there for some time – it can mean having to take out a lot of money. This is because of the RMDs.

Taking a lot of money out of the account can mean paying a lot of taxes.

The more money you have saved in a traditional IRA account, the more taxes you’ll eventually have to pay.

While putting money away for retirement (read: IRA) is always good, paying taxes is never fun.

Why Large RMDs Mean Extra-Large Taxes

Unfortunately, the relationship between RMDs and taxes isn’t linear. It’s exponential.

This is because of the way the American Tax Code is set up. Taxes increase quicker than your income.

A large traditional IRA account can mean XXXL future taxes.

To further explain, the U.S. has a tiered, progressive tax system. As you make more and more money, you get taxed at higher and higher rates. It’s not just the dollar amount that’s higher – it’s the percentage that increases, too. As an example:

- If you have $10,000 in taxable income, you pay $1,000 in Federal taxes.

That’s a tax rate of 10%.

- If you have $100,000 in taxable income, you pay $13,879 dollars in taxes.

That’s a tax rate of almost 14%.

This is why it’s advantageous to keep your income as low as possible. If more income means even more taxes, then smaller income means smaller taxes.

And taxes in retirement can sneak up on you if you’re not careful. For example, the 2024 IRMAA brackets can spike your Medicare Part B premiums by as much as $395.60 per month!

» Learn about the 9 Best Ways to Avoid IRMAA

More income can mean even more taxes.

So, if you have a small RMD, you’ll have a small tax bill.

But, if you have a medium RMD, you’ll have a large tax bill.

And if you have a large RMD, you’ll have an extra-large tax bill! By keeping RMDs small, you can save a fortune on taxes.

Traditional IRAs vs. Roth IRAs

We’ve already talked about what an IRA account is. However, you also need to know that there are two types of IRA accounts:

- a traditional IRA account,

- and a Roth IRA account

The IRA account described at the beginning of this post is a traditional IRA. As mentioned, you pay taxes when you take money out of a traditional IRA.

You can get a tax break when you put money into a traditional IRA or traditional 401(k) account. But, it can mean paying taxes when money comes out of the account.

With a Roth IRA account, on the other hand, you don’t pay taxes when you take money out of the account.

This is because, with a Roth IRA account, you pay taxes when you put money into the account. (Technically, you don’t get a tax deduction when you put money into a Roth IRA.)

Just like a traditional IRA, a Roth IRA receives special tax treatment. With a Roth IRA, there are:

- no taxes on growth while money is inside the account, and

- no taxes when money comes out of the account.

You’ll notice that for both types of IRA accounts, the tax treatment is symmetrical. Either you pay taxes now (Roth IRA), or you pay taxes later (traditional IRA).

You put money into a Roth IRA after you’ve already paid taxes on that money. When money comes out of that account, you owe no tax on it.

Since you pay taxes on money going into a Roth IRA, you don’t pay taxes on the way out.

Since Roth IRA money is not taxed, the I.R.S. doesn’t care if it ever leaves the account, so there are no RMDs on Roth IRA accounts.

So far, we’ve covered:

- the definition of a traditional and Roth IRAs;

- how RMDs come into play; and

- how America’s progressive tax code works.

Now, let’s do some problem-solving for our client facing large RMDs.

Have a Plan for RMDs to Lower Your Tax Bill

Unfortunately, our new client didn’t plan for his big RMDs from his traditional IRA account. He was already over 73-years-old. So, his RMDs were in full swing. Sadly for him, he was simply doing damage control.

While there are opportunities to decrease taxes at his age, those opportunities are not as good as some of the tax-saving strategies that you can take advantage of with proper financial planning.

Let’s review those opportunities to determine what our client could have done to reduce taxes.

Planning for Your Gap Years in Retirement

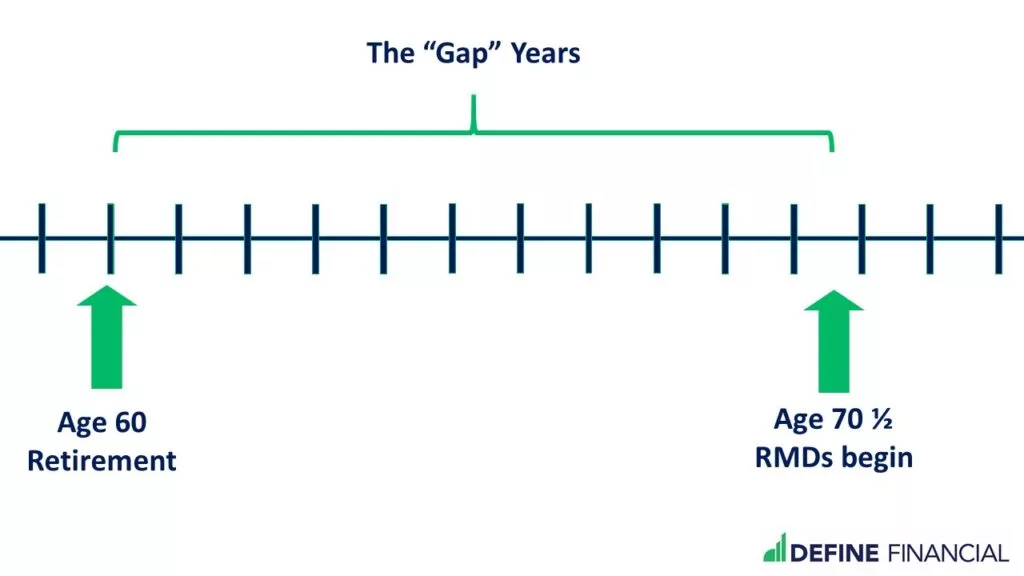

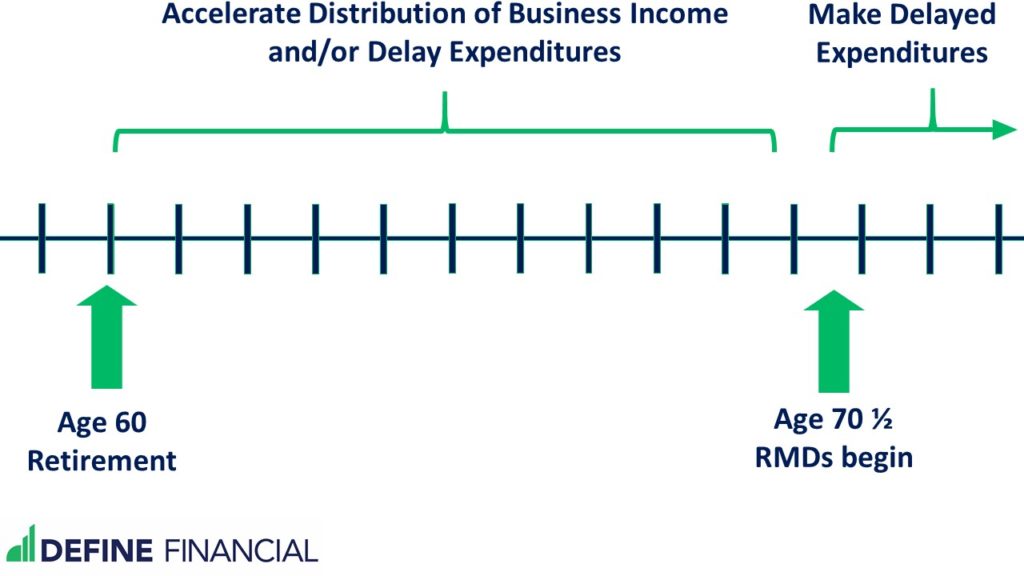

First, let’s discuss the gap years. This term describes the time between the start of retirement and when RMDs begin.

If you retire at age 60 and RMDs start at 73, the years between those events are your gap years.

The time between you retire and when RMDs kick-in is known as the “gap years.” Gap years are a fantastic financial planning opportunity if you know how to lower taxes in retirement.

The gap years provide a special opportunity for financial planning, which can:

- reduce taxes,

- increase the after-tax value of your investments, and

- help set a game plan for the rest of your life.

Delaying Social Security

Before I explain how to optimize Social Security to increase income and reduce taxes, let’s review what benefits are and how they work.

If you already know all about Social Security, you can skip to the next section.

If you’ve been paying into Social Security (like most people), you are entitled to receive Social Security retirement benefits. (If you’re not sure how much money you’re entitled to, you can look up your payments here.)

You can start receiving your retirement benefits as early as age 62 or as late as age 70.

Social Security Strategies to Save Taxes and Increase Income

While it’s easy to see why consumers would be inclined to start claiming Social Security benefits as early as possible, this is often a mistake. For most people, the best strategy is to delay Social Security benefits for as long as possible.

Does delaying your Social Security benefit payments make sense for you?

It depends on your resources. Those resources may include:

- cash in a savings account

- investments in a taxable account

- money in a Roth IRA

- a pension provided by an employer

- RMDs from an inherited IRA

- distributions from a business

- passive income from rental property

If you can lean on any of those resources (or others) to provide you income before age 70, you should. Doing so will allow you to delay your Social Security retirement benefits.

But, why would you want to delay your Social Security retirement benefits?

Because delaying Social Security benefits is a double-win in your gap years. Here’s why:

Reason #1: You’ll get more money from the Social Security Administration

For every year you postpone Social Security benefits, the Social Security Administration will pay you more money. Your rate of return on delaying your Social Security benefits is approximately 8% per year.

That’s a pretty fantastic guaranteed rate of return. You won’t find a guaranteed return of 8% anywhere else in the world.

If you delay your Social Security benefits, you can increase your benefit payment. You can use this strategy to help lower your taxes in retirement.

Reason #2: You’ll reduce your taxable income while you do partial Roth conversions

Social Security benefit payments are partially taxable. By postponing your Social Security benefit payments, you postpone taxes.

Moreover, you’re decreasing your income, which means paying substantially less in taxes (because income tax rates are progressive).

By keeping your income lower by delaying Social Security during your gap years, you set yourself up for tax-efficient partial Roth conversions.

What’s a partial Roth conversion? Stay with me, dear reader, and you’ll find out.

Partial Roth Conversions

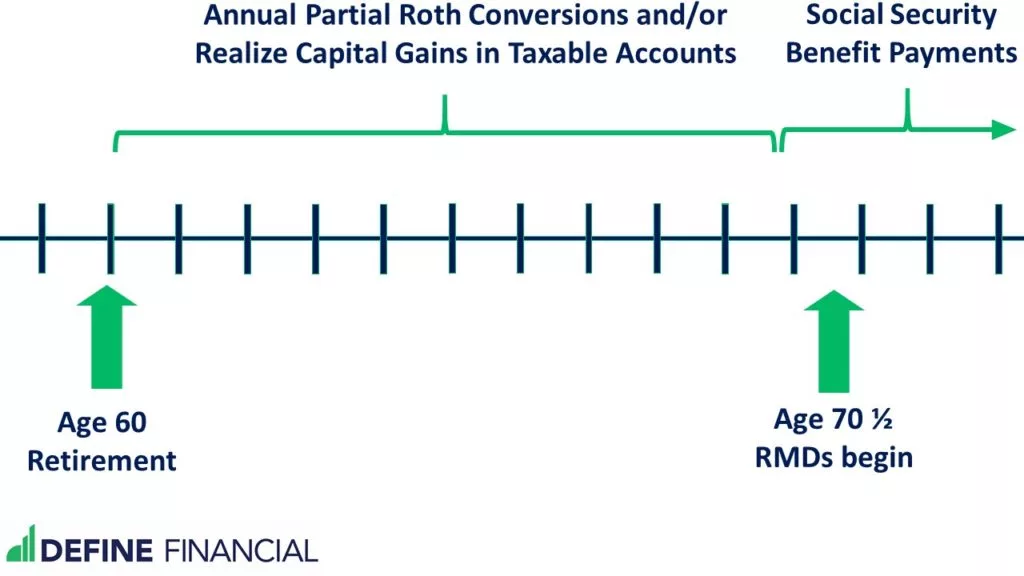

In your gap years (the time between your retirement and age 70), you can do something called a partial Roth conversion, or a Roth conversion ladder.

With a partial Roth conversion, you take a little bit of money from your traditional IRA account and put it into your Roth IRA account.

When you do this, you must pay taxes on the money you take out of the traditional IRA account.

When you take money out of a traditional IRA – including doing a partial Roth conversion – you may owe taxes on that money.

Why would you want to take money out of your IRA account – and pay taxes on it – before you absolutely have to?

A good reason to speed up paying taxes on your traditional IRA (via a partial Roth IRA conversion) is you can pay a little bit of taxes during your gap years to avoid a lot of taxes on big RMDs later.

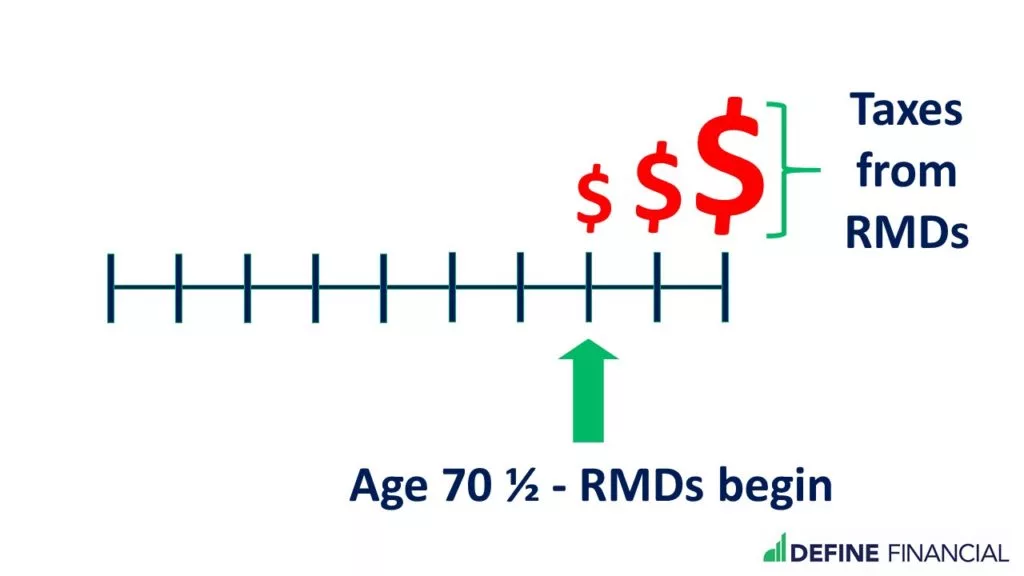

Taxes you can expect from required minimum distributions (RMDs) from your traditional IRA or traditional 401(k) if you don’t do a partial Roth conversion or Roth conversion ladder strategy.

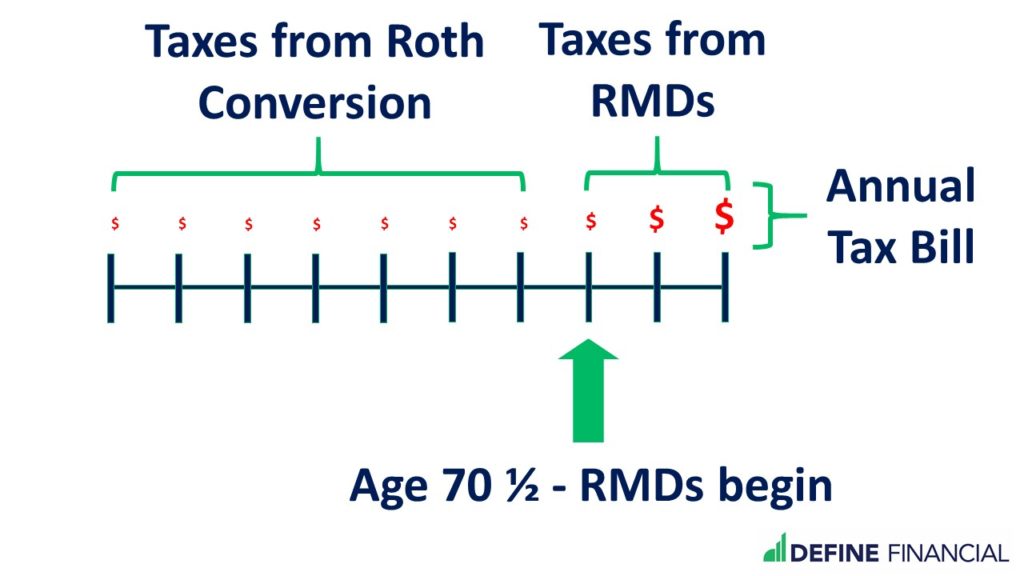

With a partial Roth conversion, you are paying small amounts of taxes each and every “gap” year. You do this to avoid a lot of taxes once RMDs begin.

This strategy of partial Roth conversions during your gap years can reduce your future tax burden.

Doing a partial Roth conversion from your traditional IRA to your Roth IRA to avoid big RMDs is how to lower taxes in retirement.

Minimizing Taxes from an Employer Pension

If you’re receiving a pension from an employer, you should take that into consideration when planning for your gap years.

Just like Social Security payments, payments from a monthly pension benefit are subject to income taxes. Always consider how pension income will impact your financial plan.

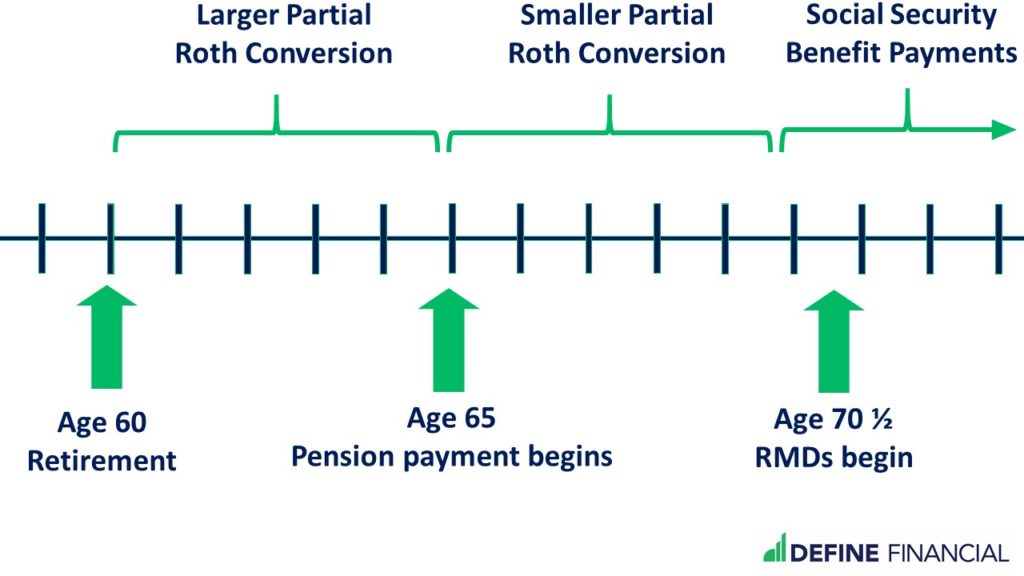

The best financial planning would put partial Roth conversions into play before your pension benefit begins. (Most pension benefits begin at age 65).

Consider the following example of how to lower taxes in retirement for those that have a pension:

Planner Peter has a traditional IRA account with $1 million dollars. He also has a Social Security benefit payment of $30,00 annually starting at age 67. Planner Peter can take his Social Security benefit as early as age 62. If he takes benefits at age 62, he’ll receive a benefit of $21,000 annually. If he claims benefits at age 70, he’ll receive $37,209 each year.

After running the numbers and deciding he is eager to retire, Peter decides to leave his job. He is 60 years old. With money in a taxable investment account and cash savings, Peter slowly takes money out of those accounts to pay for his living expenses. Given his savings, Peter decides to postpone his Social Security benefits until age 70. Between ages 60 and age 65, Planner Peter executes partial Roth conversions. He does this by taking a little bit of money from his traditional IRA and putting it into his Roth IRA each year.

At age 65, Planner Peter’s pension benefit begins. This increases his taxable income. Planner Peter continues his annual Roth conversions but does so with smaller amounts each year. This is because of his higher taxable income from his pension.

At age 70, Planner Peter receives Social Security benefits. This further increases his taxable income. His RMDs are also now set to begin. At this point, Planner Peter stops his partial Roth conversions because his income from both Social Security and his pension is so high.

This allowed him to minimize taxes not only at his eventual RMD age of 73, but also on the partial Roth conversions every year.

By paying fewer taxes to the government, Planner Peter has more money for himself!

Giving to Charity in Your Gap Years

For many who have been blessed with a successful life, charitable giving often comes up in conversations. Fortunately, some careful planning during the gap years can make giving back much easier on your wallet.

Qualified Charitable Donation (QCD) from a Required Minimum Distribution (RMD)

While you can always make a charitable contribution at any time, certain strategies can generate the greatest tax savings.

Let’s take a look at Planner Peter’s situation again to see how he can make the most impact with his money:

Planner Peter retires at age 60. He now has plenty of time to seek out and research the charities that inspire him. However, even if Peter finds the right charity, it may not be the right time for him to donate.

Referring to the timeline above, the most tax-efficient donation that Peter can make will be when his RMDs begin at age 73. Assuming Peter has sufficient income from his Social Security benefits and his pension – and he doesn’t need the income from his traditional IRA – Planner Peter can use his RMD to donate to charity. He does this by turning his RMD into a Qualified Charitable Contribution (QCD). This can decrease his tax burden.

At the end of the day, turning your RMD into a Qualified Charitable Donation (QCD) can be even better than making a donation outright. Waiting until the age of 73 to make a donation is usually the smartest thing to do for two reasons:

- Given increased income (and the associated taxes) of Social Security – and possibly even a pension – tax rates will be higher after age 73 compared to the gap years. If you make a charitable donation when you are in a higher tax bracket, you can save pay less in taxes.

- Waiting to make a donation until age 73 – as opposed to age 60 – means money invested in an IRA will have an additional decade to grow. This means that you may be able to donate more money, making a bigger impact for the charity receiving the donation and saving more money on taxes.

Managing Other Income in Your Gap Years

If charitable donations aren’t your thing, there are plenty of opportunities to manage taxes during your gap years.

Realize Capital Gains to Decrease Taxes in Retirement

Capital gains are just a fancy way of saying that you made money on your investment.

Capital gains occur in a regular taxable account – in other words, not your traditional IRA account, not your Roth IRA, not your 401k, not your 403(b), or anything else receiving special tax treatment.

A regular taxable account is a plain-vanilla taxable account that’s subject to taxes on interest, dividends, and capital gains.

Realize taxable gains during your gap years to increase the tax basis of your investments.

But, just because you’re dealing with a regular taxable account doesn’t mean there aren’t financial planning opportunities to reduce your tax burden during your gap years.

In your gap years, it may make sense to sell some of your investments that have made money – investments that have capital gains.

The reason you may want to do this is that you may be taxed at zero percent (0%) on long-term capital gains if you in are the two lowest Federal tax brackets.

Accelerate Income

If you have a side business, it may make sense to distribute more income during your gap years. This is because you’ll be taxed at a lower rate during your gap years.

Postpone Expenses

If you have a business or rental property generating income, it may make sense to postpone expenses until you reach RMD age.

With a rental property, postponing expenses (but not capital expenditures) may mean waiting to replace the carpet or even re-painting a unit.

If you can postpone expenses until you are at an age where you must take RMDs, this will mean you’ll be able to decrease your income. Less income means fewer taxes.

It may be tax efficient to make business distributions when you are in a lower tax bracket during your gap years.

RMDs While You Are Working

Some people choose to work well into their 70’s. In that case, a lot of the strategies discussed here may not apply. (You may not want to do partial Roth conversions while you’re working, for example.) This is because working means taxable income, and thus being in a higher tax bracket than if you were not working.

However, there are still opportunities to plan for taxes if you work past age 73. Those strategies include:

Strategy #1: Delay Social Security

Whether you’re working or not, you still want to delay Social Security. If you are working, delaying Social Security makes extra sense. This is because you’ll already have income – and taxes – from working.

Strategy #2: Prevent RMDs While Working

You especially don’t want RMDs while you are working. That’s because RMDs and working individually means income taxes. But, because of the U.S.’s progressive tax code, RMDs and income from working at the same time mean XXXL taxes.

Fortunately, you can roll all traditional IRAs and other traditional tax-advantaged retirement plans from previous employers (such as a 401(k), 403(b), etc.) into the retirement plan of your current employer.

You want to do this because (if you are still working), you do not need to take RMDs from your traditional 401(k) or 403(b), etc.

Know that this only applies if you’re not an owner of the company.

How Do You Lower Taxes in Retirement? Careful Tax Planning During Your Gap Years

Depending on your circumstances, none or all of the above can apply to you. Regardless, the lesson remains:

“With careful planning during your gap years, you can have more money if you know how to lower taxes in retirement.”

The strategies described above would have worked for our client – had he only met with us sooner! Unfortunately, his options were limited since he was over age 73.

If you’re approaching your gap years or already in them, you should start planning now to decrease your future taxes!

Disclaimer: This article is for entertainment purposes only. None of this is to be considered tax advice. Before doing anything, speak with a qualified tax professional.