Today I’m answering a timely reader question, “should I sell my stocks now?”

The stock market has been skyrocketing for over a decade. In fact, the S&P 500 has returned 500+% since March 2009.

So, should you sell stocks now?

Maybe.

If you want to learn how to prudently think about your investments and determine if you should sell stocks now, you’ll love this article.

First, instantly grab these free resources (no email required!):

- Investment Issues to Consider Reviewing [PDF Checklist]

- When You Have to Pay Taxes When Selling Stocks [PDF Flowchart]

- Are You Subject to a Behavioral Investment Bias? [PDF Flowchart]

Should I Sell My Stocks Now

Historically, fear has been a valuable emotion.

Fear has gotten humanity to where it is today.

Thousands of years ago, fear caused us to flee in terror at the possibility of a large predatory cat stalking the grassland.

And rightly so.

Obviously, fear kept us alive and unmolested by very real dangers.

But, as civilization has evolved, so has our relationship with fear. What was once a useful emotion can now circle back to bite us in the metaphorical butt.

The same can be said for having a voracious appetite.

Thousands of years ago (or maybe just as far back as college), a voracious appetite was a boon. Eating ourselves sick made sense because we never knew when the next meal would show up.

But today, that disposition to eat anything and everything has dire consequences for our bodies and our lives.

What does this have to do with whether or not you should sell stocks?

Unfortunately, a lot.

Recently, I was working with a new client when she shared a story of how her friend’s financial advisor got her out of the market during a recent correction. The fearful advisor saw stocks losing value and decided it made sense to sell stocks.

Unfortunately, selling based on fear (or anything else) doesn’t work.

If you’ve read up on this subject, you may know that selling stocks based on emotions (a.k.a. market timing) is rarely successful. Remember, time in the market is more powerful than timing the market.

What If You Never Sold Your Stocks

If you shouldn’t sell stocks when you get scared or hear something crazy on television, what should you do?

The answer is simple: Hold your investments forever.

Believe it or not, this works. Here are a couple of reasons why:

#1: Transaction Costs Eat Up Gains from Timing the Market

When you hold an investment forever, you don’t incur any additional fees. And, no matter what anyone says, fees matter. In fact, fees have been shown to be the number one factor that determines your investment return.

At Define Financial, we are absolutely obsessed with fees. That’s because of the overwhelming evidence that shows more fees means less money for our clients.

Using fees to determine if you should sell stocks now.

For us, market timing means higher fees. And higher fees result in lower returns.

#2: Timing the Market Can Mean Giving Up Really Good Stock Market Returns

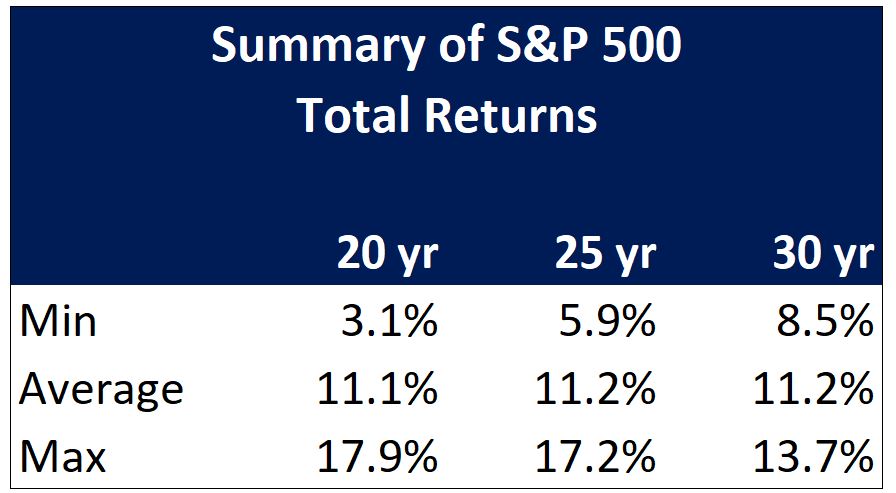

The beautiful thing about never selling your stocks is that you have the chance to capture almost all of the stock market’s return. And the stock market’s return over the long-term is quite appealing:

Determining if you should sell stocks now depends on how willing you are to give up healthy, long-term stock market returns.

Trying to time the market means giving up what has historically been a pretty good deal. Trying to time the market also involves a lot more risk.

No matter what any “stock guru” says, the odds are pretty bad that someone has enough skill to consistently time the stock market.

Why Selling Stocks Now May Never Make Sense

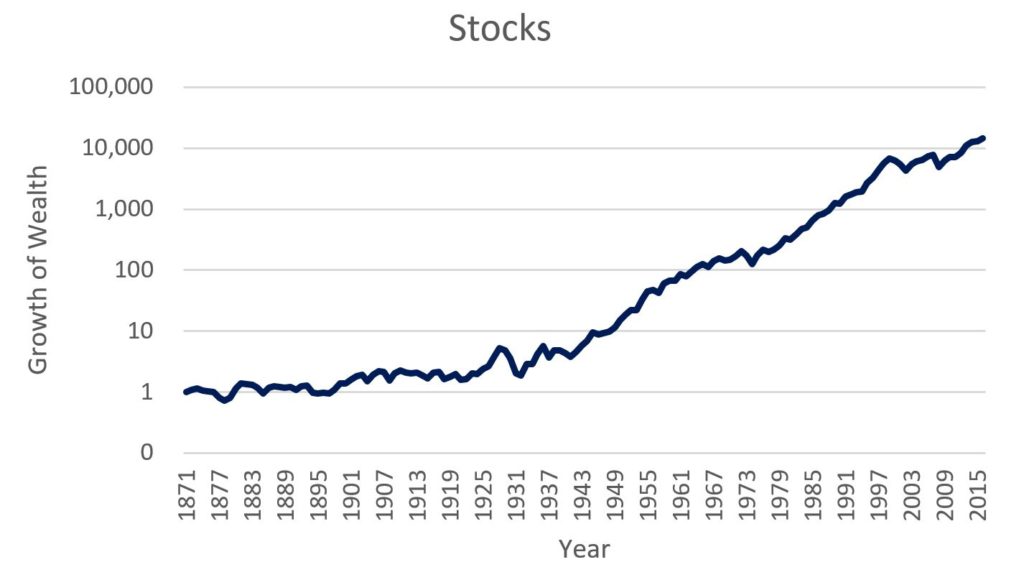

Stocks have been going up in value for a very long time. Don’t believe me? Check out this chart!

Can you spot the trend? Are you able to pinpoint when you should sell stocks?

On a long enough timeline, you would miss out on massive gains if you sold at the wrong time. That’s because, over long periods of time, stocks have historically gone up in value.

Anyone squinting at the chart provided will notice that there are quite a few bumps along the road. And those bumps can mean YEARS of negative investment returns.

But, that’s okay. This is a reason why you want to diversify your portfolio.

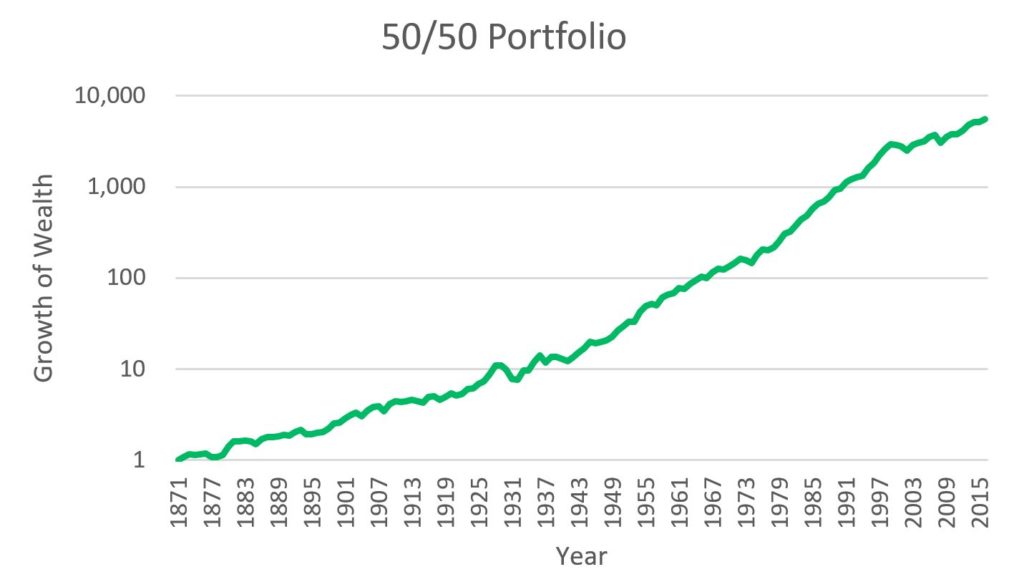

Below is what your stock market return would have looked like with a 50/50 mix of stocks and bonds up through 2015.

Looking at this, do you think that it could make sense to sell your stocks and bonds?

When your portfolio is properly diversified, the bumps are…less bumpy and the growth is…more consistent. If that’s still too wild of a ride for you, you can always take less risk.

When It’s OK to Sell Some of Your Stocks

Finally, I want to make the distinction between never selling all your stocks versus never selling them.

Despite all the proof I’ve shared that “hold forever” is the best investment strategy there is, there are times when it can make sense to sell some of your stocks.

#1: Portfolio Rebalancing

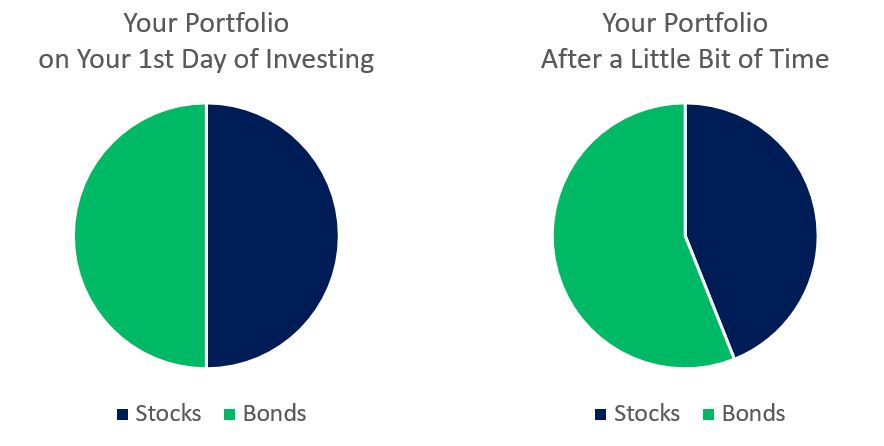

It is critical that your investments reflect your personal goals over the long-term. But, not all investments grow at the same rate. Portfolio rebalancing is the act of selling some investments that have strayed from their original target.

Your portfolio will change over time. Sell some stocks now to get it back in balance.

#2: Life Changes

As you get closer to retirement or any other big life change, it may make sense to reduce your risk. This often means selling stocks (the risky part of your portfolio) and buying more bonds (the safer part of your portfolio). This is a natural part of the investment process.

As you get farther away from retirement, it can sometimes also make sense to take more risk, trading up some of your bonds for more stocks.

Conclusion: Should You Sell Stocks Now

Anyone who has ever done any research on the subject has come to the conclusion that market timing just doesn’t work. With that in mind, you’ll probably want to get cozy with the stocks you have and the ones you plan to buy in the future. If you’re investing the right way, you’ll have them for a long, long time.