Today I’m going to share how to buy international stocks.

I’m also going to share why most investors should have them in their portfolio.

In fact, a basic allocation to international stocks can save you from a major investing pitfall.

So if you want to improve your retirement portfolio, you’ll love this simple breakdown for investing in international stocks.

How to Buy International Stocks and Should You Own Them

Investing in the stock market can be frightening.

And, going abroad with your stock investments can make it even scarier.

That’s why many investors only invest in stuff they are familiar with. Stocks like Google (GOOG), Apple (AAPL), Netflix (NFLX), or Amazon (AMZN).

However, this strategy has problems.

Investing exclusively in companies you’re familiar with means giving up diversification. And when you don’t diversify, you increase your risk.

“You’re right, Taylor. Diversification is important. I will invest in all 3,000 U.S. stocks through a low-cost index fund. Am I good to go now?”

Maybe. Maybe not.

Since you can also invest in companies outside of America, the question becomes, is it worthwhile to diversify beyond the U.S.?

At this point, the answer depends on which investment professional you ask.

John Bogle on International Stocks

Recently, I had the honor and pleasure of attending the 2017 Bogleheads Conference.

The Bogleheads are a group of investors – professional practicing advisors and retail investors alike – who fiercely champion low-cost investing.

The group is named for John C. Bogle, the founder of Vanguard Group – the first investment company to launch a true low-cost index fund and the industry leader in low-cost investing.

John C. Bogle, the star himself, was at the conference and took time to answer myriad questions about investing.

Given Bogle’s uncommon view on international stock diversification, it was inevitable that someone would ask for his thoughts regarding the need to include international stocks to increase the diversity of your investments.

Bogle humored the audience, once again justifying why he thinks the only diversification you need is every single United States company – and not a single one outside of the United States.

I’ll do my best to summarize Bogle’s views here.

Challenging Growth Prospects for Overseas Companies

The three biggest economies outside of the United States are Britain, Japan, and France – in that order, reported Bogle. Bogle holds less than optimistic projections for all of these countries.

Here’s a summary of his views:

- Brexit is Britain’s challenge to future excess growth. Bogle believes such a difficult transition will likely mute the country’s growth prospects.

- Japan’s highly-structured society along with its decreasing birth rates gives Bogle the confidence to forecast subdued economic growth.

- And finally, there is France, which has a tradition of strong government regulations on limiting the workweek. This could also suggest only moderate economic growth potential relative to the U.S. economy.

United States Companies Provide International Stock Exposure

Another point Bogle makes is that although Apple, Google, Facebook may have their roots as a United States company, their reach is global.

With so many U.S. companies earning revenue from international efforts, owning U.S. companies means effectively gaining exposure to international economies.

The fact that certain U.S. companies have international business activities is undeniable. But, are those business activities sufficient to show up in the returns in the U.S. stock market?

We can attempt to (at least partially) answer this question by looking at what has happened.

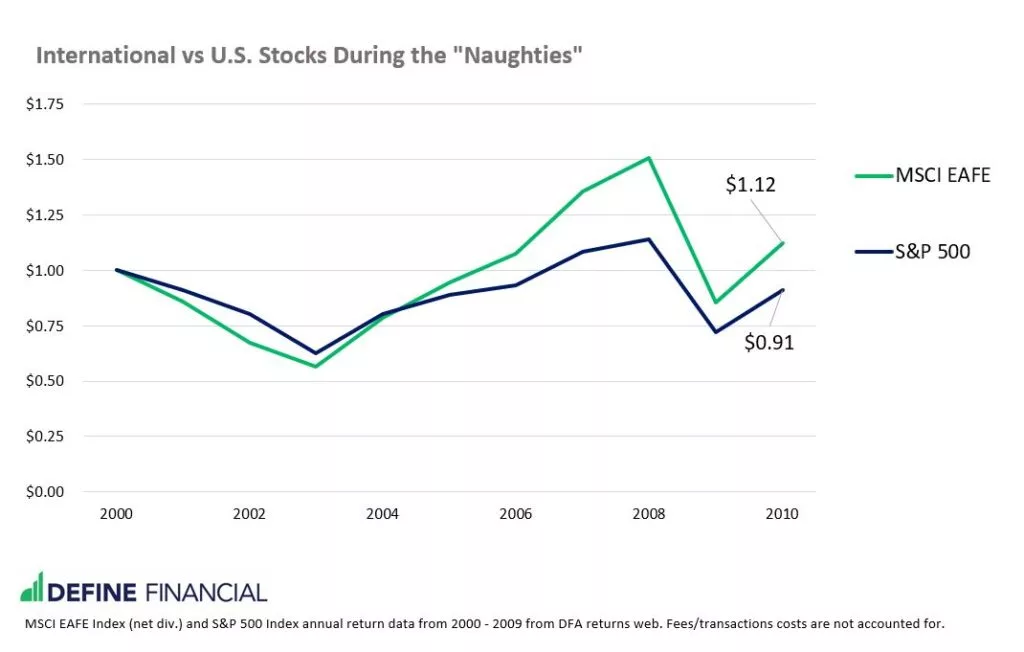

Perhaps the most interesting time period to evaluate is the “Naughties,” or the 10-year period between 2000 and 2009.

During this time, the S&P 500 (as a measure of United States stocks) produced quite meager returns.

The total return over the 10-year period was negative 3.25%.

What value would international diversification add then? Let’s run the numbers and find out!

Owning international stocks may increase your portfolio’s diversification.

Instead of a negative return for the period, an investor who owned some international stocks was able to squeak out almost 2% per year for 10 years.

That greatly outperforms U.S. stocks alone.

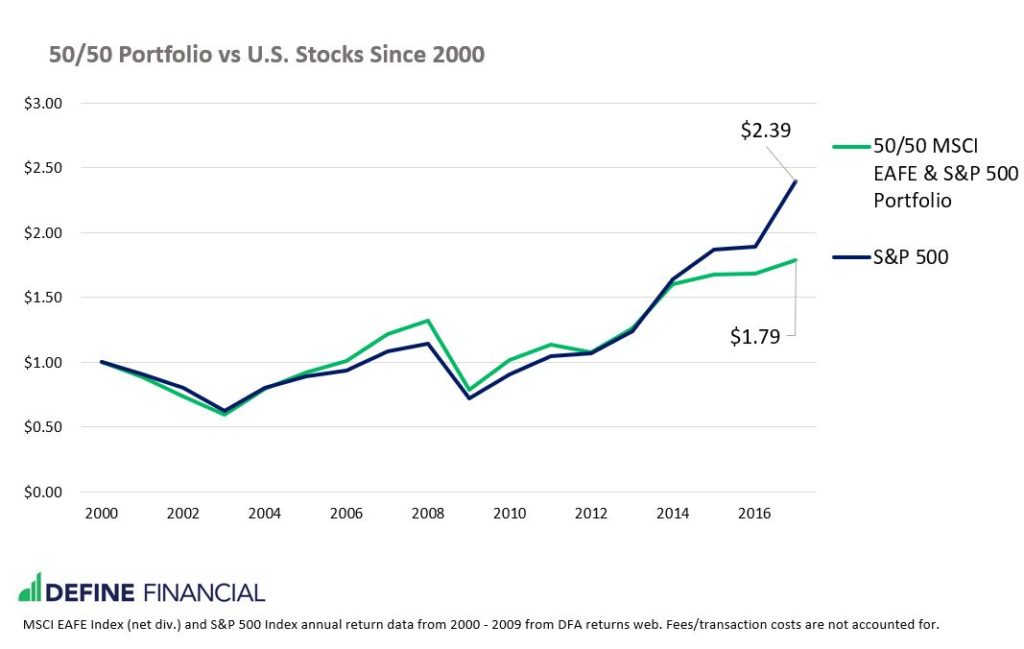

Further, adding international stocks to a diversified portfolio and rebalancing that portfolio (selling what’s gone up in value and buying what’s gone down in value) in a disciplined manner may mean greater benefit than holding U.S. stocks alone.

However, such performance is most certainly not guaranteed. Extending the period past the Naughties and through the end of last year changes the picture.

The struggling performance of international companies meant less money for investors putting assets into international economies.

The value of owning international stocks on a long timeline are unclear.

Perhaps then, the value of holding international stocks is not an increase in returns over time, but the chance to earn more money if the U.S. economy were to underperform over short periods of time.

Conclusion

Bogle’s argument is indeed compelling. Framed this way, it looks like there may be a strong case for holding United States stocks exclusively.

However, at the end of the day, a financial planner’s job is to put the client in the best possible position for success. And in my opinion, omitting half of the world economy is very risky, especially given some periods of performance in the past.

For my own accounts, and our clients, international economies are included. While others may disagree, we think including international stocks gives everyone the best chance at investing success.