Ah, secrets. One of the most intriguing words in our language.

Especially in investing.

I mean, if you just knew the secret – you’d be richer than Warren Buffet, amiright?

Well, the “secret” is out – and it’s more disappointing than you think.

Is There a Secret For Investing Successfully?

Recently, a friend asked me:

Don’t you know some secret investing stuff?

Of course, he didn’t use the word stuff. But, this is a family blog, after all.

Semantics aside, I’ve got some bad news for my friend:

There is no investing secret keeping you from immense riches.

When it gets down to it, true investing success boils down to hard work or patience, or sometimes both.

Stock Market Investing: Active and Passive

You might be familiar with the idea that mutual funds can be “active” or “passive.” When it comes to investing with mutual funds, active means that you’re hiring a money manager to pick the winning stocks and/or bonds for you.

Unfortunately, hiring a money manager to invest on your behalf rarely beats the alternative.

Passive Stock Market Investing for the Win

What’s the alternative to hiring a money manager?

Buying everything – buying every publicly-traded investment or offer. This works because, on average, the global economy grows…and you share in the profits of publicly-traded companies or collect the coupon payments from bonds.

Active Investing for Other Asset Classes

Stock market investing is one of the only places you can invest passively for growth and have your investments beat inflation. Most other forms of investing require an active manager, be it individual real estate, private equity, or anything else.

Manager fees decrease your investment return.

As with stock market investing, when you invest in other asset classes – such as real estate – you can do it yourself (as you would stock picking), or you can hire it out to someone else.

The catch in hiring someone else – as is the catch with stock market investing – is that the hired gun must make up for their fee.

And active managers, regardless of what they are managing (i.e. real estate, private equity, etc.), are rarely able to outperform passive stock market investing after the managers have paid themselves.

Successful Active Investing Will Be Truly Hard Work & Require Rare Skill

Let’s start with our first example mentioned above: illiquid real estate. Real estate investing has been around for thousands of years. And as with stock market investing, you can either do it yourself or hire someone to do it for you.

Unfortunately, unlike stock market investing, you can’t buy tiny slices of every single real estate investment available.

It’s simply not possible to invest in real estate passively like you can in the stock market. (You can buy a real estate investment trust (REIT) index fund, but’s it’s not quite the same thing.)

Non-Traded REITs

If you decide to invest in illiquid real estate, will you do it yourself or will you hire someone?

If you hire an active manager, they’ll need to take their cut. They need to get paid, after all. And unfortunately for you as the investor, their pay can be quite hefty.

Private, illiquid REITs or other various real estate investment schemes can have laughably high fees. (Consider a common, up-front fee: losing more than 10% of your investment the moment you buy-in.) And just like with active stock market investing, if you’re paying a ton of money to a money manager, that’s less money you get to keep yourself.

In the end, that may mean you’re better off investing elsewhere like a REIT index fund or in the broader stock market.

Managing Investments Yourself

We’ve already covered that paying an outside manager to run your investments likely won’t outperform a passive alternative (i.e. a stock market index fund). So, what’s your next move if you’re dead set on investing in other asset classes such as illiquid real estate? Do it yourself.

Congratulations! You’ve just given yourself a new job.

That’s not to say that investing for yourself is unworthy or something you shouldn’t do. Just know that successful investing (stock picking, illiquid real estate, etc.) requires a lot of work – and a lot of skill. It’s also very high risk.

If you’re hoping to outperform a plain vanilla REIT index fund, you’ll need to locate an investment property that you’ve calculated can outperform the alternative (you’ve spreadsheeted out your ROI, right?). Yo’ll also need to source and manage a team of people who will make it all possible.

For real estate, that means finding a property manager and possibly a general contractor. For private equity, that means finding the right manager. Then, your job will be to stay on top of them to make sure that they are doing their job.

If you’re going to manage the business yourself, then that’s your new job. If you choose to self-manage real estate and/or will repair or rehabilitate a property yourself, now you have two extra jobs!

That’s not to say that you shouldn’t be doing any of those jobs. It’s just if you are going to be successful (as measured by outperforming the passive alternative), know that it’s going to be a lot of work. At this point, are you even investing – or are you simply working?

Successful Investing Will Test Your Patience

If you’re not interested in giving yourself a new job (or three), and since we already know that hiring someone else to manage your investments is rarely as successful as the low-cost, passive alternative, then what do you need to be a successful investor?

Invest passively, using low-cost investments. And then wait. Have patience. A lot of patience.

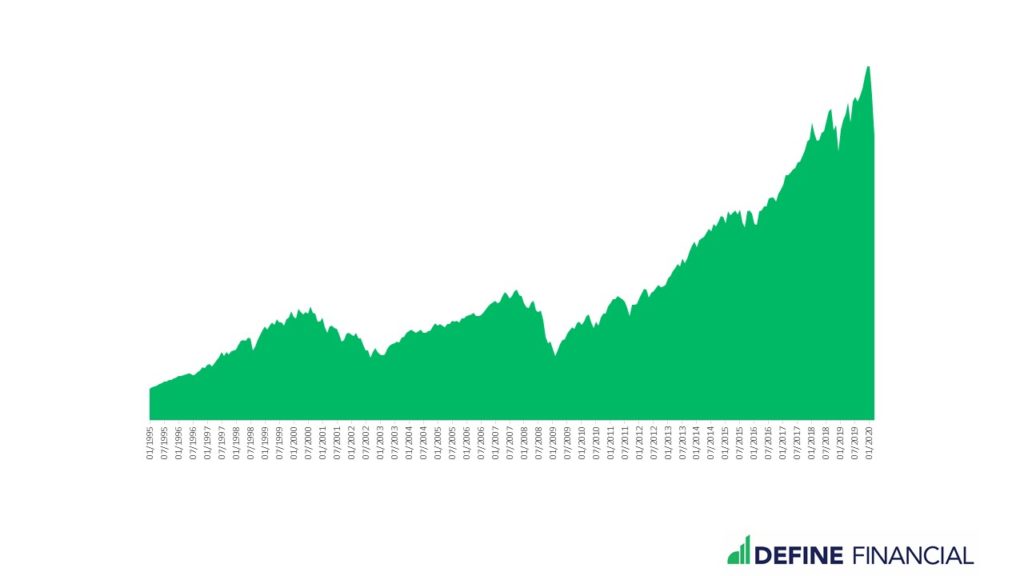

Look no further than the recent coronavirus pandemic – or the housing bubble before that – or the dot.com bubble before that. From these episodes, we know and understand what goes up must come down – and go back up again.

Look at how the S&P 500 rolls up and down in value over the years. The secret to passive investing is – therefore – patience.

Being a successful passive investor means getting some low-cost stock market investments – and then forgetting about them entirely. You must wait out the unending stock market roller coaster.

Because if you do, you can be rewarded.

The Secret to Investing

So, there you have it. That’s the secret to investing: hard work or patience. I’ll make sure to forward this blog post onto my inquisitive friend.

Now, he’ll know the secret to investing.