SAN DIEGO, January 01, 2017—Jon Luskin, MBA, CFP®, had his academic paper, “Dollar-Cost Averaging Using the CAPE Ratio: An Identifiable Trend Influencing Outperformance,” published in The Journal of Financial Planning.

The Journal goes to 45,000 financial planning professionals around the world. Its mission is to expand the body of knowledge of the financial planning profession. With monthly feature articles, interviews, columns, and peer-reviewed technical contributions, the Journal’s content is dynamic, innovative, thought-provoking, and directly beneficial to financial planners in their work.

Luskin’s study explored the nominal investment return offered by two strategies for investing in the stock market – dollar-cost averaging and lump-sum investing.

Previous research has usually shown that dollar-cost averaging underperformed lump-sum investing. However, the body of existing research has not closely examined the circumstances of this outperformance.

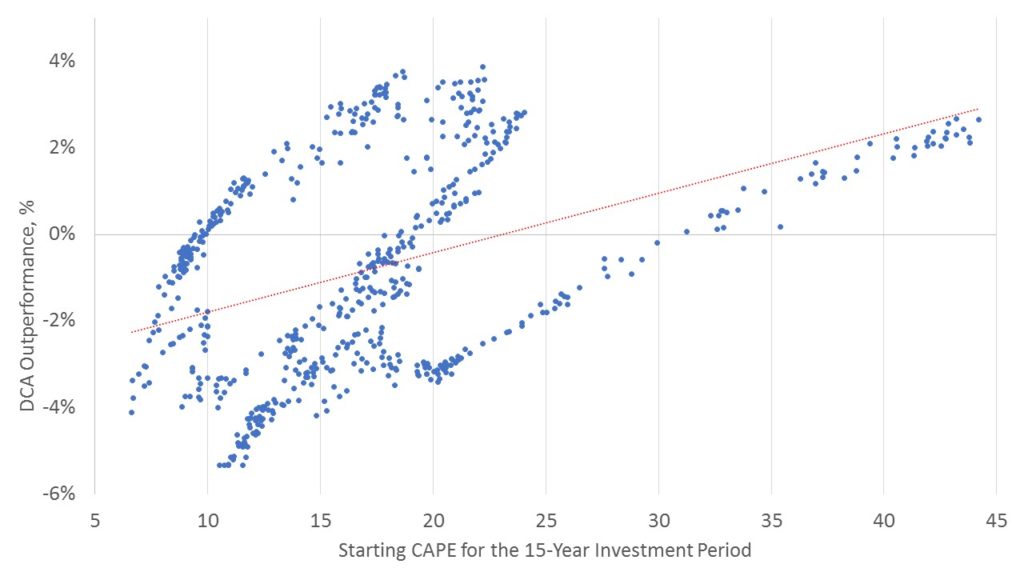

Dollar-cost averaging (DCA) is the process of making small investments over time – as opposed to investing everything at once (AKA lump-sum investing). Luskin found a pattern between market valuations and the likelihood of dollar-cost averaging outperformance over lump-sum investing. The cyclically adjusted price-to-earnings (CAPE) was used as a valuations metric, and found that DCA outperformance is a function of the CAPE ratio at the beginning of the investment period, with higher CAPE ratios linked to greater dollar-cost averaging outperformance.

Pattern behind dollar-cost averaging outperformance over lump-sum investing and the CAPE ratio.

“Having personally experienced surprising results using DCA in my own investment accounts, I was curious as to why that happened. I couldn’t find a lot of existing information about why DCA would outperform, only that it usually doesn’t. This project gave me a chance to find that answer,” said Luskin.

Jon Luskin, MBA, CFP® joined Define Financial as a Financial Planner in July 2016. For his master’s thesis on investment management, Jon showed how university endowments can generate more wealth (and take on less risk) by adopting low-cost strategies. When he’s not practicing financial planning, Jon can be found teaching safe cycling skills to the youth of San Diego, or volunteering with San Diego’s canine rescue organizations.

About Define Financial

Define Financial is a commission-free wealth management firm headquartered in San Diego, CA. Founded in 2014 by Taylor Schulte, CFP®, CEO, the firm specializes in retirement and tax planning for individuals over age 50.

Define Financial prides itself on adhering to the Fiduciary Standard 100% of the time, ensuring clients’ interests are always put first. Its comprehensive services include investment management, retirement and tax planning, charitable giving strategies, insurance optimization, and social security timing.