SAN DIEGO, December 01, 2017—Jon Luskin, MBA, CFP®, had his second academic paper, “Examining Total Portfolio Performance: U.S. Government Vs. Corporate Bonds,” published in the December 2017 issue of The Journal of Financial Planning.

The Journal goes to 45,000 financial planning professionals around the world. Its mission is to expand the body of knowledge of the financial planning profession. With monthly feature articles, interviews, columns, and peer-reviewed technical contributions, the Journal’s content is dynamic, innovative, thought-provoking, and directly beneficial to financial planners in their work.

Luskin’s second paper explored how two types of commonly-used bonds – U.S. Treasury bonds and U.S. corporate bonds – can impact the performance of an investment portfolio.

Previous research on bonds focused on investment performance in insolation – comparing one type of bond to another type of bond, or one type of bond to stocks. This limited approach is rarely applicable. This is because – in practice – most investors pair bonds with stocks to create a diversified portfolio.

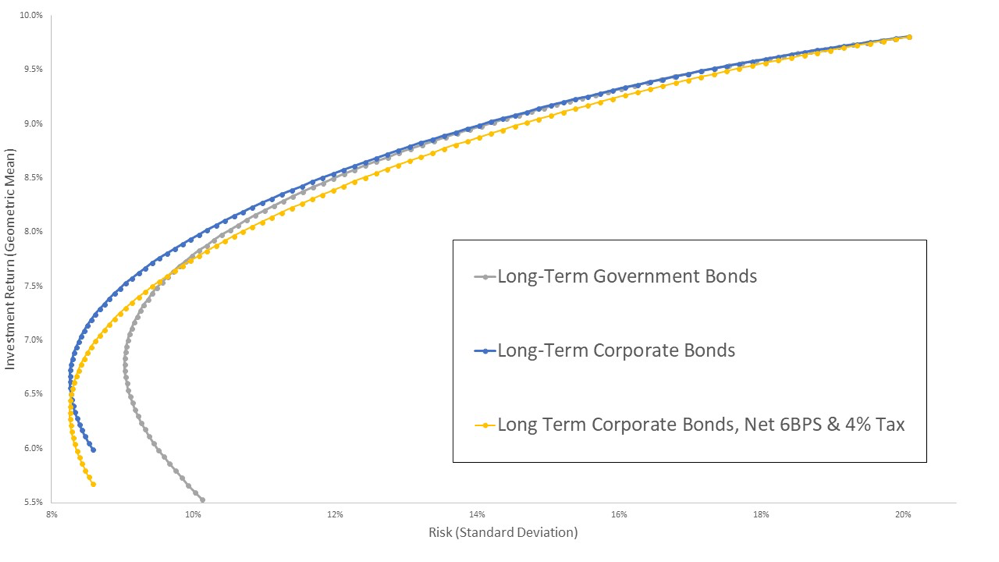

In pairing bond indices with stock indices, Luskin found that – before taxes – portfolios holding either type of bond performed similarly. So, while higher-paying corporate bonds earned investors more money in a vacuum, that wasn’t necessarily the case when those same higher-paying corporate bonds were paired with stocks to create a portfolio.

When you pair higher-paying (read riskier) corporate bonds with stocks, the advantage of higher-paying corporate bonds disappear. This is because the alternative – pairing U.S. government bonds with stocks – offered superior risk-adjusted investment returns, as shown by Luskin’s research.

“With more than one investing icon advocating for Treasuries over any other type debt – but without a comprehensive empirical analysis, I was curious to test the numbers myself. With the numbers successfully crunched and the results conclusive, I am confident that this information will help investors create the best portfolios,” said Luskin.

Read the paper in its entirety here: Examining Total Portfolio Performance: U.S. Government Vs. Corporate Bonds

About Define Financial

Define Financial is a commission-free wealth management firm headquartered in San Diego, CA. Founded in 2014 by Taylor Schulte, CFP®, CEO, the firm specializes in retirement and tax planning for individuals over age 50.

Define Financial prides itself on adhering to the Fiduciary Standard 100% of the time, ensuring clients’ interests are always put first. Its comprehensive services include investment management, retirement and tax planning, charitable giving strategies, insurance optimization, and social security timing.