Today we are sharing a summary of the CARES Act (a.k.a Coronavirus Aid, Relief, and Economics Security Act).

It was passed by the U.S. Government on March 26th, 2020 and it’s the largest economic stimulus bill in history.

The CARES Act provides financial support for:

- Individuals & Families

- Small Businesses

- Corporations

- Healthcare Providers

- State Governments

A few highlights of this financial support include forgivable small business loans, student loan deferment, credit protection, and funding to produce medical supplies.

It also ensures that an eventual COVID-19 vaccine and treatments will be covered under all private insurance plans.

If you don’t have time to read the 900-page emergency relief bill, check out our simple-to-follow guide below.

You might also enjoy podcast episode I recorded on the topic:

More of a visual learner? We have you covered:

[lwptoc numeration=”none”]1.) Direct Tax-Free Payments to Individuals and Families

If you fit the criteria of 90% of US taxpayers, then you have a check coming with your name on it. Here is what you may be wondering about these tax-free payments:

Who is eligible?

Eligible participants include anyone who has filed a federal return for 2019, or 2018 for those who have yet to file for 2019. Those receiving socials security benefits are also eligible. Dependents, non-US residents, and estates/trusts are excluded from this benefit.

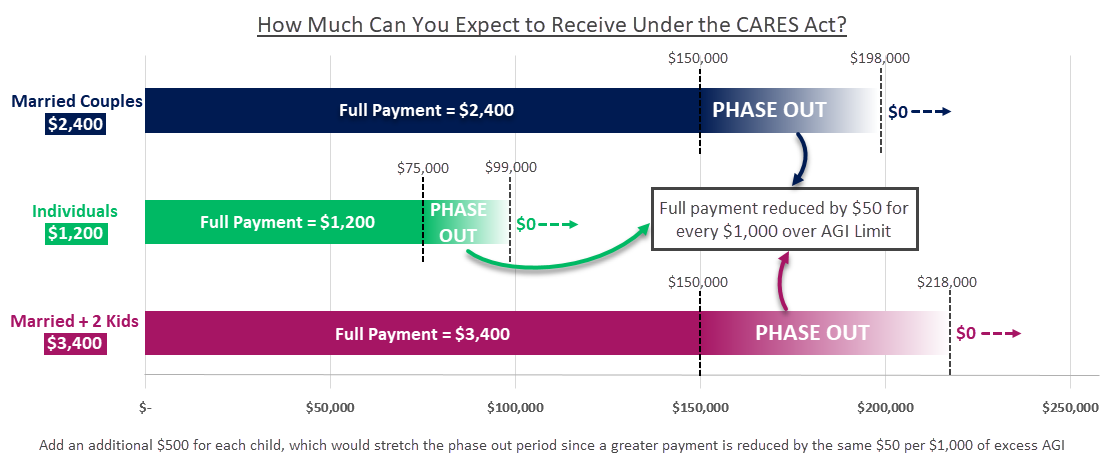

How is my benefit determined?

Individual tax-filers earning an adjusted gross income (AGI) less than $75,000 can expect a $1,200 check. For joint tax-filers, those with an AGI less than $150,000 can expect a $2,400 check.

There is an additional benefit available to families with dependent children who will receive $500 per dependent child under age 17.

For those of you receiving social security benefits, the IRS will just use the data available to them from your annual Social Security Benefits statement to determine your benefit.

A household’s maximum benefit, including both the standard payment and the per-child benefit, is phased out by $50 for every $1,000 of AGI over the respective individual and joint AGI thresholds. The benefit is phased-out to $0 at an AGI of $99,000 and $198,000 for individual and joint filers, respectively.

When will I get my check?

The CARES Act does not provide a concrete date other than checks will be sent out after April 1st, 2020.

How is my check going to be delivered?

Payments will be electronically deposited in the taxpayer’s authorized bank account used to accept prior tax refunds or social security benefits.

If you do not have a bank account that has previously received a tax return or social security benefit, a physical check will be mailed to your home address.

If your address has changed since your last tax return, you will need to fill out IRS Form 8822 and send it to the IRS as soon as possible to avoid a delay in receiving your benefit.

My 2019 income is too high, but what if in 2020 my income falls below the AGI threshold?

If your 2019 AGI was too high to receive a check today but you expect your 2020 income to fall below the stated thresholds, then you will receive a tax credit equal to your calculated benefit when you file your 2020 taxes.

2.) Extended Deadline for 2019 Federal Tax Filings and IRA Contributions

Federal Tax Filing

The traditional April 15th Federal tax filing deadline has been extended to Wed, July 15, 2020.

State tax filing deadlines vary by state, though most have aligned with the new Federal deadline.

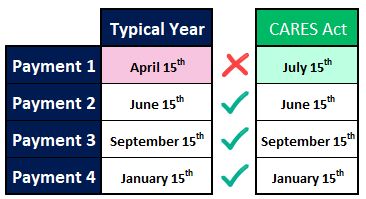

Estimated Taxes

For those who make estimated tax payments, the due date of the April 15th, 2020 quarterly payment is now July 15th, 2020.

As of March 30th, 2020, the estimated tax payments due June 15th and September 15th remain unchanged.

Can I still make a 2019 IRA contribution?

For the first time, the prior year IRA contribution deadline has also been extended to July 15th, 2020.

3.) 2020 Required Minimum Distributions (RMDs) Waived

Who is eligible?

The 2020 RMD waiver applies to any required distributions from Traditional IRAs, Inherited IRAs, and other qualified retirement accounts.

The RMD waiver also delays required distributions for those withdrawing under the 5-year equal periodic payment rule.

What if I already took my 2020 RMD?

If your 2020 RMD was taken within the last 60 days, then you may be eligible for 60-day rollover treatment if you refund the full amount withdrawn.

If you already took some or all of your 2020 RMD and you’d like to avoid the taxable income, you might consider rolling the funds back into your IRA if you’re able.

Please consult your financial advisor to see if this is a viable option for you.

Other Considerations

In rare cases, the RMD waiver may also apply to taxpayers who were required to take their first RMD in 2019, which would have been required to be withdrawn by April 1st, 2020.

If this rare case applies to you, then you would get to avoid your 2019 and 2020 RMDs.

“Who says procrastinating never pays off?!”

Chalk one up in the WIN column for the procrastinators out there who turned 70½ in 2019 and missed out on the SECURE Act’s new RMD starting age of 72…you gained one back against the IRS today, a rare feat!

4.) Penalty-Free Withdrawals from IRAs and 401(k)s

Who is eligible?

Taxpayers are eligible for penalty-free withdrawals, up to $100,000 for 2020 only, from qualified accounts under any of the following circumstances (i.e. It’s just about everyone):

- You, your spouse, or a dependent in your household was diagnosed with COVID-19

- You suffered adverse financial consequences as a result of quarantine, furlough, reduced hours, or a layoff

- You are unable to work due to lack of childcare

- You own business that closed or had reduced hours of operation during the quarantine

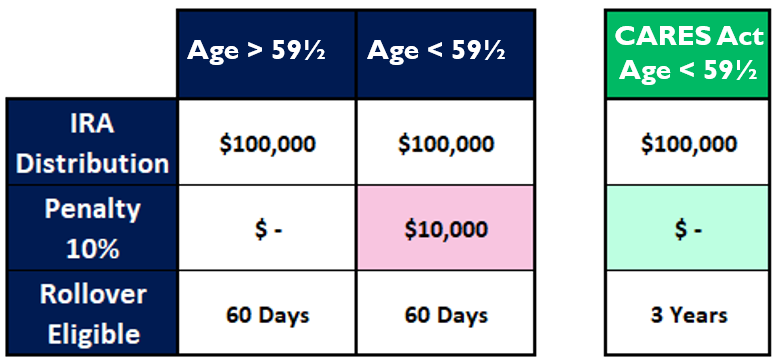

What is the benefit?

If you withdraw money from a qualified account before reaching age 59½, there is typically a 10% penalty due on the amount withdrawn.

For example, if you’re 50 and withdrew $100,000 from your IRA, a 10% penalty, or 10,000, would be due on your next tax filing.

Notice we only said penalty-free, not tax-free. Any distributions from qualified retirement accounts are still taxed as ordinary income.

However, these taxable distributions are eligible:

- For repayment over 3 years, effectively a “roll-back” into the account in any amounts or frequency during that period

- To be spread across up to three future tax years.

Withdrawing funds from retirement accounts should always be viewed as a last resort but it’s good to know those in dire need have some additional flexibility.

5.) Homeowners protected from foreclosure for 180 days

Who is eligible?

The foreclosure protection under the CARES Act only applies to mortgages owned by the federal government (i.e Fannie Mae and Freddie Mac).

Most of us don’t know what happens to our mortgage loan after we sign the dotted line. Thankfully, you can look up yourself if your mortgage is owned by either Fannie Mae or Freddie Mac.

How does it work?

Borrowers experiencing hardship can apply for up to 180 days of loan forbearance.

Forbearance means the loan payments may be postponed but interest will still accumulate at a rate equal to the scheduled amount for the delayed payments. Forbearance is different than deferment, where deferment is a halt on principal payments and interest accumulation.

How long can I delay my payments?

The initial forbearance period is 180 days. An additional 180 days may be requested but its approval in full is not guaranteed and is up to the discretion of the US Government.

Can I enter forbearance on rental properties?

Rental property owners may request mortgage loan forbearance, but it comes with some strings attached.

The most significant is that landlords may not evict tenants while their properties are in the forbearance period and in no case may they evict their tenants before 30 days written notice to vacate.

Congrats! You Just Read 900 Pages of Legalese in 5 Minutes!

The CARES Act comes during a time where we as a human race find ourselves in truly uncharted territory.

Things are changing by the day and although each of our circumstances is different, one commonality between us all is that with a little planning, guidance, and community we will emerge from this with a greater appreciation of what each of us finds most important in life.