Wouldn’t it be great if trades were free?

A newer investing platform that comes with its own snazzy app aims to do just that. It’s called Robinhood.

But does it really move wealth into the hands of the common man with free trading?

Not really. Here’s why.

Common Investing Fees

The reality is, there’s no such thing as a free trade.

Trading and investing, in general, come with many costs. However, most people are only familiar with some of the costs of investing.

Investing fees commonly known and understood include:

- The commission fee to trade a stock – such as $4.95 at Charles Schwab, or “free” at Robinhood

- Taxes on any increases in the value of your investments

- An administrative or a setup fee for a workplace-provided 401(k)

- The fee charged by your financial planner to manage your investments for you – and to invest on your behalf

- Investment fees which could be mutual fund fees, exchange-traded fund (ETF) expense ratios, or the hilariously-high fees of private equity and hedge funds

It’s easy to see why one may think the investment fees listed above are the only ones you’ll ever pay.

That’s because all of these fees are visible.

Usually, you’ll see these fees listed as a line item on your regular account statement. You see exactly what you are paying for.

It may look something like this:

1.8.20 – $4.95 – Trading Commission

3.1.20 – $1,128.43 – Asset Management Advisor Fee

4.31.20 – $10.00 – Account Administration Fee

The thing is, if you believe those are the only fees you’re paying to invest, you are wrong.

There’s another very important fee that you will never, ever see you on your account statement.

It’s called the bid-ask spread.

The Bid-Ask Spread

Unfortunately, free trades aren’t really free due to a concept called the bid-ask spread.

There’s simply no other way for me to explain how costs can be hidden without bringing up this esoteric term.

The bid-ask spread is where massive investment costs can hide – costs which will eat away at your investment returns if you are not very, very, careful.

Let’s start with an example to help explain what a bid-ask spread is:

Joe wants to buy a small value index fund.

Small value stocks have historically outperformed other categories of investments – and using an index fund means that Joe will not only keep his costs low, but will also reduce risk by diversifying across the entire asset class that is small cap value.

Good job, Joe!

Joe picks the SPDR S&P 600 Small Cap Value ETF (SLYV) and saunters over to Charles Schwab to place a trade.

Now, let’s take a look at the numbers.

SLVY – an exchange-traded fund (ETF) – is trading at $119.91. But, in order for Joe to purchase one unit of SLYV, he must pay the ask of $119.99.

In short, as soon as he places his trade (called a market order), Joe loses eight cents, or 7 BPS (0.07%), of his investment.

While 0.07% isn’t huge, it can be twice the expense ratio of some ultra-low-cost mutual funds.

And while Joe isn’t paying a $4.95 trade fee, he certainly isn’t buying the investment for free.

That’s because the trade has a very well-hidden cost.

The Psychology of Free Trading

Self-guided investors may take pause when confronted with paying a trade fee.

But, the absence of such a fee may remove that hesitation.

As such, investors taking advantage of free trades may witness themselves trading more frequently – and that’s when the cost of the bid-ask spreads begin to add up without them being aware of it.

While a 7 BPS expense for a one-time trade may not be detrimental to one’s investment returns, 7 BPS compounded over time will.

That’s because fees add up – and the magic of compound interest means that a fee paid now means losing big money in the future.

Bid-Ask Spreads Gone Wild

I am being nice in the above example. Bid-ask spreads can be much higher – which is why I highly suggest paying attention to them.

Bid-ask spreads don’t just apply to exchange-traded funds (ETF’s) either. Individual stocks also have a bid-ask spread to monitor.

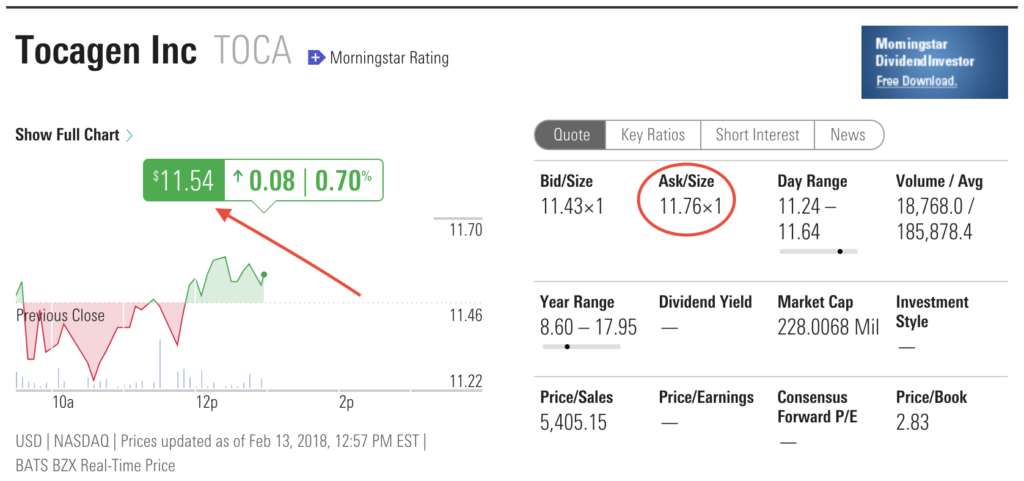

For a more extreme (but still common) example, let’s look at the San Diego-based company Tocagen (Ticker: TOCA).

As of this writing, the stock is trading at $11.54 per share.

However, if you put in a market order to purchase the stock, you would have to pay the ask of $11.76 per share.

That’s a hidden cost of almost 2%!

Sometimes You Pay the Bid-Ask Spread Twice

At Define Financial, we almost exclusively use mutual funds (many of the mutual funds we use trade for free).

This is because trading ETFs requires greater due diligence. We also use them to minimize the impact (cost) of bid-ask spreads from stocks and ETFs.

Side note: The mutual funds we use are low-cost, index investments. Of course, there are low-cost index investments available in ETFs as well. Either mutual funds or ETFs can be used for low-cost investing. However, mutual funds have certain advantages over ETFs.

As mentioned already, when you buy a stock or an ETF, you’re paying a bid-ask spread. However, when you buy any fund (be it a mutual fund or ETF), the fund manager pays a bid-ask spread.

So, if you’re buying an ETF, you’re losing money twice because of the bid-ask spread: first, when you buy the ETF, and second when the ETF manager buys the securities comprising the ETF.

You can avoid paying the bid-ask spread twice on the same investment by either:

- Using mutual funds

- Buying your individual stock and/or bond picks directly

For most investors (ourselves included), the second option is a non-starter.

This is because picking the few investments that will outperform is a loser’s game – and also because buying enough investments to achieve an appropriate level of diversification is cumbersome.

Don’t Fall for Free Trading

If you see a company advertising free trades or promising to help you grow wealth for free, think twice before you pull the trigger.

It’s mostly a marketing ploy.

You will be paying the bid-ask spread (sometimes twice), even if a trade appears to be free.

“Free” trading may tempt you to change your investments more frequently than necessary, which can increase internal costs and reduce long-term returns.

Our advice – stick to low-cost index investment and be a boring investor instead.