Financial independence bloggers have made the idea of “early retirement” all the rage over the last few years.

If you earn plenty of money and invest it wisely, early retirement enthusiasts claim that you can quit work earlier than your peers and enjoy decades of freedom before you reach old age.

The good news is, these people are absolutely right.

Early retirement is possible if you start planning early and make smart financial moves along the way. We’ll cover some of the most important things you should know about early retirement planning.

Three Main Challenges of Early Retirement

If your goal is early retirement, there are three main challenges you should know about. How you handle these challenges will determine whether you successfully retire early – or fail.

To enjoy a “successful” early retirement, you need to stash away enough cash so that you don’t run out of money before you die. And trust me, it really is all about math.

Here are the three challenges you’ll face as you try to escape the rat race as quickly as you can:

Challenge #1: Less Time to Save Money

One factor that makes early retirement difficult is that you have less time to save. This means you have fewer years to put money into your company 401(k), and/or your Individual Retirement Account (IRA).

While it may not seem like it now, those extra years out of the workforce can make a huge difference. If two people are contributing the same amount to their retirement accounts every year, the person who saves longer will always have more money (all else being equal). The math is simple:

$10,000 savings X 10 years < $10,000 savings X 20 years

There is simply no way around the fact that more time yields a larger nest egg. All else being equal, if you’re saving money for only twenty years before you retire, you won’t have as much money as the guy working until he’s 67.

What’s the solution? Save more money (and make more) while you can.

Fortunately, most would-be early retirees are already doing this. They are maxing out their workplace plans like a 401(k). Most who are serious about the goal of early retirement may also make contributions to a non-deductible IRA, and even use their Health Savings Account (HSA) to save for retirement. From there, many build huge slush funds in taxable brokerage accounts.

When it comes to retirement, the more money you can save early, the better off you’ll be.

Challenge #2: Less Time for Money to Grow

When it comes to early retirement, the mathematical challenges are nearly endless. Not only do you have less time to save, but your money also has a shorter timeline to grow.

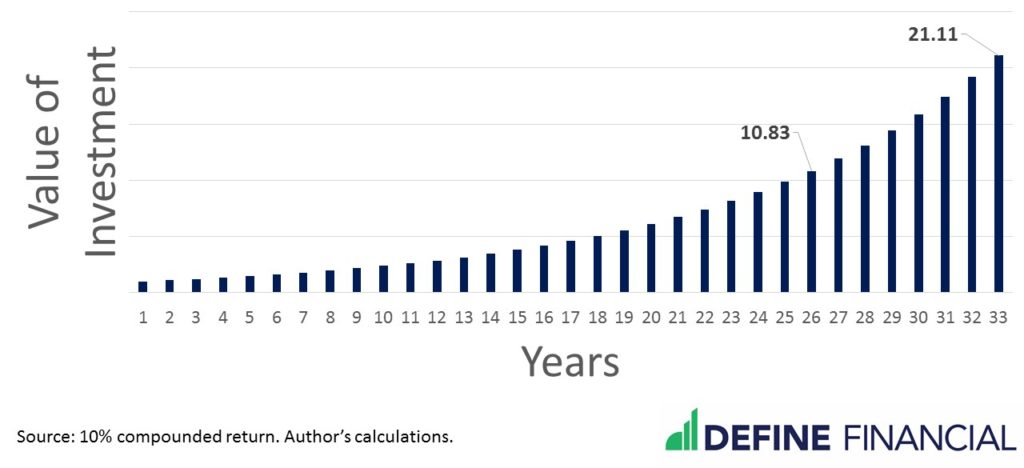

This can be very, very important with investing, because the bulk of your gains come from compound growth. Compound growth means that your growth grows. With compound growth, the exponential nature of it means that the really big growth comes at the end. So, if you move the end point back, the loss is significant.

Consider a hypothetical investment earning a 10% rate of return. It will take that investment more than 24 years to grow ten-fold, or ten times its original size. How much longer does it take to grow to 20 times its original size – or twice as large? Because of the magic of compound growth, it will take roughly 7 years.

Given this challenge of compound growth – what’s a would-be early retiree to do? There are two solutions:

- Save more money to make up for the loss of compound growth

- Be more aggressive with your investments in the early years of investing

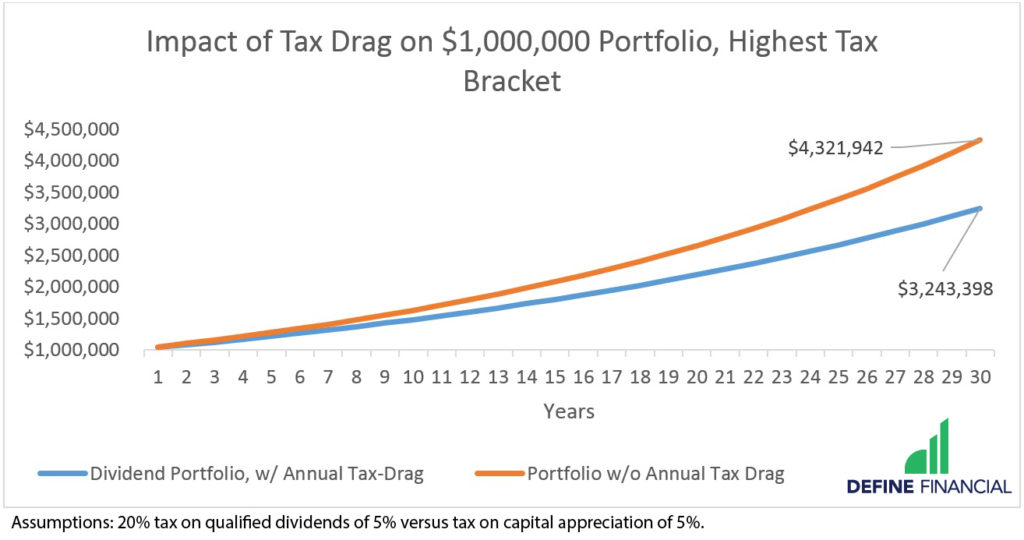

Whatever your actual risk tolerance, if you want early retirement to happen, you will likely need to be more aggressive. This means allocating to stocks – and potentially not selecting any bonds. (And it also means not being distracted by inane investing trends, like Bitcoin or Dividend Investing.)

If you’re not comfortable seeing the value of your portfolio go up and down, perhaps early retirement may not be possible for you.

Challenge #3: More Time for Your Money to Be Spent

If you’re retiring early, you’re going to have a longer retirement than the average retiree. (This is the same reason why the 4% rule doesn’t apply to early retirees.) That means instead of your investments lasting 30 years, they may need to last 40, 50, or even 60 years!

How can one make sure their nest egg will last? Spend less money. The less cash you draw from your portfolio, the longer it will last. If you don’t like the idea of spending less money in retirement, you can save more money before retirement and/or ramp up how aggressive you are at the onset of your investing adventure.

Addressing the Investing Challenges of Early Retirement

When it comes to investing, there are only so many levers one can pull – that is, there may only be a few ways to change your outcome. Of course, there are additional strategies outside of investing, such as:

- Delaying Social Security

- Accessing home equity

- Tax planning and account distribution strategies

But, while the above can increase your odds of success, a big part of your financial plan will boil down to how much money you have and how quickly you intend to spend it.

How much money you have will depend upon how much you have saved and the performance of your investments. The amount you save, how quickly you spend the money you have, and your appetite for risk are all things that you can control.

In the absence of a winning lottery ticket or huge inheritance, you have three choices – investing as much as you can, dialing up your risk, and living off as little as you can get away with once you retire. And if you want to drastically improve your chances of staying retired forever, you should do all three.

Where the Early Retirement Movement Has it Wrong

Often times, people take the time to learn just enough about finance to be dangerous – that is, they learn a handful of important financial concepts and glaze over the rest.

The “4% rule,” which is commonly repeated by early retirement enthusiasts, is a good example. The 4% rule is a mathematical concept that says you can retire once you are able to withdraw 4% each year while maintaining enough principal to keep you afloat until death.

I cringe when I see early retirement bloggers espousing the virtues of the 4% rule. Why? Because the 4% rule is a thing of the past. If you think your investment portfolio can sustain a 4% withdrawal every year, think again. Here’s why:

- In his study, William Bengen’s 4% rule was applied to a 60-year old retiree, not someone in her 30s or 40s. Bengen didn’t do an analysis past 50 years of withdrawals, so if you’re planning on retiring long before age 60 and living to age 100, you will likely run out of money using the 4% rule.

- Bengen’s research was published in October of 1994. Newer studies have declared sustainable withdrawal rates should be as low as 1.26% net of fees, depending on your investments.

But, enough of that. When it comes to early retirement bloggers, there is another huge piece of the puzzle missing.

Many early retirement bloggers focus their investments on tax-deferred accounts as if the bill will never come. In the meantime, they fail to plan for their future (and potentially huge) tax bills. In my opinion, this is a huge mistake.

What Is a Tax-Deferred Account?

A tax-deferred account works exactly as it sounds – it’s an account that defers taxes. It does not eliminate taxes. With a tax-deferred account, you don’t pay taxes now…but you do pay them later down the line. You are still paying taxes. A tax-deferred account is not a tax-exempt account.

Just because you have to pay taxes on a tax-deferred account doesn’t mean it’s a bad account to have. In fact, it’s quite the opposite. Postponing taxes means that your investment grows without the tax-drag – a phenomenon that can slow down the rate of growth of your investment. In that respect, an investment that defers taxes is usually better than one that doesn’t have any sort of tax benefits.

Although tax-deferred accounts postpone taxes to help your investment grow, you must eventually pay your taxes. And that’s the big issue here – many early retirees fail to plan for how much they’ll lose to taxes in retirement.

As you probably know, many popular retirement accounts like the 401(k) and 403(b) are tax-deferred. Again, this is a great tax benefit because your investments grow without the hindrance of taxes. Yes, you will have to pay taxes eventually, but tax-deferral is better than nothing.

But, the benefits don’t stop there; not only are these common retirement accounts tax-deferred, but you can enjoy a smaller tax bill this year just by putting money into your own retirement account.

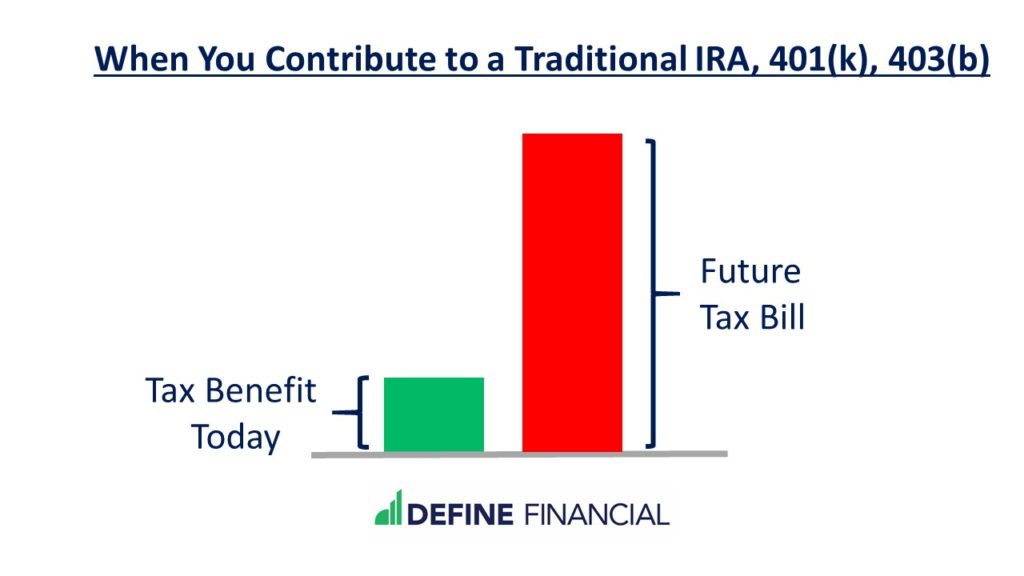

Unfortunately, today’s tax break comes at a higher cost in the future. While you get a tax deduction for making a contribution to your retirement account, you will eventually pay that money back to the government in spades. There’s no way around this.

Early retirement hopefuls need to start considering the prospect of taxes in all of their future plans. Their portfolio may look great on paper, but those future taxes could cost more than they realize.

Traditional vs. Roth: Pay Taxes Now or Later?

Taxes are an unavoidable component of citizenship. However, that doesn’t mean you don’t have any options when it comes to when to pay them. The key to making the right decision is educating yourself – as in, don’t let short-sightedness (or a lack of information) cause you to make a bad decision.

With a traditional IRA, 401(k), etc., you get an initial tax break on your contributions (i.e. when you put money into the account). This gives you a tax savings today. Eventually, however, you will have to pay taxes on the money you take out. And there’s a catch – you will pay more in taxes in the future when you use a traditional IRA, 401(k), etc.

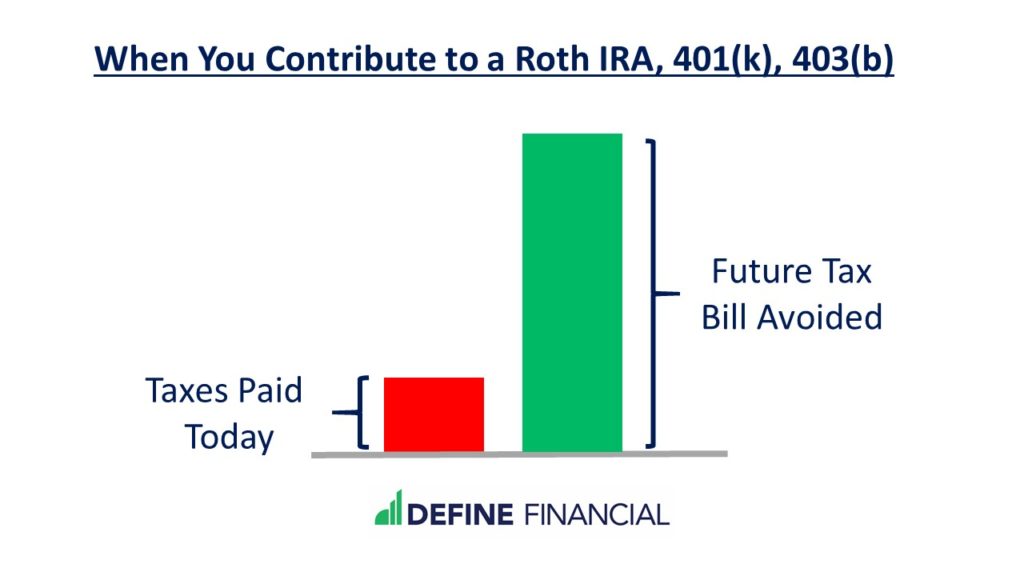

Now, even though you are paying more taxes in the future, it may still make sense to use a traditional IRA or 401(K), etc. Alternatively, you may be able to contribute to a Roth IRA (or a backdoor Roth IRA) or your workplace Roth 401(k), Roth 403(b) or Roth 457. When you use a Roth account, you pay taxes today to avoid a much larger future tax bill.

I’m a huge fan of the Roth option – and not just for the avoidance of a large future tax bill. Using a Roth IRA effectively saves you more money – which means you’ll have more tax-free savings in the future.

Many folks are tempted to go with the traditional IRA, 401(k) etc. because they are enjoying the tax break today. But, the key point I want to make in this post is that you are not avoiding taxes; with a traditional IRA or 401(k) you are only delaying taxes. Moreover, you may be trading a relatively small tax savings today for a very big future tax bill. Unfortunately, nobody has a crystal ball that can tell them for sure.

Why $1 Million Isn’t Nearly Enough for Early Retirement

Understanding how much you need for your retirement isn’t easy. It may feel like all you know is that it’s a big number. And with so many variables in play, it seems easier to just pick a large sum that feels like a substantial amount of money.

Because of this, many people assume they need $1,000,000 to retire. If they hit that number, they’re golden.

But is a million bucks enough for your retirement savings goal?

It might make sense to aim for a nest egg of this size. But, the amount you need to save isn’t as simple as finding a number that sounds great.

You need to look at a slew of factors to determine what “enough” money for retirement looks like for your specific situation. Here’s some of what you need to consider.

Understand Your Tax Situation

The more you pay in taxes, the less money you’ll have for retirement income. Using our $1,000,000 mark as an example, let’s look at how that money could be allocated across 4 different portfolio arrangements when you retire — and how each has a different actual value when it comes to funding your retirement.

1) If Your Million Is in a Roth

Building up $1,000,000 in a Roth account, (IRA, 401(k) or 403(b)), is ideal. Why?

There are no taxes on distributions. In this scenario, your one million dollars truly is one million dollars.

2) If Your Nest Egg Is in Traditional Tax-Deferred Accounts

Now let’s imagine your million dollar retirement nest egg lives in a tax-deferred account, like a traditional IRA rollover or a traditional 401(k). Thanks to the impact of taxes, your account may only be worth $850,000, $750,000, or even just $600,000.

And that’s just considering federal income tax on your distributions in retirement. Your million dollars could be further reduced by state taxes.

3) If You Incur a High Basis…

If your $1,000,000 is in a taxable account, what’s the basis (the original purchase price) of your investments? If you bought all your investments yesterday, your $1,000,000 is truly worth $1,000,000.

4) …But If You’re Dealing With a Low Basis

If you bought all your investments decades ago, you are likely looking at a big tax bill when you sell anything in the $1,000,000 portfolio. Said another way, your $1,000,000 portfolio isn’t really worth $1,000,000 after you consider taxes.

What’s the Length of Your Retirement?

Another factor to consider when determining if one million dollars is enough to retire on is how long your retirement might be.

Do you plan to retire at age 70 or age 50? What’s your family’s average life expectancy? Did your parents live well into their 90’s? If so, you should take that into account.

If you plan on retiring at 70 and have a family history with a shorter life expectancy, then $1,000,000 could be a sufficient amount to shoot for in terms of retirement savings.

But, what if you plan to retire early and you live to age 100? In that case, you should know you’re going to need more than $1,000,000 to make it through your long retirement.

What Are Your Living Expenses?

Just like the length of retirement plays a big role in how far a million bucks can stretch, so does how you plan to spend that money.

How much money do you want to spend? What’s your intended lifestyle?

Do you see yourself reading books in your living room, working on your garden, and playing bridge with your neighbors in retirement?

If so, then $1,000,000 may be enough.

But, if you see yourself traveling half the year or remodeling your house, $1,000,000 may leave you short of what you really need for the retirement you want.

Look at the Fees on Your Accounts

Our clients are probably sick of us talking about fees all the time. But we never stop talking about fees on your investments because they matter so much.

You can pay 3.00% for your investment funds or you can pay 0.03%. That 100-fold difference creates a huge impact on your chance for a successful retirement.

If your retirement savings goal is $1,000,000, your actual savings needs to be higher to account for the fees your investments incur.

How much you pay in investment fees will help determine just how valuable your $1,000,000 of retirement funding is when you’re ready to use it.

But, how much will you pay? As with all financial planning questions, the answer is, “it depends.” It all boils down to your particular situation — which is why working with an objective, educated third-party can be so valuable.

Talk through these factors and more with your financial advisor to get a rational — not emotional — perspective on how to craft the ideal retirement plan for your goals.

How to Factor in Other Income Sources

If you think about the length of your retirement and the type of retirement you want to have and find that $1,000,000 won’t be enough after all, don’t panic. Saving more isn’t necessarily the answer because you don’t have to live on savings alone.

A million dollars in a vacuum won’t fund many people’s retirements on its own. Assuming a 2% safe withdrawal rate, that’s only $20,000 in annual income.

But working with one or two household Social Security income streams and/or a pension benefit payment can make a world of difference.

You won’t get far on $20,000 in annual income. Adding an additional $30,000 from Social Security benefits could bring that total to $50,000. You’ll have a much different quality of life living off $50,000 versus $20,000.

You can also consider strategies that will build ongoing income streams into your long-term retirement plans. Perhaps you can pick up a side hustle in retirement. Or, you can invest passively to build long-term residual income you can count on. Whatever you decide, you should know that more long-term income means better chances at early retirement success.

Final Thoughts on Early Retirement

If you want to retire early, it’s important to learn as much as you can about investing and building wealth. Retiring early takes time, but learning investing basics will still leave you better off.

And, don’t forget; one of the best ways to reach early retirement is with the help of a fee-only financial planner who has your best interests in mind. By starting early, educating yourself, and hiring a professional who can help you achieve your goals, you should be on your way to early retirement in no time.