If you pay attention to financial pundits and money blogs, you have probably heard at least a handful of “experts” praise dividend investing.

Let’s define dividend investing.

Simply put, “dividend investing” is investing in companies that make regular cash payments to their investors. Some dividend investors roll this cash back into their investment. This allows those dividend investors to accumulate even more wealth over time.

Obviously, this is genius!

I mean, who wouldn’t want to earn cash dividends they can reinvest for a greater return?

5 Problems with Dividend Investing

Unfortunately, the allure of dividend investing is worse than smoke and mirrors; it’s downright propaganda.

Regardless of whether dividend investing has been trending lately, it’s not the foolproof retirement answer it’s made out to be. Here’s why:

Let’s Define Dividend Investing Problem #1: Historic Performance

Cash dividends sound great, but is the proof in the pudding?

Unfortunately, all signs point to “no” since dividends fail the historic performance test. A mountain of data shows how dividend investing makes no sense.

There are many investing strategies – including value investing, investing to focus on shareholder yield, or investing in companies with a low dividend payout ratio.

More than one study has made this point.

If you want to make money over the long-term – which is why we’re investing in the first place – dividend investing simply hasn’t proven itself as the best way to do that.

Dividend Investing Problem #2: Cost

On average, keeping your investment costs low is the key to scoring the best investment return. When you pay less to invest, you keep more money for yourself. The math is pretty simple.

A dividend-centered investment fund (a mutual fund or an ETF) is almost always more expensive than a broader, more-diversified fund.

Let’s use these two examples as a basis for this argument:

- iShares Core S&P Total U.S. Stock Market ETF expense ratio: 0.03%

- iShares Select Dividend ETF expense ratio: 0.39%

Look at the two funds above and you’ll notice the dividend fund costs 13 times as much as the broader, more diversified fund. And this comparison assumes you’re buying low-cost funds to begin with.

Obviously, the price difference might be even worse if you’re opting for the expensive active-management route. Believe it or not, you could be paying up to 36 times (or more) for a dividend-focused fund compared to a low-cost broadly diversified index fund.

Fees Make Dividend Investing Expensive

But, wait! There’s more . . . more fees.

If you’re reinvesting your dividends, that means you are paying a fee called the bid/ask spread. So, not only can a dividend-investing strategy be expensive in terms of internal fund fees, but transaction costs can also eat away at your investment return.

Over time, these added costs will chip away at your earnings. You may be receiving cash dividends, but you’re paying a lot more money out than the alternative.

Dividend Investing Problem #3: Diversification

The value of diversification is so ubiquitous that I’m sure you’ve heard this before. Still, it bears repeating that you should never put all of your eggs in one basket.

When you focus your investments on those companies that pay dividends, you’re doing the opposite of diversification: you’re concentrating your investments into just one type of company. This makes your investments riskier.

So, if you think dividend investing is a safe strategy, you’re dead wrong. Focusing on dividends is very risky.

This is a very important point – especially since may dividend investors are retirees. And when you’re a retiree, it’s a lot hard to keep working to make up for your investing mistakes. So, let’s say it again:

“Focusing on dividends is very risky.”

Dividend stocks are risky.

Don’t believe me? Think dividend stocks are foolproof? Allow me to reference the very same euphoria for dividend-paying companies that caused a stock market bubble and poor stock market performance of the 1970’s.

Dividend Investing Problem #4: Performance Chasing

Studies continue to demonstrate the value of sticking with buy-and-hold investments. The gist of these studies is this: Over time, investors who buy and hold long-term investments, and specifically low-cost index funds, earn more money than investors chasing the latest investment trend. The recent popularity of dividend investing is no exception.

If you think you’re the only one investing in dividends, think again.

Trust me when I say everyone and their grandma is doing it and countless people are blogging about it, too. It’s only a matter of time until the dividend bubble follows the gold bubble, real estate bubble, and tech bubble of previous generations.

Need More Proof? Today’s Valuations

Valuations measure how expensive or cheap something is. This information is valuable because, historically, cheap things tend to become expensive. On the flip side, expensive things usually go back to being cheap.

So, if you buy something when it’s cheap, you can sell it when it becomes expensive and turn a profit. If you buy something expensive, on the other hand, you’ll lose money if you sell it after it loses value.

The pattern behind valuation & investment return

Now, consider this:

Dividend-paying companies are in such demand that the Vanguard Group recently closed the doors on its dividend fund. The significance of this bears repeating: so many people were pouring money into this fund that Vanguard felt they were running out of investment opportunities.

The market for dividends is crowded and the investments are expensive. Is this something that you want to put your money in?

How expensive is it? Check out “P/B” a common valuation, on the Vanguard dividend fund. It’s 60% more expensive than the stock market average. That’s pricey!

Dividend Investing Problem #5: Taxes

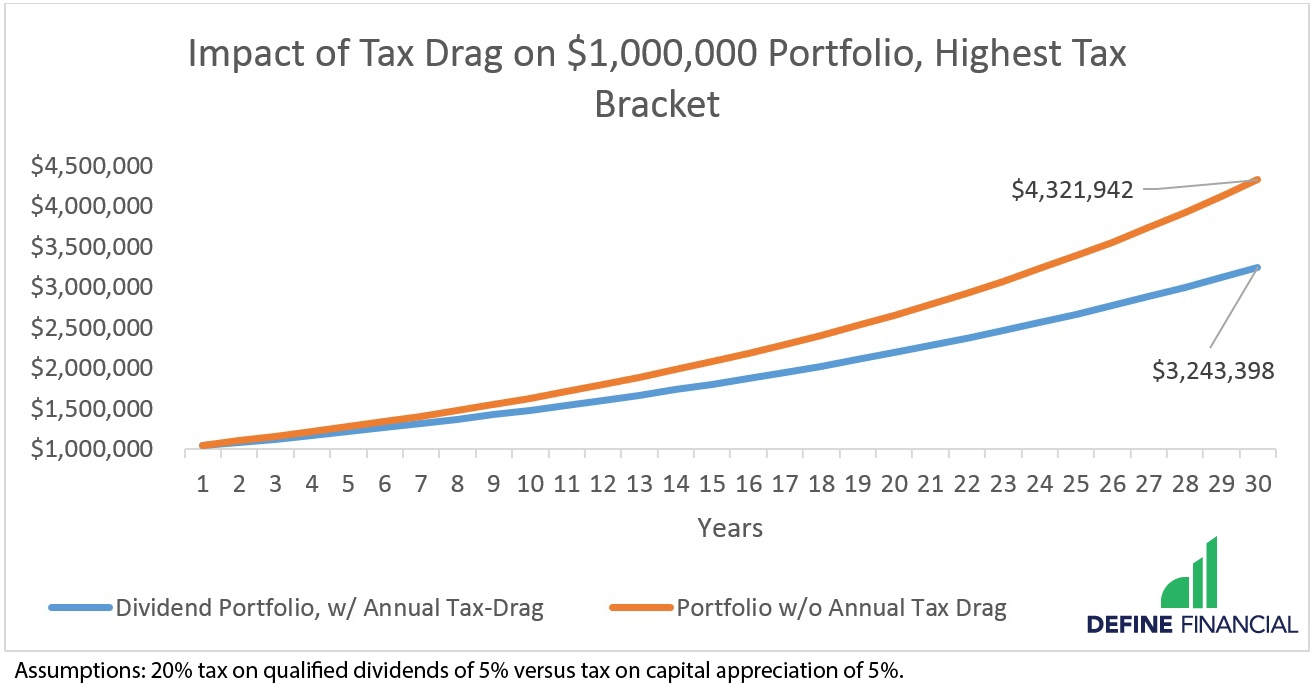

The final problem with dividend investing is that it comes with hefty tax consequences.

Even if you’re holding your dividend-paying investments longer than one year (to get better tax treatment), you’re still paying taxes every single year. This hurts your investment returns.

Each time you receive a dividend, you get a tax bill. Companies that reinvest their profits are able to give you an investment return without an immediate tax consequence, but that doesn’t mean you won’t eventually pay the piper.

Check out the chart below to see how taxes might drag down your performance over time:

Remember, your tax bill matters more than you think. And over time, more taxes coupled with higher fees and less diversity means less money in your pocket – not more.

Smart Tax Planning & Dividend Investing

Don’t let the above header, “Smart Tax Planning & Dividend Investing” confuse you. With dividend investing, you can’t possibly be smart when it comes to your taxes.

That’s because when dividends show up in your investment account (and they usually do once a quarter), a tax bill is guaranteed to show up at the end of the year.

And there is absolutely nothing you can do about this tax bill. However, there are better investing strategies. These other strategies do more than offer a higher return; they offer fewer taxes.

You’ll have fewer taxes with total-return investing than with dividend investing. That’s because while total-return investing will include some stocks that pay dividends, total-return investing will also include stocks that will increase in value. When stocks increase in value, you have more money. But, this money isn’t immediately taxed as dividends are. Instead, that money is only taxed when you decide to spend it. (You do this by selling your investment.) With dividend investing, you’re taxed whether you need cash or not.

And this is an important difference. Because sometimes you don’t need the cash. And if you don’t need the cash, it doesn’t make sense to pay a tax bill for cash you don’t need.

Why wouldn’t you need cash in retirement? I can think of a few reasons. Maybe you already have a ton of cash because:

- Your rainy day fund is too big.

- You just received an inheritance.

- You just sold a business.

- You just sold a rental property.

- You just downsized your home.

- Your pension started paying out.

- You’re claiming Social Security benefits.

In short, with a total-return investing strategy, you have flexibility. You can plan when to pay taxes based your needs – and not on the schedule of when a big corporation sends cash to its investors.

The Bottom Line: Invest Smarter, and Ignore the Trends

Remember, it’s important to think about total return investing – not just a handful of cute dividends. When you invest for total return, you look at ALL the money you get from your investments. This income can come in the form of dividends paid out in cash, or as an increased investment price as the value rises.

Most folks opt for the dividend investing strategy because they want the income that comes from dividends. The thing is, the alternative to dividend investing – investing for total return – will get you even more money than a dividend investing strategy ever will.

When it comes to being a smart investor, you don’t need to become a rocket scientist. To get the best returns over time, you need to focus on the three pillars of smart and profitable investing – keeping costs low, diversifying your investments, and not chasing performance.

While dividend investing might be all the rage these days, it fails all of these tests. Not only has it underperformed other strategies historically, but it comes with a tax drag to boot. Worse, dividend investing can be extremely expensive.

Skip dividend investing for proven, low-cost, diversified investments instead. You’ll be a lot better off in the end.