Are you trying to save money on auto insurance?

I’ve got some simple advice that can help you save hundreds of dollars on your auto insurance policy.

Every year, thousands of people make a specific mistake with their coverage that costs them big time. These people are literally taking hundreds of dollars every year and lighting it on fire.

I’ll show you how to avoid these mistakes so you can keep more money in your pocket every single year.

Auto Insurance You Need

Before I explain how and why to save money on auto insurance, let’s talk about several types of insurance you need and how they work.

Liability and Umbrella Coverage

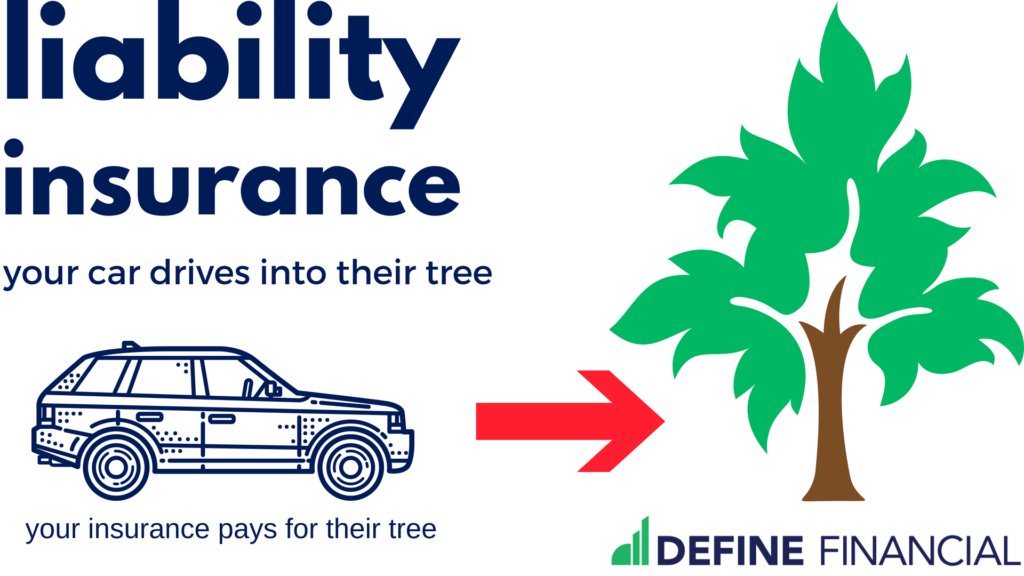

Liability coverage is just one type of insurance that makes up your auto insurance policy. It is the mandatory part of your insurance policy. In other words, liability coverage is required by law. You must have liability insurance whether you like it or not.

Fear not, because the requirement is for a good reason.

Liability insurance covers you when you drive your car into another car, a person, a house, a tree, etc. Since a 4,000-pound object being pushed into anything can cause a lot of damage, you want liability insurance. And you want a lot of it.

When it comes to liability insurance, you want to make sure you’re getting the maximum amount of coverage. The maximum varies by insurance company, but it ranges between $100,000 and $500,000. You should strive to buy the maximum given by your insurance company.

In addition, you can buy a separate umbrella insurance policy, which increases your protection. Your liability coverage and umbrella coverage will come in handy if you’re hit with a $500,000 lawsuit. If that ever happens, you’ll be happy you have maximum liability coverage plus umbrella coverage.

In short, we want to increase your liability coverage. So, liability coverage is one area where we will not be able to save money on auto insurance.

But stay tuned. We will review other opportunities to do just that.

Uninsured and Underinsured Motorist Coverage

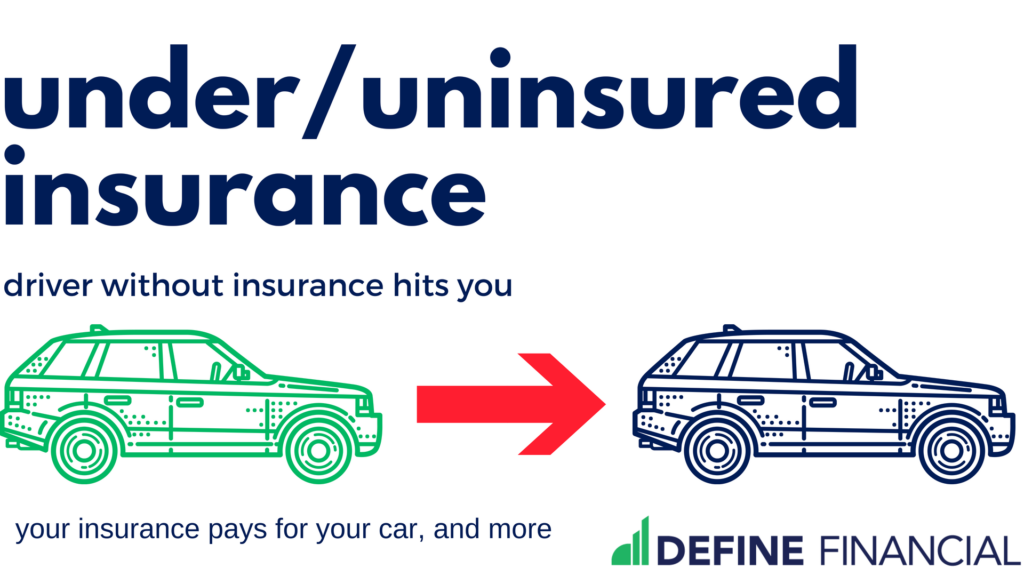

This is another very big – and very important – part of your auto insurance. This insurance helps you when the other driver is at fault AND doesn’t have big liability coverage (which is very, very common).

Consider this example:

Bob selects his insurance company’s default liability coverage choice of $30,000.

On his way to work, Bob is enjoying a messy breakfast. Bob realizes he has made a mess of his shirt, so he leans over to grab a napkin and doesn’t see you right in front of him. His car plows right into you.

Your car is totaled and you end up in the hospital. You’ve got $100,000 in medical bills as a result of the accident. Worse, you can’t work for several months due to your injuries. This causes you to lose $50,000 in income. Based on that math alone, Bob owes you a car and $150,000.

But guess what? You’re only getting $30,000 from Bob’s insurance company – because that’s all the liability coverage Bob has. Unfortunately, suing Bob won’t get you anything else because he doesn’t make much money and doesn’t have anything saved up.

Sure, your medical insurance might cover some of your medical bills – but not all of them. And your disability insurance policy may replace some of your income – but not all of it. Let’s not forget; you still need a new car. Where is all the money going to come from?

Enter uninsured/underinsured motorist coverage. This is coverage that fills the gap left by another driver.

As you can tell in the example above, having this coverage makes a big difference. Like your liability coverage, you should max this out. Being out of work and having very expensive medical bills is a big deal.

You can protect yourself by maxing out your uninsured/underinsured motorist coverage on top of selecting the maximum for your liability coverage.

Just like liability coverage, under/uninsured coverage is very important. So, we won’t be able to save money on auto insurance with this particular coverage, either.

Auto Insurance You May Not Need

Now let’s talk about how we’re going to save money on auto insurance, likely several hundreds of dollars per year. Are you ready?

Comprehensive & Collision Coverage

Comprehensive & collision coverage insures the value of your car. This coverage kicks in when you drive your car into a tree (collision), or when a tree falls on your car (comprehensive).

Pretty much every car insurance company thinks you need to load up on this coverage.

But if you want to save money on auto insurance, should you be spending several hundred dollars on comprehensive & collision coverage?

As with all great financial planning questions, the answer is, “it depends.”

Comprehensive & Collision Coverage Versus Savings Account

Here’s one simple query that can help you decide if paying for comprehensive & collision insurance is right for you:

Do you have more cash than your car is worth?

If the answer is yes, you should skip comprehensive & collision insurance and bank the money you would spend on that coverage.

Why should you skip comprehensive & collision if you have more cash than what your car is worth? Math. But not just any math – probability, statistics, and actuarial stuff.

Basically, it boils down to this: an insurance company is only going to sell you an insurance policy if they believe they can turn a profit. That is, on average an insurance policy is priced so that you’ll lose money and the insurance company will make money.

So, on average, you will save money by skipping this type of coverage. And when it comes to comprehensive and collision coverage, the most money you could lose is the amount of money your car is worth.

But, if you have the money already, it’s not going to cause you financial ruin.

This is why liability and uninsured/underinsured coverage is different. If you skipped either type of coverage, you could be out hundreds of thousands of dollars or more. Not having $500,000 could easily ruin your finances and lead you to bankruptcy.

If you have more cash than your car is worth, skip comprehensive & collision insurance. On average, you’ll save money. And if you ever do need to replace your car from an accident or incident, you will be able to.

Work Your Deductible Instead

Of course, not everyone has a big pile of cash in the bank. Fortunately, you can still save money on your comprehensive and collision insurance by working your deductible.

Your deductible is the amount of money you must pay out-of-pocket before your insurance company pays you anything. Here’s an example of how this works:

Bill just bought a new truck for $35,000. He has an insurance deductible of $500.

Bill doesn’t have $35,000 in cash sitting in the bank. Bill gets comprehensive & collision insurance on his new rig. The next day, a tree falls on the truck, destroying it completely. Bill’s insurance company pays him $34,500.

The larger the deductible, the less the insurance company pays out and the more money you can save on your auto insurance policy.

You can save money by picking a deductible that’s equal to the size of your cash savings. Do you have $500 in cash? Get a $500 deductible. Do you have $1,000 in your rainy-day fund? Opt for the $1,000 deductible instead.

The bigger your rainy-day fund, the bigger your deductible should be – and the more money you’ll save on auto insurance.

Auto Insurance Coverage to Skip

Another way you can save on your insurance policy is by skipping the company’s roadside assistance coverage.

The reason is that using roadside assistance will ding your insurance history. Your insurance provider will likely raise your rates for using their roadside service.

If you must have roadside assistance, make sure to get that coverage from someone other than your insurance company. For example, if you have auto insurance through Progressive, get your roadside service via AAA.

Going back to our deductible conversation, skip premiums for coverages that you can afford to pay out of pocket. Depending on how much cash you have sitting in the bank, that may mean skipping additional auto insurance coverages as:

- rental car coverage

- mechanical break coverage

- windshield replacement coverage

When you skip coverage for things you can afford to cover yourself, you will save money in the long run.

How to Save Money on Auto Insurance

Start by maxing out your liability and uninsured/underinsured coverage.

Then, get an umbrella insurance policy to increase your liability coverage even more.

After those tasks are squared away, pick the biggest deductible that’s within the limits of your rainy-day fund.

Alternatively, consider getting rid of comprehensive automobile insurance entirely if your rainy-day fund can manage the cost of replacing an entire vehicle. That way, you can pay lower auto insurance premiums and save money over time.