Should you purchase extra insurance through your job? It’s a question many employed folks must answer as they navigate through any number of employer benefits.

While receiving health insurance for free is a no-brainer, there is a trickier question:

Does it make sense to buy disability insurance, term life insurance or any other benefit through your employer?

Read on to find out if buying life or disability insurance from your employer makes sense for you!

Life and Disability Insurance from your Employer

Many employers give some basic level of life and/or disability insurance to their employees – all at no cost to the employee. (This falls under the category of employee benefits.) With some free insurance in hand, employees then have the option to purchase more coverage, coverage on top of what the employer offers as a free benefit.

The same goes for disability insurance. Employers frequently give a base level of disability insurance coverage for free. Sometimes, this coverage can be up to 40% of one’s salary. Employees then may have the option to buy more disability protection – insuring up to 20% or 27.7% of their salary. Purchasing this extra coverage would mean bringing one’s disability insurance coverage to 60% or 67.7% of one’s salary.

Since protecting your income is a no-brainer, this begs a similar question to the above:

Should you purchase additional disability insurance coverage from your employer?

It’s a great question. And as with most financial planning questions, the answer is:

It depends.

Of course, the “it depends” answer only applies to a small group of people. On average, you usually don’t want to purchase additional insurance through your employer. (But, that’s not to say that you shouldn’t get additional insurance coverage elsewhere.)

There are a couple of reasons why you don’t want to purchase additional life or disability insurance through your employer’s benefits department.

Quality of Employer-Provided Insurance

Some types of insurance are easy to compare, like term life insurance and umbrella insurance. That’s because when it comes to term life insurance, $1 million of coverage just means $1 million of coverage. (Term life insurance is a simple insurance product. It’s not to be confused with complex life insurance, like whole life.)

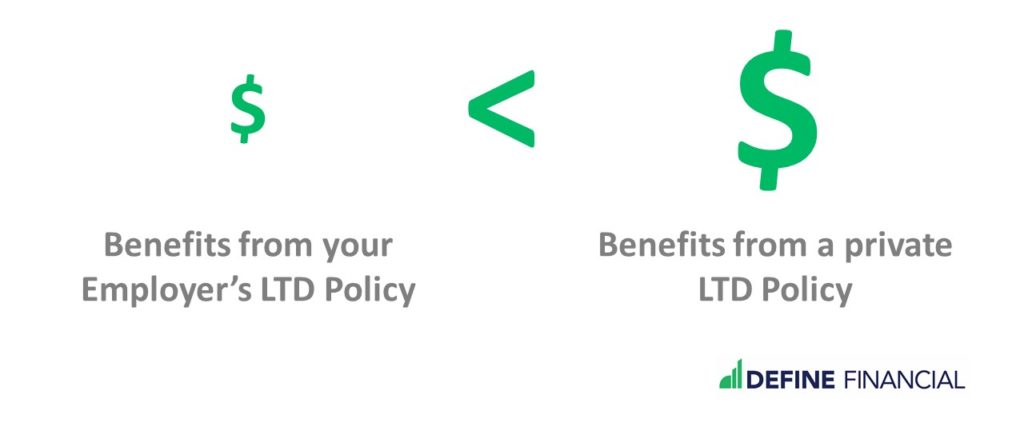

Disability insurance is more complicated; a disability insurance policy has all sorts of little – but important – nuances. Therefore, if you opt for a disability insurance policy on the price tag alone, you may be disappointed with the benefits. Disability insurance provided by employers is usually inexpensive. However, the benefits provided by these types of policies are lacking.

Long-Term Disability Insurance from Your Employer

In short, most long-term disability policies offered by employers aren’t very good. That’s because many employer-provided long-term disability policies may only offer benefits for two years. After two years, you may see your benefit substantially decrease – in the event of a long-term disability.

In plain English, this means that you won’t be able to get paid for being disabled after two years – if you have the wrong kind of (read: inexpensive) long-term disability insurance policy. This is why it may make sense to purchase a private long-term disability insurance policy. (You can learn more about the important details of a disability insurance policy here.)

The Price of Life and Disability Insurance through your Employer

You’ve likely heard the expression, “you get what you pay for.” That’s why it doesn’t make sense to compare a disability insurance policy on price alone – because it’s an apples-to-oranges comparison. A private long-term disability policy will be more expensive than a group (employer-provided) policy because the benefits of a private disability policy are usually better.

An inexpensive long-term disability insurance policy from your employer means skimpy benefits.

When it comes to the price of a term life insurance policy, it just might be the opposite; you may be paying more to get the same product through your employer’s benefits department. That’s – if you’re in good health – you could likely get a better deal on term life insurance with a private term life insurance policy than by buying what’s available at work.

But quality and price shouldn’t be your only consideration when choosing insurance through your employer. You should also consider convenience.

The Convenience of Employer-Provided Insurance

Some employers offer very robust insurance packages:

- Health insurance

- Dental Insurance

- Vision Insurance

- Short-term disability insurance

- Long-term disability insurance

- Life insurance

- Accidental Death and Dismemberment

Now, imagine if you’re switching employers and all your insurance benefits are tied to that one employer. It’ll be quite a headache to set up new policies, either with your new employer or via a private policy. This could even mean you think twice about switching employers — even if there’s a better job opportunity — because you have so much tied up in workplace benefits.

Also, consider just how busy you are. There’s the job, the spouse, the dog, the cat, the kids and the duties of homeownership. Switching jobs means more stuff to do and consider. The last thing you want to add to your task list is getting new insurance policies.

This hassle could be even bigger if you’re moving to a new place to start your new job. Now, imagine not just the task of starting a new job, moving your family and your possessions to a new place – but now you’ve got the paperwork headache of signing up for new disability and life insurance policies!

Don’t Purchase Extra Insurance Through Your Employer Unless . . .

Getting insurance through your employer can be pretty convenient. But, remember that usually, your best bet is to get a private insurance policy when it comes to disability insurance, life insurance, and umbrella coverage. Like many financially-savvy moves, the downside is that this may mean a little more work than just signing up for whatever is offered at work.

The one exception to the above is insurability. If you can’t qualify for the above policies because of a pre-existing condition, then getting coverage through your employer may be a great way to go.