Are you better off putting extra money into your 401(k) instead of purchasing a life insurance policy?

While investing in your 401(k) is a must if you want to retire, leaving your family without life insurance can impact them greatly if you die prematurely.

Here’s how it works.

The Problem: Life Insurance or 401(k)?

Today’s question comes from Phillip. Phillip just had his first kid, Alexander. Being a good parent, Phillip is making progress toward three vital things for new parents:

- Life insurance

- Disability insurance

- A will

Like any budget-conscious person, Phillip is aghast at the cost of the insurance policies he now needs. He shared his concern with me, saying:

Life insurance is expensive. Aren’t I better off putting this money into my 401(k) to save for retirement?

That’s an absolutely fantastic question. And here’s the answer:

No.

Intrigued? Me too! Let’s discuss why.

Life Insurance and 401(k) Scenarios

Finding the best life insurance policy is important because it’s a big expense. For Phillip, he’s looking at a bill of $700 every year. That’s a lot of money, especially over many years.

Phillip has a good point about investing the $700. If he put that $700 into his 401(k) account, he’d be looking at an extra $50,525 in his retirement account. (This assumes 20 years of $700 inflows and compound growth of 5% for 35 years.)

An extra $50,000 on Day One of retirement provides a retirement budget increase of $1,500 a year. (This assumes a 3% withdrawal rate.) Therefore, putting in extra money to fund his 401(k) gives Phillip a best-case scenario of having a little bit extra spending money in retirement.

But – what happens if Phillip dies without a life insurance policy? Phillip’s family just lost half its income. Phillip’s wife, Olympia, must now raise Alexander not only as a single parent – but with much less money than what the family is accustomed to.

Let’s Look at a Better Scenario

This time Phillip buys life insurance and contributes less to his 401(k). In a best-case scenario, Phillip lives to the ripe old age of 100 – having never used his life insurance policy. His spending in retirement is a little bit less than what it could have been, given that Phillip now has $50,000 less in his retirement account.

In a worst-case scenario, an assassin murders Phillip while he is still young. Fortunately, the insurance policy pays out to Olympia. This gives Olympia ample resources to provide for Alexander.

Life Insurance Scenarios

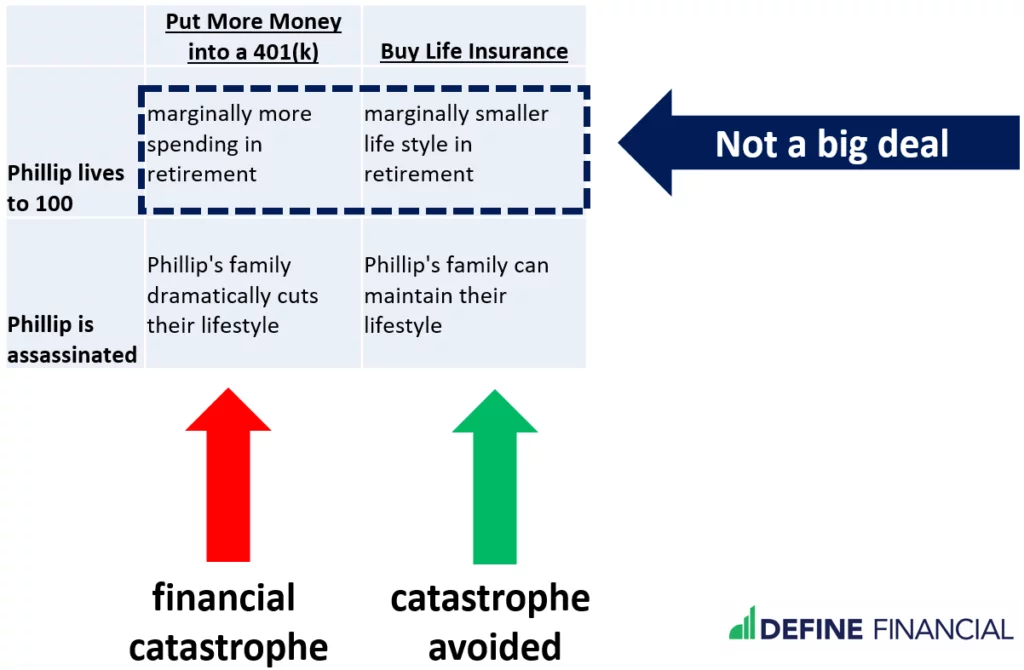

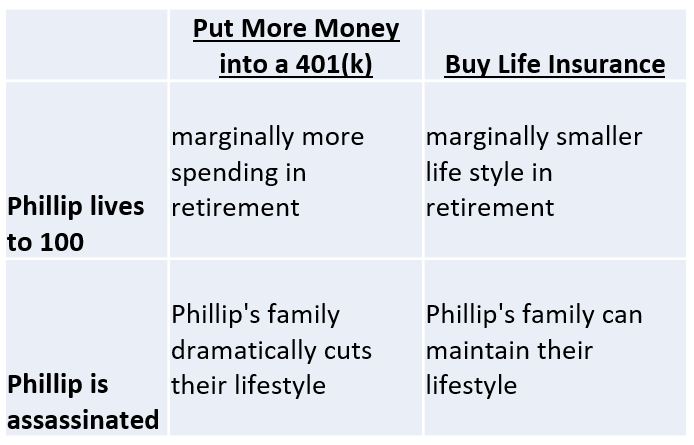

Given the variables – there are four possible outcomes. For the two outcomes where Phillip lives to 100, the differences are not very big: a small change in lifestyle during retirement.

For the two other outcomes – where Phillip dies prematurely – the differences are very big. There will be a significant impact on the quality of life that Phillip’s family has.

So, while an insurance policy can be expensive – it is very necessary if you’re a breadwinner and the parent of minor children.

To get the best deal on a policy, always opt for a term life policy and skip permanent polices (i.e. whole life, universal life, variable life).