Your Free Retirement Assessment™

A 3-step process to help you evaluate our services and make an informed decision about working together.

- Tax Return Analysis

- Investment Analysis

- Retirement Paycheck

We're Retirement & Tax Planning Experts and Do Our Best Work With:

Aged 50+

Retirement investors age 50+ who are retired or close to it.

$2 Million+

Diligent savers with investments over $2 million (excluding real estate).

Expert Guidance

People who value expert help because retirement is too important.

Your Free Retirement Assessment™

A 3-step process showing you how to

lower taxes, invest smarter, and maximize retirement income.

Schedule 20-Min Call

A 20-minute phone call will give us both a chance to make sure your situation matches our expertise.

After all, you wouldn’t see a Cardiologist if you needed foot surgery!

Team Meeting

Like a doctor, it’s important to diagnose before we prescribe.

The next step is meeting with our team (in-person or virtually). During this 1-hour meeting, our team will get crystal clear on your retirement goals, needs, and concerns.

Review Assessment

With your Retirement Assessment complete, we will have another 1-hour meeting to review our findings and recommendations.

In plain English, we will explain exactly what you can do to improve your retirement plan, lower taxes, and optimize your investments.

Think About It!

At the end of this process, we will simply ask you to think about it. We are looking for long-term relationships, not a quick transaction. If you decide that we aren’t a good fit, we will happily help you find another professional with the right expertise. There is never a hard-sell or pressure to say "yes."

Still Have Questions? Keep Reading...

You should consider hiring our firm if you want to:

- Turn your nest egg into a reliable paycheck in retirement.

- Lower taxes and keep more of your hard-earned money.

- Improve after-inflation returns and reduce portfolio risk.

- Spend more of your time doing the things you love in retirement.

- Ensure your heirs have a trusted professional to lean on if something happens to you.

You can learn more about our expertise by checking out the Stay Wealthy Retirement Podcast, reviewing our case studies, or reading our blog.

There are three really important things about our firm that separate us from others:

- We are retirement and tax planning experts for people aged 50+. Just like a Cardiologist would not perform foot surgery, we remain highly specialized and only work with retirement savers we have the expertise to help.

- We limit the number of new clients we take on (1 per month). This allows us to provide unparalleled value and highly personalized service to the families that have entrusted our firm to help them.

- We work as a team to service our clients. Instead of being "assigned" to a financial advisor, clients work with our entire team. Combining our resources and intellectual capital enables us to deliver high-quality advice and ensure nothing falls through the cracks.

Most advisors have similar titles, designations, and service models. Many of us also work with similar vendors and custodians (e.g., Fidelity, Schwab).

The fact that it's hard to differentiate one advisor from another is EXACTLY why we offer a Free Retirement Assessment™.

If you think there is a potential fit between your needs and our expertise, the first step is to schedule a complimentary phone call.

» Also, check out the Best Questions to Ask a Financial Advisor

Yes! We are licensed to operate everywhere in the U.S. We currently help approximately 105 families across 30+ states navigate retirement, reduce taxes, and invest smarter.

Our firm regularly meets with clients through Zoom video conferencing. Each virtual meeting is protected by a complex, unique password, and we adhere to strict security guidelines to protect your privacy.

It only makes sense to hire a financial advisor—or any professional—if the value they provide exceeds the cost.

In other words, the time and effort saved by hiring an expert + the tax savings and retirement plan improvements need to exceed the fees being charged.

The Free Retirement Assessment we deliver will quantify the benefits you will receive so you can make an informed decision about hiring our firm.

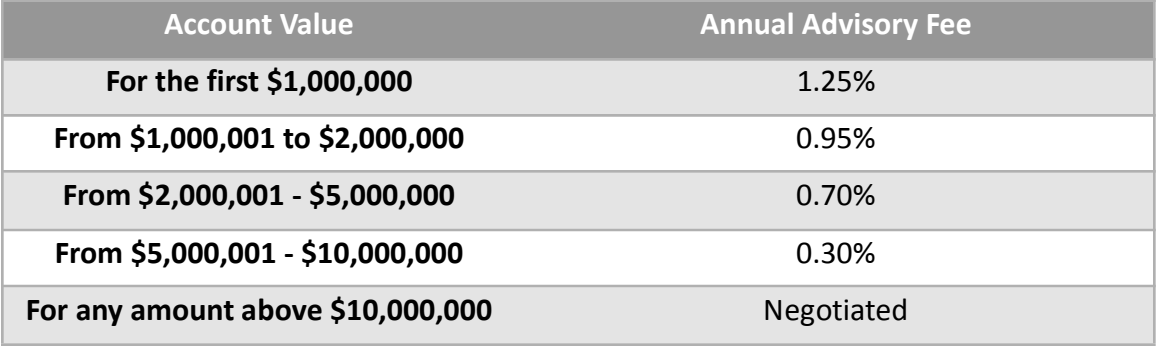

Our transparent fee includes ongoing retirement and tax planning + tax-smart management of all investment accounts.

The blended fee is calculated based on a percentage of the total value of the investments we oversee and manage:

(Depending on the client's situation and scope of work, a flat annual fee may be considered instead of a % based fee.)

Scheduling your first phone call with us is the first step in determining whether we are a good fit to work together.

We do our best work with retirement savers who need (and want!) a long-term relationship. Currently, our firm is not equipped to offer an hourly fee schedule or a one-time project fee option.

If you prefer a financial planner who offers these limited-term engagements, consider reaching out to the Garrett Planning Network.

For your safety and convenience, Define Financial uses Fidelity Investments as a third-party custodian for our client investment and retirement accounts.

Fidelity administers more than $10.3 trillion in assets for more than 40 million retirement savers.

As a trusted custodian, Fidelity safely holds your investment accounts and provides reporting to you and the IRS each year. Your accounts can be viewed at any time at www.fidelity.com or through the Define Financial Client Portal.

Step #1: Schedule Your 20-Min Phone Call

NOTE: It's not uncommon for our calendar below to have limited availability. We intentionally limit the number of calls to ensure we provide a high level of service to current clients. If you don't see anything on our calendar that works for you, please call our office at (858) 345-1197, and we will do our best to accommodate.

Not Ready to Schedule An

Appointment? Join Our Newsletter!

"*" indicates required fields