If you’re nearing retirement and are worrying about having enough money, there’s a huge mistake you should know about. This big mistake is taking Social Security benefits as soon as possible. Instead of signing up to receive Social Security retirement benefits at age 62, wait until you’re 70 (if you can afford it.)

Why should you wait to claim your Social Security retirement benefits? Because you’ll probably earn more money over your lifetime if you delay. That’s because each year you delay receiving Social Security, you get paid more money.

The longer you wait, the more money you get as a monthly Social Security retirement benefit.

The Social Security Administration goes over this concept in its 2019 Guide to Social Security Benefits. In the guide, they ask:

Would it be better to get Social Security benefits early — but get paid a smaller monthly amount for more years …

OR

Wait for a larger monthly payment – but only get that larger payment over a shorter time?

To help answer the question, consider the following example:

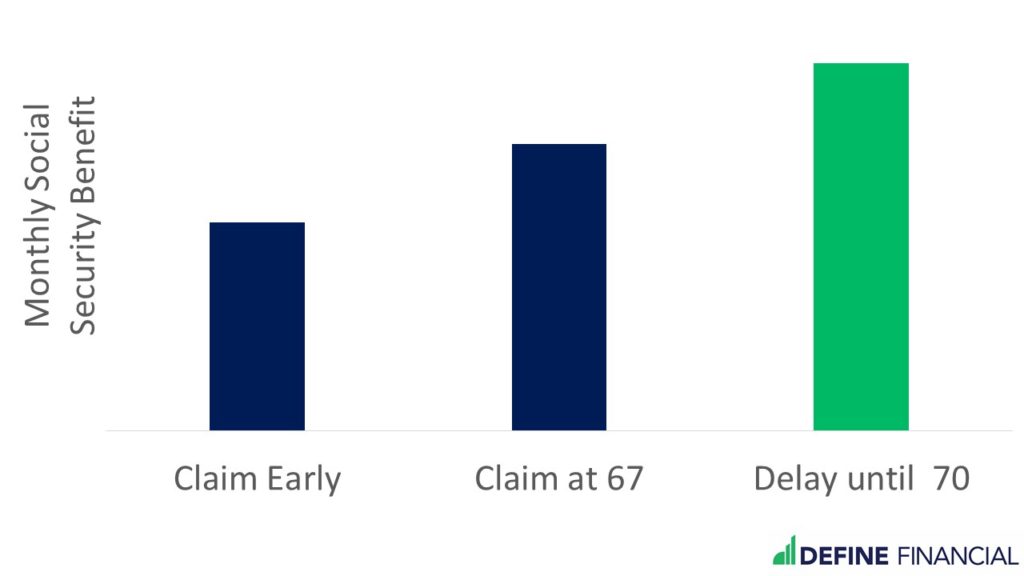

- You can have retirement benefits of $3,000/month — if you claim your benefit at your normal retirement age of 67.

- If you start getting benefits as early as age 62, the Social Security Administration will pay a monthly benefit of only $2,175.

- If you delay benefits until age 70, your monthly benefit jumps to $3,840.

As you can see, you would wind up with $1,665 more each month if you delay receiving benefits until age 70.

You could miss out on big money if you make the mistake of claiming Social Security benefits too early.

Will delaying really be the better deal? Probably, but only if you live long enough. If you wait until age 70 to begin receiving benefits and die the next day, then it’s a poor deal. On the other hand, if you live into your mid 80’s, you’ll end up ahead.

The more you look at the numbers, the more obvious the answer gets. Over your lifetime, the difference in benefits is huge. Consider someone who lives to age 90.

- If you start taking benefits of $2,175 per month at age 62, receiving them to age 90, you would get $730,800 in cash during that time.

- If you wait until age 70 to receive benefits — getting $3,840 per month until age 90 — you would receive $921,600.

That’s a difference of more than $190,000. If having $190,000 more is something that interests you, you may consider delaying Social Security benefits.

• • •

While it might feel like you’re going against the grain to not accept benefits you’re eligible for, the numbers above prove why this is a smart plan. Since Social Security benefits increase each and every year you delay them, putting off Social Security means receiving a much bigger benefit down the line.

Managing Investments and Social Security Retirement Income

As financial planners, we pride ourselves in looking at the entirety of a client’s financial life. So when a client asks us:

When should I take Social Security?

We know that the answer actually involves a lot more moving parts than just Social Security retirement benefits alone. There are investments to think of as well.

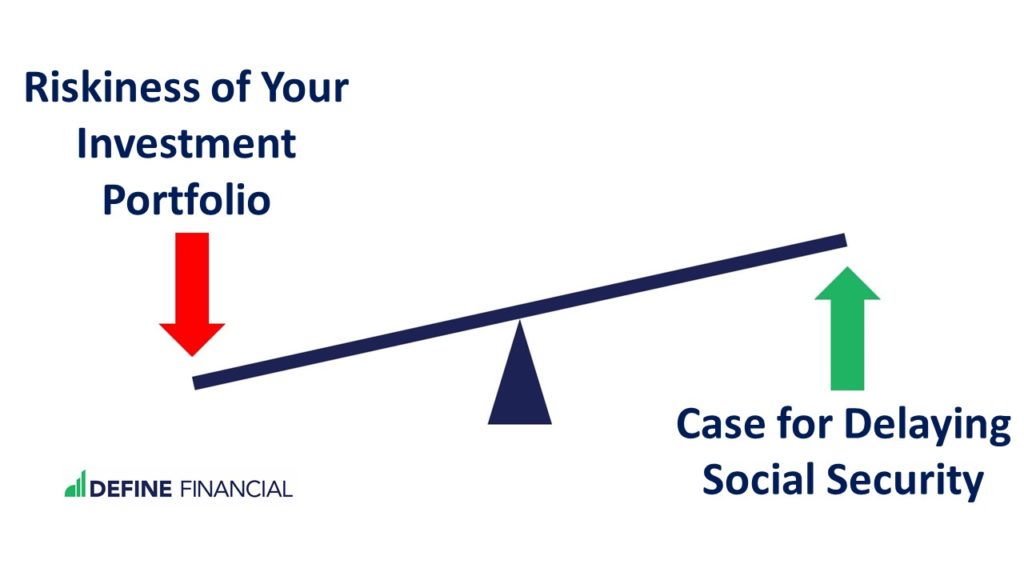

Those with more conservative investments should strongly consider delaying Social Security benefits.

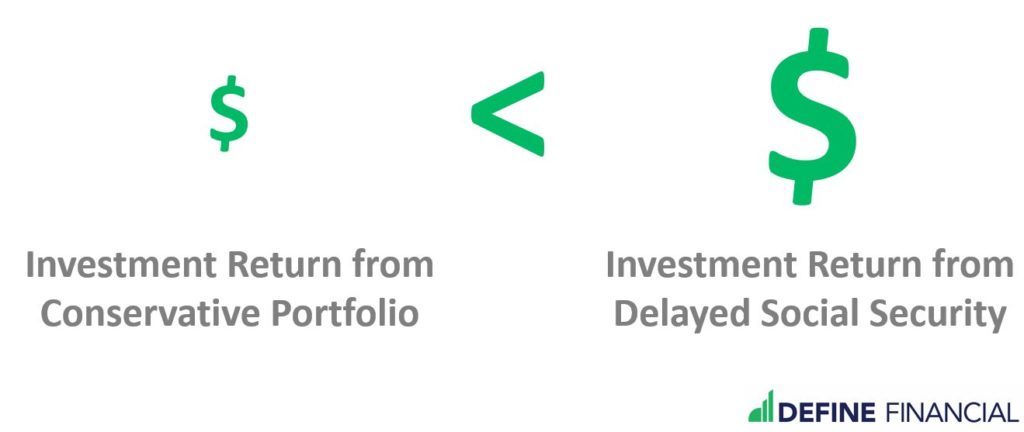

That’s because the decision to delay Social Security relates to your investment portfolio. The more conservative your investment portfolio, the more sense it makes to delay Social Security benefits. That’s because the increase in your Social Security benefit, when you delay receiving Social Security benefits, is likely more than the return you’d make on your investment portfolio.

You can earn more by delaying Social Security than you may be able to get investing.

Said another way, you’ll likely have more money by taking from your investments first and Social Security benefits second – not the other way around.

It’s Not Just About Social Security

The chance to do partial Roth conversions is another reason to consider delaying Social Security benefits. By delaying Social Security, you’re creating a great opportunity for partial Roth conversions: doing Roth conversions while you are in a relatively lower tax bracket. This strategy helps you save tens of thousands of dollars in taxes over one’s lifetime.

In short, taking Social Security early has two downsides:

- Likely receiving less money in Social Security benefits over your lifetime

- Possibly paying more in taxes over your life because of a lesser opportunity for partial Roth conversions

Fixing One Big Social Security Mistake

A lot of soon-to-be retirees do not know about this “one weird trick” of delaying Social Security benefits until it’s too late — until after they’ve signed up for benefits. For some, there is a solution to this problem: You may have the option to repay the benefits you’ve received to date. To qualify for this option, it has to be less than a year since you started receiving Social Security benefits.

If you decide to go that route because you claimed Social Security benefits too early, you’ll need to submit Form SSA-521 to the Social Security Administration. Once you do that, the Social Security Administration will let you know what amount of money you owe them.

We can all agree that it’s not fun to willingly give your money back to the government, but doing this will mean more money for you over your lifetime. And who doesn’t want more money?