When it comes to issues that have the potential to drain your nest egg, healthcare is usually at the top. But healthcare includes more than just paying for health insurance.

You also have to consider how you might pay for long-term care one day, even if your health seems fine right now.

Nobody wants to think about needing long-term care insurance because, let’s face it, the thought of not being able to care for yourself is depressing.

However, having a long-term care policy in place can be the difference between a successful retirement plan…and a health event that depletes your life savings.

Do I Need Long-Term Care Insurance?

Do you believe you’ll never need long-term care? It’s possible you won’t, but the statistics tell another story.

According to the American Association for Long-Term Care Insurance, nearly 7 out of 10 Americans will need some form of long-term care insurance in their lifetime. When you consider the fact that the percentage of Americans over the age of 65 is expected to increase from 47.8 million to 87.9 million by 2050, it’s easy to see where we stand.

In addition, government statistics show that the average cost for a semi-private room in a nursing home was $225 per day or $6,844 per month at last count.

Want a private room? Then you’ll need to pay an average of $253 per day or $7,698 per month.

And with the cost of care more than doubling the rate inflation since 2005, it’s not hard to imagine how that kind of spending could drain your investment accounts and leave you with nothing in a hurry.

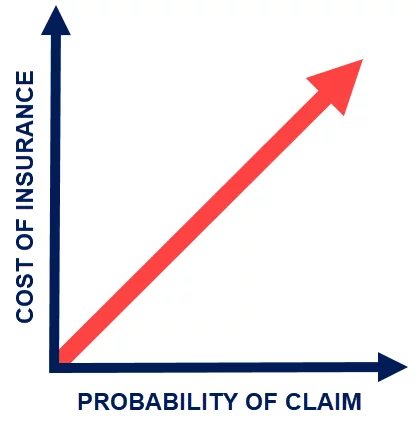

Like it or not, long-term care insurance is crucial if you want to protect your life savings and your legacy. And the cost of coverage reflects the fact that most of us will need it at some point.

Just imagine how your car insurance premiums would look if 70 percent of drivers got in an accident every year. The thing is, unlike car insurance claims, long-term care (LTC) claims don’t just cost the insurance company a ‘one-and-done’ $5,000. They can cost the company tens of thousands of dollars for years or even decades to come.

What Are My Options For Long-Term Care Insurance?

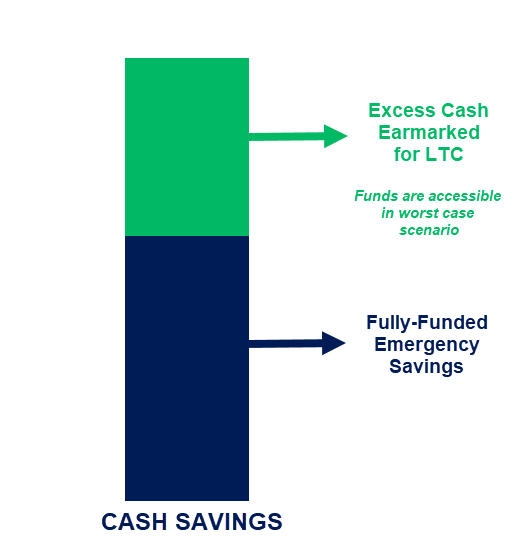

While some people are fortunate enough to be able to self-fund a long-term health event, the vast majority of families are unable to sustain an added $10,000 monthly expense for an extended period.

For those of us who need LTC, there are two main types to choose from — traditional or hybrid policies.

In the event of a claim, both types of policies will pay a predetermined monthly benefit amount over a specified period (i.e. $200/day for 36 months). Further, both traditional and hybrid long-term care policies also offer a joint policy option for married couples.

This option allows for one or both individuals to receive long-term care benefits, but typically at a lower price than two separate policies. This is because it is unlikely both spouses will need coverage at the same time.

Both traditional and hybrid long-term care policies can also include additional features like inflation riders (i.e. 4% compounding), waiver of premium riders, or international facility riders, among many others.

You don’t always need these bells and whistles. But with the rising costs of healthcare, an inflation rider is something most people should seriously consider.

What is a Traditional Long-Term Care Policy?

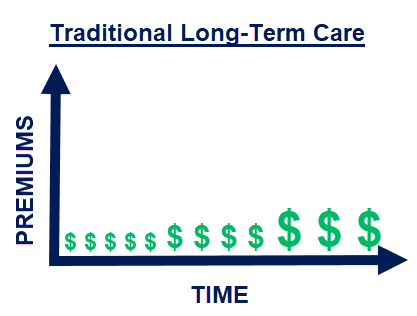

A traditional long-term care policy is much like your typical auto insurance policy. You pay a monthly premium to purchase a certain amount of coverage, which you can count on if you need it.

And just like an auto insurance policy, your premiums may be subject to increases over time. By and large, traditional long-term care insurance policies cost less than hybrid policies.

Of course, it should be everyone’s goal to never have to file a claim. But, with the high cost of long-term care insurance, it can be easy to wonder if you’re not just throwing money down the drain each month.

As we already mentioned, the cost of long-term care insurance is currently outpacing inflation. With that in mind, it makes sense that potential premium increases would, too.

As an example, for the long-term care coverage period beginning in January 2021, Blue Cross Blue Shield of Florida increased annual premiums for their LTC policyholders by an average of 94%.

This is just one real-life example, but premium increases for traditional LTC policies do happen, and the price increases can be alarming.

This is one reason traditional long-term care policies are less expensive than the hybrid option; your long-term care provider can simply raise the price of your premiums to continue providing benefits to policyholders.

What is a Hybrid Long-Term Care Policy?

Hybrid long-term care policies continue growing in popularity for some valid reasons.

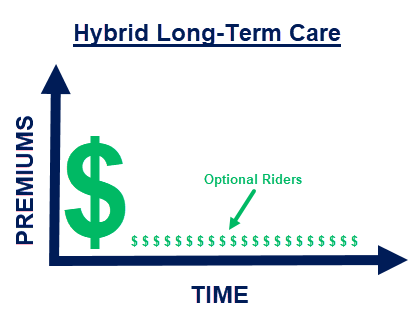

Hybrid long-term care policies can be purchased with a lump sum upfront, although you may also be able to spread your premiums out over a designated period. Either way, hybrid long-term care insurance is better suited to those who have a larger sum of money to spend.

Here’s an example: Let’s say you have $200,000 in cash, but only need $100,000 in your emergency fund. You could fund a hybrid LTC policy with the excess money.

In theory, that $100,000 could fund a long-term care policy that covers both spouses with a $200,000 death benefit and a monthly long-term care benefit of $6,000 per spouse for 3 years. You may also be able to purchase an inflation rider and/or a lifetime benefit rider for an additional annual fee.

If your financial plan were to ever implode, you can cancel your hybrid policy and recoup your premiums paid, less any surrender fees. The same cannot be said for a traditional long-term care policy where money spent on premiums is gone forever.

However, while you may be able to recoup your premiums, this liquidity and flexibility comes in the form of a higher premium relative to traditional long-term care policies.

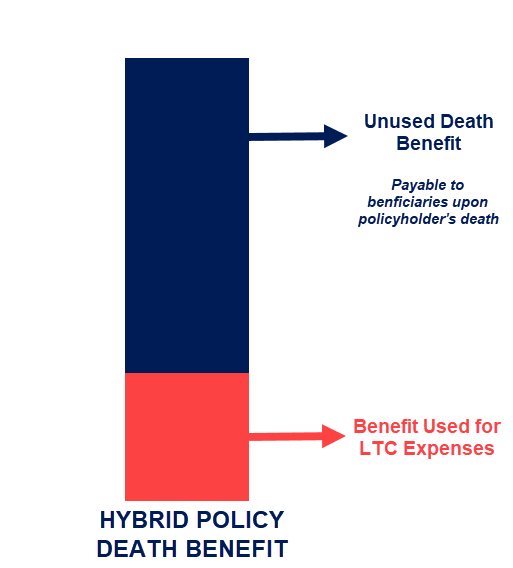

A hybrid LTC policy is technically a life insurance policy. That means if you never make a claim, your heirs can collect the death benefit purchased by your original premium. In addition, if your policy has a death benefit of $200k and you only use $50k toward LTC expenses, you retain a death benefit of $150k.

If you exceed the death benefit of the policy, the long-term care benefits will continue to be paid up to the maximum period specified in your policy.

Which Type of Long-Term Care Policy is Right for Me?

There are more nuances to consider for long-term care policies than we can describe in a blog post. But, there are still some basic advantages and disadvantages that come with each.

Traditional LTC Policies

Traditional long-term care policies are easier for consumers to understand since they are less complex overall. Here are some of the main pros and cons:

Advantages:

- Can be cheaper, though there is the risk of future premium increases

- Monthly premium payments can make it more affordable

- In a low-interest-rate environment, the likelihood of premiums increasing diminishes, as insurance companies can recoup the increased cost of care through rising interest rates

Disadvantages:

- Premiums paid are gone forever

- Premiums can increase over time, placing a strain on your finances in the future

- If interest rates stay low, there is a higher likelihood the increased cost of care will be passed along to the policyholders

Hybrid LTC Policies

Hybrid policies have more working parts, which can make them a better (or worse) option depending on your needs. Here are the main pros and cons:

Advantages:

- If you don’t use it, you retain a death benefit payable to your beneficiaries

- If you use only some of it, the unused death benefit is still payable to your beneficiaries

- Fixed premiums will not increase over time

Disadvantages:

- Some plans require an upfront premium payment

- Requires you to buy life insurance whether you need it or not

- You lose investment control over your money spent on premiums

- Can be more expensive for comparable coverage to a traditional policy

Am I Buying the Right Long-Term Care Coverage?

When working with an insurance agent to purchase a long-term care policy, make sure the agent understands exactly what you want from your policy. From there, carefully review the proposals and make sure you’re not being “sold” on a plan that doesn’t even provide the benefits you need the most.

Also remember, an insurance agent is not a fiduciary. This means they do not always have your best interests at heart, and may have their own bottom line at the forefront of their minds. Their goal is to sell you a policy that nets them the highest commission, and if it helps you out, that’s a plus.

At the end of the day, it’s your responsibility to review the policy to make sure you are getting exactly what you need — nothing more or less.

On the other hand, you don’t have to sort through all this information and make a decision on your own. You can work with a fee-only fiduciary financial planner to review any long-term care contract proposals for you.