Today I’m sharing everything you need to know about Per Stirpes.

In fact, this confusing Latin word recently saved our client from sending over $500,000 to the wrong beneficiary.

(And she didn’t need an attorney to take action!)

If you want to ensure the right people inherit your hard-earned money, you’ll enjoy today’s article.

Key Takeaways

-

Per stirpes ensures your assets stay within the family branch, so if a beneficiary passes away, their children inherit their share.

-

Without per stirpes, your assets may be redistributed to surviving beneficiaries, which could unintentionally exclude grandchildren or other heirs.

-

Reviewing and updating your beneficiary designations regularly—especially after major life events—helps avoid mistakes and ensures your wishes are carried out.

What Is Per Stirpes

Per stirpes is a legal term used in estate planning to ensure the assets of a deceased person are distributed fairly among their family members.

It stems from Latin, meaning “by branch” or “by roots,” signifying that each family branch should receive an equal share of the estate.

Per stirpes comes into play when one or more beneficiaries predecease the owner(s) of the estate.

Put simply, if a beneficiary dies before you die, the deceased beneficiary’s children inherit your money.

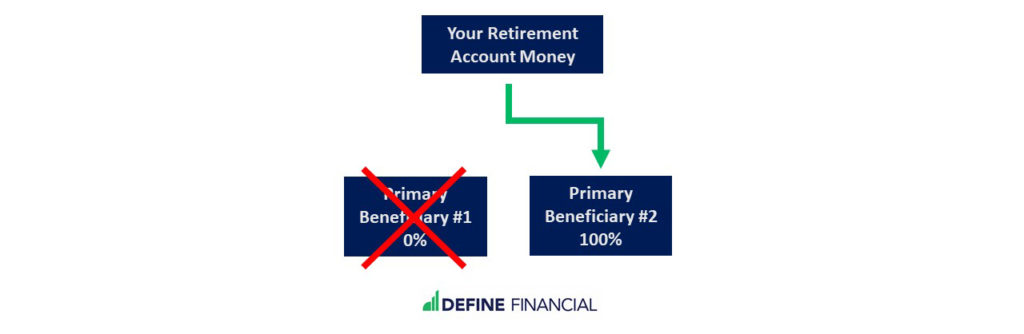

Without per stirpes, everything is passed to the remaining primary beneficiary.

It is essential to consider all aspects of your financial and personal situation when creating an estate plan.

Including the per stirpes designation can help ensure your assets are distributed as you intended, maintaining fairness and clarity for your family and loved ones.

By considering the use of per stirpes when planning your estate and beneficiary designations, you can have peace of mind knowing that your family’s inheritance is well-planned and secure.

How Per Stirpes Works (Example)

To understand how per stirpes works, consider the following example.

Grandma Gloria has a $1 million retirement account. Her only remaining family members are her daughter and granddaughter.

Right now, her daughter is named as the primary beneficiary on her retirement account. In other words, when Grandma Gloria dies, her daughter will inherit the account.

However, if the daughter dies before the grandmother, the retirement account would not make it to the granddaughter.

That might make the granddaughter very sad.

More importantly, it might make the grandmother sad that her intentions weren’t carried out.

If the grandmother chooses per stirpes and her daughter passes away before her, the inheritance would directly go to the granddaughter.

Elect per stirpes on your retirement account beneficiary designations to ensure that your heirs’ heirs receive their share.

Using the per stirpes method for distributing your assets ensures that your wishes are honored and provides clear instructions for your loved ones.

By adopting this approach, you can minimize the risk of disputes and complications, making sure that your estate is distributed according to your intentions.

Setting Up Your Beneficiary Designations on Retirement Accounts

An important aspect of this planning is establishing your beneficiary designations.

Beneficiary designations determine who will receive your retirement account funds upon your passing.

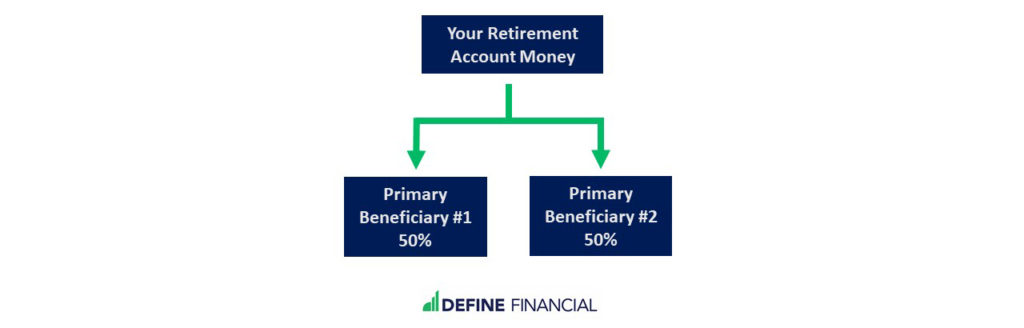

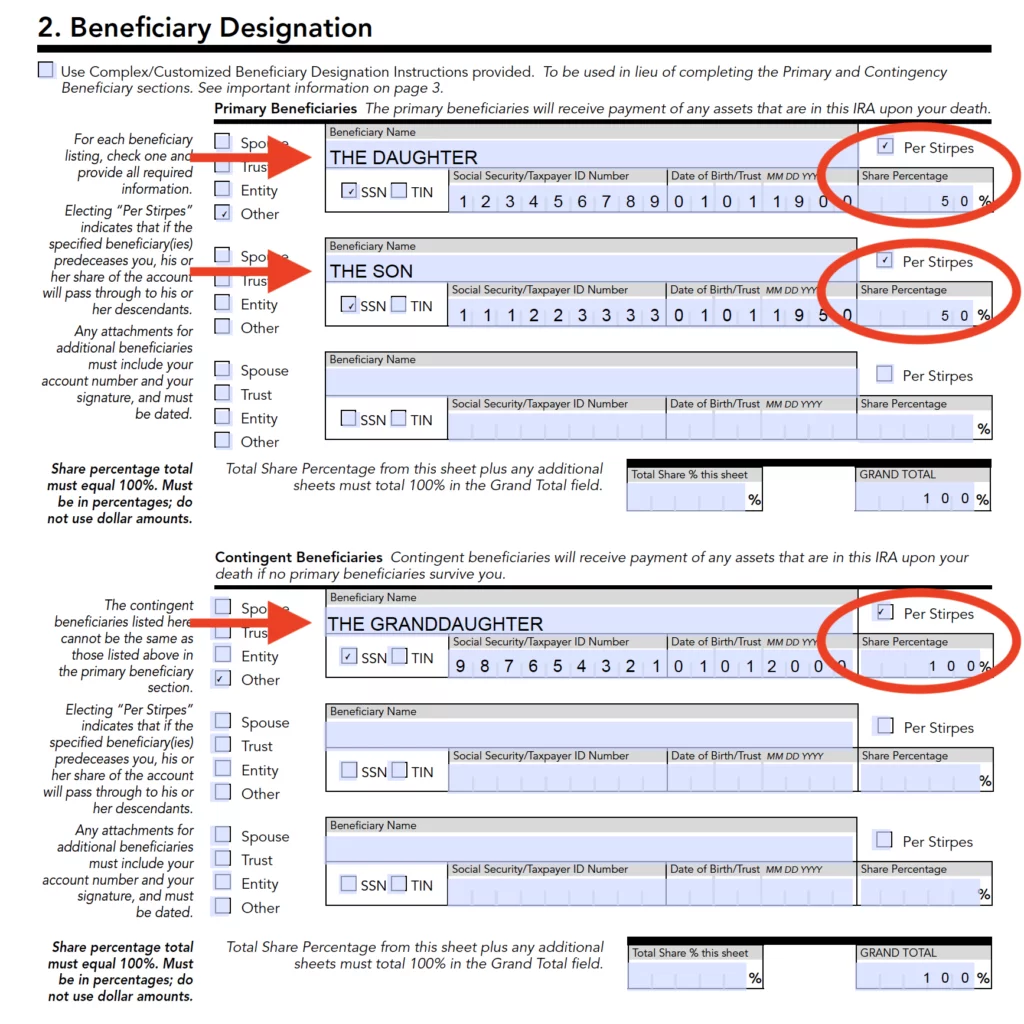

One example of how to set up your beneficiary designations – with two individuals receiving equal halves.

Your retirement accounts include your IRA accounts and your employer-sponsored retirement plans such as:

- Traditional and Roth IRAs

- SIMPLE IRAs

- SEP IRAs

- Traditional and Roth 401(k)’s

- Traditional and Roth 403(b)’s

- Traditional and Roth 457s

- 401(a) accounts…and more!

Primary vs Contingent Beneficiaries

Most married people opt for their spouse as their primary beneficiary.

If you do that, it means your spouse will receive the money in your retirement accounts upon your death.

This scenario is so commonplace that, if you are married and you don’t assign your spouse as the primary beneficiary, you will likely need some special paperwork to make that possible.

In other words, your spouse may need to sign a notarized document that says he/she is okay with not being the primary beneficiary on your retirement accounts.

Additionally, you will likely need to designate contingent beneficiaries for your retirement accounts.

If you’re married with kids, your contingent beneficiaries might be your children.

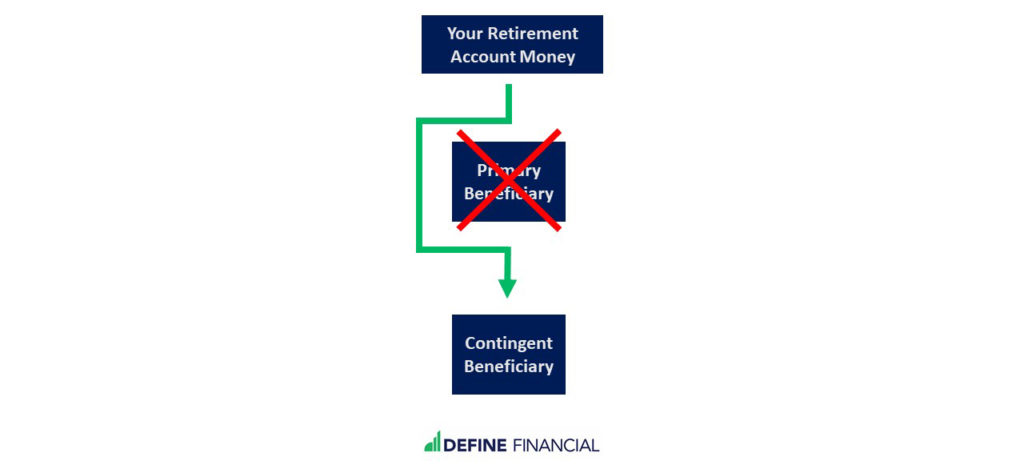

If your primary beneficiary passes away before you do, your money will go to your contingent beneficiaries.

Contingent beneficiaries inherit your assets if the primary beneficiary passes before you do.

Per Stirpes vs Per Capita

A final consideration when setting up your beneficiary designations is whether to elect per stirpes or per capita.

What is Per Capita?

Per capita is typically the default option on most retirement accounts if per stirpes isn’t chosen.

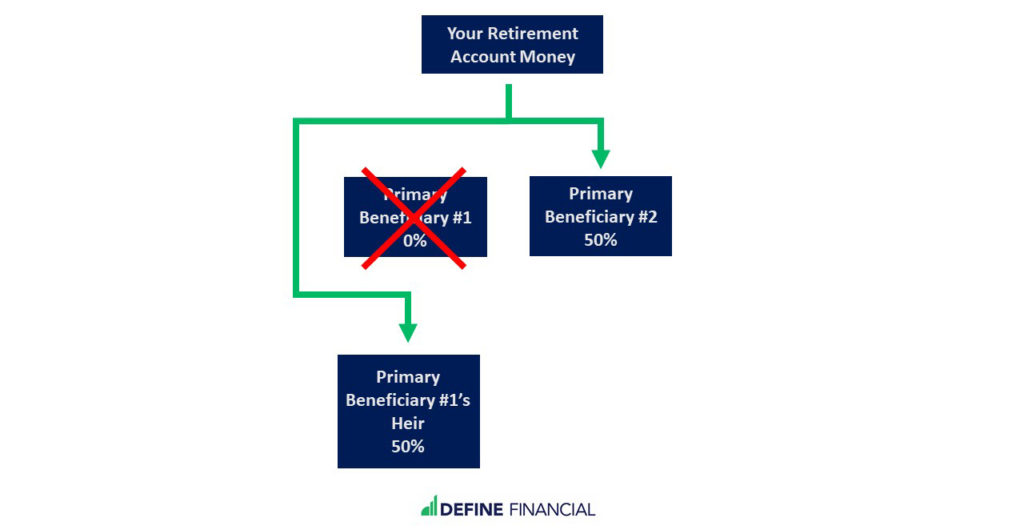

Returning to our example above, let’s say the grandmother still has a daughter and granddaughter, but she also has a son.

The daughter and son are listed as 50/50 beneficiaries on the grandmother’s $1 million retirement account.

So, if Grandma gets run over by a reindeer tomorrow, each would receive $500,000.

However, if the daughter is run over first—and per capita was chosen by default—the $500,000 earmarked for the daughter will go to the son.

The son would have one million dollars, while the granddaughter would receive nothing.

Should I Use Per Stirpes for My Beneficiary Designations?

If you’re setting up the beneficiary designations on your retirement accounts, you will be faced with this very question.

“Should you use per stirpes?”

The right answer for you depends on several factors.

For example, do you want your money to pass to your beneficiary’s heirs? It’s possible this was your plan all along.

However, it’s also possible that you don’t want your grandchildren to have access to your money.

One factor to consider is the age of the heirs who would receive the money via per stirpes.

For example, if you’re considering passing assets to your children (and their grandchildren via per stirpes), consider the ages of the grandchildren.

Are the grandchildren minors? Would the grandchildren be able to manage your assets on their own?

These are not easy questions to answer.

This is why you may want to consult with a financial planner and estate attorney to help choose your beneficiary designations.

Additional Scenarios Where a Per Stirpes Distribution May Fall Short

One thing per stirpes doesn’t do well is handle complicated family relationships.

For example, let’s say you have a deceased child who left behind children from multiple partners—or stepchildren you helped raise but didn’t legally adopt.

A per stirpes setup follows bloodlines only. That means some people you care deeply about could be excluded without you realizing it.

It also lacks flexibility.

If your goal is to support children, grandchildren, and great-grandchildren differently—maybe giving more to one child who needs extra help or staggering inheritance by age—per stirpes (alone) can’t get you there.

And don’t forget about taxes!

Per stirpes doesn’t take into account who would be the most tax-efficient heir.

Depending on how your retirement accounts are passed along, younger heirs could face bigger tax bills or lose out on certain withdrawal strategies.

In some cases, using a trust or adjusting the structure of your designations can help avoid costly surprises and allow a more tailored distribution.

Step-by-Step: How to Elect Per Stirpes or Per Capita on Your Retirement Accounts

Step 1

Contact the bank or custodian where your retirement accounts are held (e.g., Fidelity, Vanguard, Morgan Stanley, etc.) and request a copy of your current beneficiary designations.

Review your current designations and do two things:

- Verify that the elections you currently have on file are correct and aligned with your intentions.

- Check to see if per stirpes has been selected. (Remember, per capita is typically chosen by default.)

If everything looks good, your job is done! If things need updating, proceed to step 2.

Step 2

Every bank or custodian has a “beneficiary designation form.”

If you need to make a change to your beneficiaries, including per stirpes or per capita, you must contact your bank or custodian and request this form.

(You can also contact your financial planner if you have one.)

With the beneficiary designation form in hand, you can make the appropriate changes to your beneficiary designations.

It might look something like this:

Example of a beneficiary designation form where you can choose per stirpes.

Other Considerations When Making Elections

Keep in mind that certain account types—especially employer-sponsored retirement plans, such as 401(k)s—may not support per stirpes at all.

These plans often follow preset distribution rules that can override or ignore custom instructions; therefore, it’s essential to confirm what’s allowed with each account.

When per stirpes is not an option, contact your plan administrator to specify legal language and name individual beneficiaries. Additionally, consider whether a rollover to an IRA, which typically offers more flexibility, is a viable option for you.

Don’t assume your share is divided equally among heirs unless the plan allows you to specify that structure clearly.

If your accounts are spread out across various banks, brokerages, or insurers, it’s worth reviewing them side by side.

Inconsistent beneficiary choices across institutions could accidentally give one part of the family more than you intended.

Lastly, even if you think everything looks right on paper, it’s a good idea to double-check after major life events.

Births, deaths, marriages, or divorces can all impact how your assets are distributed—and whether your current beneficiary setup still fits.

Frequently Asked Questions (FAQs) About Per Stirpes

1. What is a per stirpes beneficiary?

A per stirpes beneficiary is someone who inherits as part of a family branch rather than as an individual. If a beneficiary dies before the account holder or estate owner, that beneficiary’s descendant—such as a child or grandchild—will receive the inheritance instead.

This approach helps keep the share of your estate within that specific family line rather than redistributing it among surviving heirs or unintentionally skipping a generation.

2. What does per stirpes mean in a will?

When included in a will, per stirpes acts as a generational safety net. If a named beneficiary predeceases you, their beneficiary descendant—typically a child—steps into their place and inherits what was intended for them.

3. Per capita vs pro rata vs per stirpes: What’s the difference?

Here’s a simple way to think about it using a $900,000 estate meant for three children (Alice, Ben, and Carla):

- Pro Rata: Each named person gets a portion based on their assigned percentage. If you assign 40% to Alice, 30% to Ben, and 30% to Carla, that’s what they get. It’s about proportional allocation—not about what happens if someone dies.

- Per Capita: The money is divided equally among all living named beneficiaries. If Alice dies before you, Ben and Carla would each receive $450,000 (half of the estate), and Alice’s children would get nothing.

- Per Stirpes: A per stirpes distribution ensures that each family branch retains its portion intact. If Alice dies, her beneficiary descendant (like her child) inherits her share of your estate—in this case, $300,000—rather than having it split between Ben and Carla.

4. Can I use per stirpes in a trust?

Yes, you can incorporate per stirpes principles into a trust, but it must be clearly spelled out. Trusts can be designed to mimic per stirpes distribution patterns or go beyond them by offering additional layers of control—such as staggered payments, special provisions for minor children, or protections for beneficiaries with legal or financial vulnerabilities. The language used in the trust document should clearly indicate how distributions should occur if a beneficiary dies.

5. Is per stirpes recognized in every state?

Yes, generally, per stirpes is recognized in most states across the US. However, some states may interpret the rules slightly differently or have default inheritance laws that affect how assets are divided.

If your estate plan is likely to involve multiple states or if you’re unsure about your state’s laws, it’s smart to work with an attorney who can craft language that allows your assets to be distributed exactly as you intend.

In Conclusion

If you’re staring at the’per stirpes’ checkbox when setting up your next retirement account, pat yourself on the back.

More than half of U.S. adults do not have an estate plan, and the numbers increase significantly for minority groups.

Planning for a future without you can be difficult, but it is a vital part of a comprehensive financial plan. A good first step is to ensure that your beneficiary designations are set up correctly.

To summarize, if you are naming your children as your primary beneficiaries, and your grandchildren (their children) are well into their 30s and capable of managing their own finances, then selecting the per stirpes option may be a straightforward decision.

If your grandchildren are minors, it may be prudent for them to work with a financial planner and an estate attorney to design a customized plan.

The bottom line is that per stirpes should not be ignored.

It’s a critical component of the retirement planning process that deserves to be reviewed at least annually.

Please note: This blog (originally published on Jan. 23, 2023) was updated on July 28, 2025, with new information.

Taylor Schulte, CFP® is the founder & CEO of Define Financial, a fee-only wealth management firm in San Diego, CA specializing in retirement planning for people over age 50. Schulte is a regular contributor to Kiplinger and his commentary is regularly featured in publications such as The Wall Street Journal, CNBC, Forbes, Bloomberg, and the San Diego Business Journal.