Today I’m explaining annuitization and what it means to annuitize a policy.

Contrary to what many people think, annuities and annuitization are not the same.

And confusing them can cause BIG problems for your retirement plan.

So if you want to learn exactly what annuitization is and if you should annuitize, you’re going to love this post.

First, grab this free flowchart we put together for you:

What Is an Annuity?

An annuity is a financial product. It’s one possible way people can invest money.

Technically, an annuity represents a contract made between the insurance company and the person who bought the annuity.

When you purchase an annuity, you can make a one-time payment for it.

In exchange, the insurance company promises to provide some sort of benefit. Usually, that’s some type of income, long-term care, or growth of assets.

Annuities Are (Usually) a Ripoff

The definition of an annuity can make them sound great. But they’re usually something you want to avoid.

Why?

Annuities typically have high fees. And high fees reduce your investment returns.

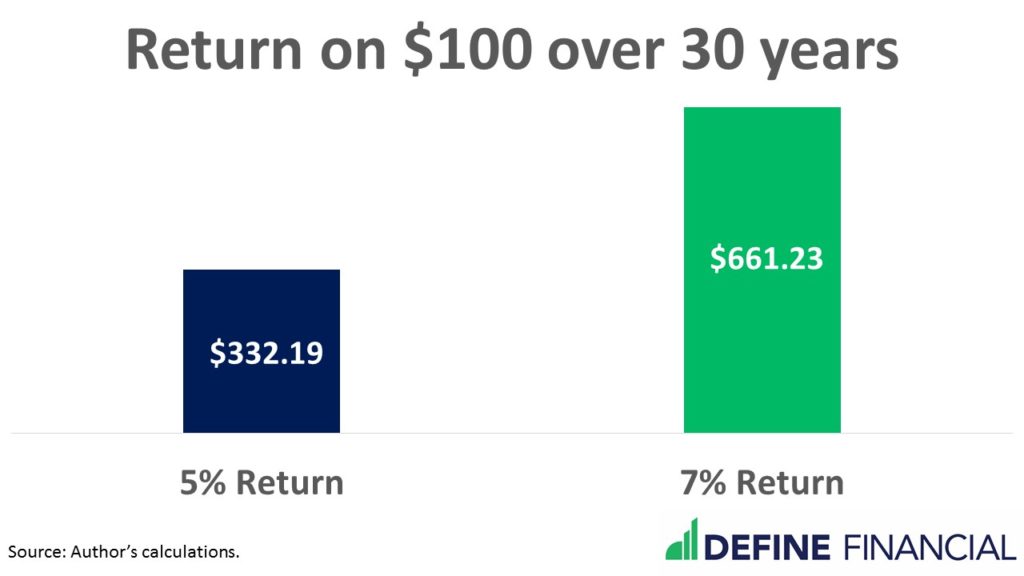

Consider two hypothetical investments:

- A low-cost index fund with a nominal fee

- An annuity with a 2% annual fee

Assuming a 7% rate of return, hypothetical investment #1 will end up with 2x as much money as investment #2 over 30 years.

Impact of fees on annuities and investments.

Of course, there are some exceptions for when annuities can make sense.

For example, one type of annuity is the single premium immediate annuity (SPIA). The SPIA usually has low fees and can be a good way to guarantee future income.

Annuities may also make sense for individuals in very high tax brackets that have already maxed out their tax-advantaged savings for the year. In this case, the high fees on the annuities can be offset by the tax advantages offered by these high-fee products.

But, for the most part, annuities are expensive financial products not worth considering.

Annuities are usually sold by insurance salespeople who are paid on commission — which means when you buy the product, the salesperson gets paid for the sale.

That creates an inherent conflict of interest, and it may be difficult to get the best advice since selling the product means a direct profit for the insurance salesperson.

What Is Annuitization + Should I Annuitize?

Annuitization is the process of converting a sum of money (e.g., $500,000) into an income stream (e.g., $1,500/month) for a certain time period.

Annuitization is NOT the same thing as an annuity.

Remember, an annuity is a financial product. Just like a mutual fund. Or, a REIT.

Here’s an easy way to understand the difference:

- An annuity is a thing. It’s a noun.

- Annuitization is a process. It’s a verb.

You can actually annuitize an annuity. That is, you can turn the dollar value of an annuity into an income stream.

You can also annuitize your pension benefit, lottery winnings, or money won from a lawsuit.

The Advantages of Annuitization

Forced Budgeting

You could use annuitization as forced budgeting.

Let’s say you have a $500,000 annuity. You’re fearful that you will spend it all at once and want to put some guardrails in place.

One solution might be to annuitize your annuity. Doing this will only give you access to a small slice of your annuity each month/year and can help prevent you from spending your money in one fell swoop.

Ease the Burden and Stress of Investing

Annuitization can also relieve you of having to manage a large amount of money.

Even if you do have the discipline to only spend $15,000/year of your $500,000, what will you do with the rest of the money?

Will you invest it? If so, how?

When you create your investment portfolio? What percentage of your money will you put into stocks versus bonds? Are you going to rebalance it annually, quarterly, or never?

Annuitization makes these decisions more manageable and less overwhelming. And annuitization can offer a competitive guaranteed rate of return relative to investing a pot of money yourself.

Throughout my career, I’ve seen annuitization schedules that offered a 6% rate of return. (The investment return is calculated by considering how many payments you’ll get over time compared to the big pot of money not received).

Six percent is really competitive. In fact, it would be nearly impossible to earn a consistent 6% rate of return on any other investment.

Give Yourself a Tax Break

Finally, annuitization can also be used as a tax strategy. Receiving a lump sum of money can trigger adverse tax consequences. Choosing to annuitize can decrease that tax burden.

Again, say you have $500,000 — but you choose to use annuitization to distribute $25,000 per year to yourself over 20 years. And that relatively smaller distribution of $50,000/year prevents you from being pushed up into a higher tax bracket. Win!

What to Watch Out For If You Annuitize

Of course, annuitization has risks. This includes company risk, market risk, and illiquidity risk.

Company Risk

When you annuitize, you put all your financial eggs in the basket of the company offering the annuity.

If that’s your previous employer, it may not hurt to research your employer’s pension. Figure out how much money they have on the books. Is the pension underfunded? That’s likely the case with many pensions today.

Stock Market Risk

If you decide to take a one-time payment, you’ll be investing the money yourself. And, as with any investment, that carries risk.

Historically, the stock market has done well on very long timelines, but has done relatively poorly on short ones. When you take a large one-time payment, you’re trading the risk the pension goes insolvent (i.e. goes under because it runs out of money) for the risk of the stock market.

Both are risks, of course, but which one is right for you depends on your comfort level.

Illiquidity

When you annuitize, you’re forced to settle for whatever annual payment you’re given. If you need cash in an unforeseen event, that’s too bad. You can’t invade the original pot of money when you annuitize.

Summary: Annuitization, Annuitize, Annuity

Remember, an annuity is an investment product. An annuity is a thing. It’s a noun.

Annuitization is a payment option you can take when dealing with a large pot of money. It’s a process (i.e., a verb).

Here it is used in a sentence:

“I am not going to annuitize my pension benefits.”

Annuitization can offer many benefits over taking a large amount of money all at once. But there are also major drawbacks to consider.

The decision, of course, is personal. Just be sure to do your research and ask a lot of questions before making it.