Today we are talking about the next stock market crash and how to prepare.

You’ve probably heard the media making all kinds of predictions:

“The stock market is overvalued. It can’t keep going up forever. It’s an election year, so the stock market is going to crash!”

And yeah, it’s fun to listen to the so-called experts make guesses about the future.

Eventually, their predictions will come true.

But, when will stocks crash?

Unfortunately, nobody knows.

However, just because we don’t know when the market will tank doesn’t mean we can’t prepare for the next stock market crash.

If you’re worried about the stock market going down and want to know how you can prepare, you’ll enjoy today’s post.

You might also enjoy the podcast we published on investing in the stock market at all-time highs:

Is A Stock Market Crash Around the Corner?

Over the years, many people have tried to guess the direction of the stock market. Almost without fail, the vast majority of investors who try to time the market bomb the task.

Although some people get lucky now and then, numerous academic studies have shown that no one successfully guesses the direction of the stock market consistently.

In short, it’s impossible to know where the stock market is headed next. And if anyone tells you where the market is headed, they are probably trying to sell you something.

(And they are probably wrong!)

While you might hate the idea that you have no idea what stocks will do next, the solution is simple: strive to create an investment strategy that will perform regardless of when (not if) the next stock market crash occurs.

Investing for the Next Stock Market Crash: 6 Strategies for Success

Investing for the next stock market crash isn’t rocket science, but there are several proven principles for investing success to consider. Those principles include:

- Buy & hold

- Diversify

- Pick the portfolio that’s right for your risk tolerance and risk capacity

- Pick an ideal bond selection

- Diversify internationally and into real estate

- Have an investment policy statement

#1: Buy, Hold, and Stay the Course

Staying the course is a surefire way to get the investment return of the stock market.

Why?

Jumping in and out of the market only guarantees that you’ll pay more in trading fees. And fees are something you must avoid at all costs, (pun intended). That’s because fees eat away at the amount of money you make investing.

Fees eat away at the money you make investing in the stock market.

Staying the course works!

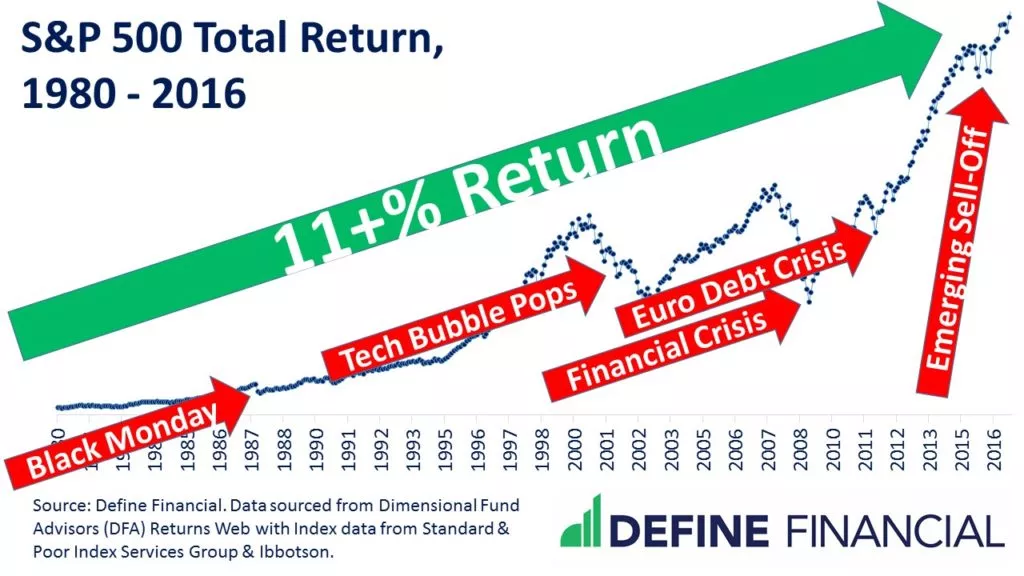

Historically, staying the course has generated handsome investment returns – even through some of the worst market crashes imaginable.

If you had stayed the course through market crashes, you would have been handsomely rewarded.

How much would you have earned if you stayed the course from 1980 to 2016?

Approximately 11 percent per year on average over a span of 37 years.

This is the type of reward people have seen historically when they invest for the long run.

#2: Diversify

Another great way to design your portfolio to weather market crashes is diversification. By not putting all your eggs in one basket, you are reducing risk – thus giving you the potential to score on investments that zig while others zag.

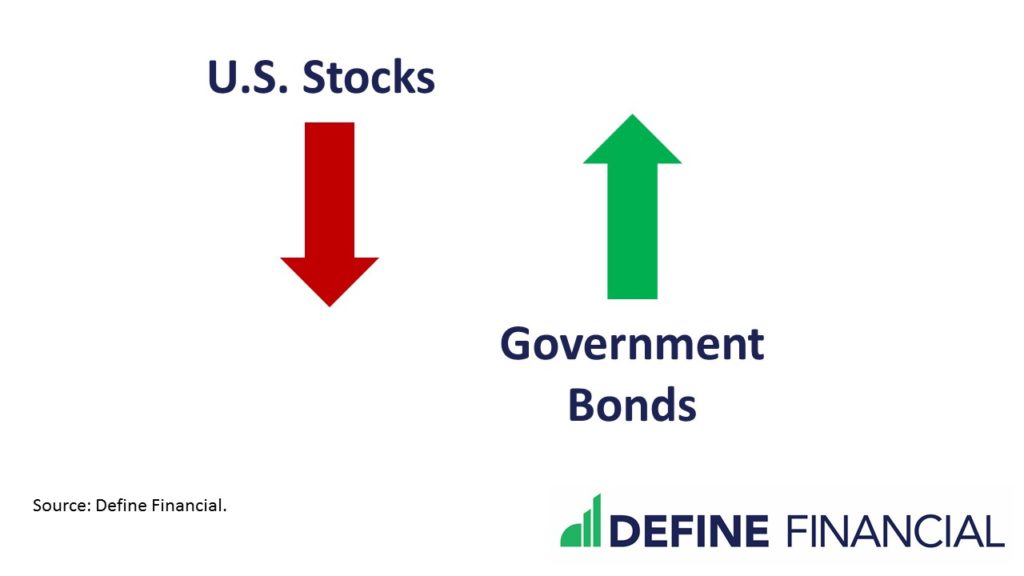

U.S. Government Bonds tend to go up when U.S. stocks crash.

How would you like an investment that can increase in value when the U.S. stock market declines?

Then look no further than United States government bonds – arguably the most valuable asset of a diversified portfolio.

This is just one example of how diversifying can help you weather the ups and downs of the stock market, but there are plenty more where that came from.

#3: Pick the Right Stock/Bond Mix for You

Another great way to design your portfolio for the next stock market crash is to create a portfolio that you can stick with!

If you can’t stomach the ups and downs of the market, either:

- Don’t look at your investments!

- Opt for fewer stocks, picking up more U.S. government bonds for your portfolio instead.

While bonds have historically underperformed stocks, being able to stick with your investments through the ups and downs is more important than trying to maximize returns.

Why?

Because if you invest in 100% stocks and then sell everything at the next market bottom, you’re going to lose money. If you choose a lower-risk portfolio you can stick with, that’s always a winning strategy.

#4: Choose the Right Type of Bonds

There are many, many types of bonds. For example, you can choose among:

- high-quality corporate bonds

- junk bonds

- municipal bonds

- international bonds, and even

- emerging market debt

And of course, there is also the infamous mortgage-backed security.

With so many bonds to choose from, which bonds should you hold to best prepare your portfolio for the next market crash?

The truth is, you may not want to hold any of the above.

Some make the case that the only bonds you should hold are United States Treasuries bonds.

Why?

Because United States Treasuries may be the most valuable diversifier when it comes to your portfolio.

The above-linked research has shown that, in a market correction, nearly every single liquid investment moves in the same direction: downward.

One exception is United States Government Bonds (a.k.a. Treasuries).

Treasuries frequently show little decline – and sometimes increase in value when the stock market heads down.

For this reason, holding Treasuries may be the single best way to prepare your portfolio for a market correction.

#5: Consider International Stocks and REITs

Many investments tend to decrease in value simultaneously during a market crash. However, these investments may not do all do so to the same degree – or at the same time.

This is why it makes sense to hold not only United States stocks, but also stocks from all across the world. Like U.S. stocks, global stocks can be broken down into developed and emerging economies.

Adding a slice of real estate via Real Estate Investments Trusts (REITs) to your portfolio may make sense, too.

Unfortunately, we do not know ahead of time which investments will decrease more and which will decrease less during the next market.

But, what we can do is hold a little bit of each of every type. That way, when one type of investment decreases more than another, we are in the best position to rebalance our portfolios.

#6: Have an Investment Policy Statement (IPS)

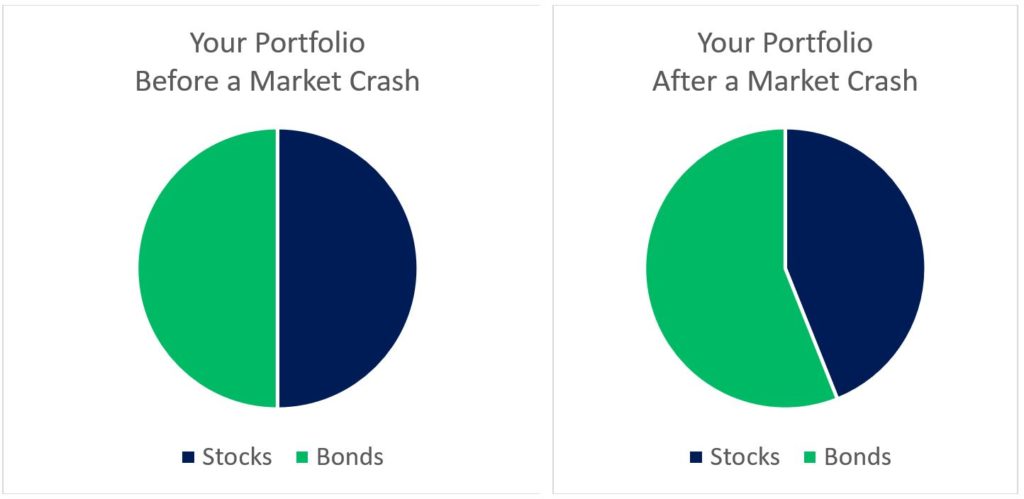

Following a stock market crash, your investments are likely worth much less than they were just days ago.

Fortunately, your United States Treasuries may be worth just a little bit more. This is because market participants panic during a crash – shunning the downward-dropping stocks for the safety and comfort of United States Treasuries.

Because of all this, your portfolio is now out of balance.

Your Investment Portfolio of Stocks and Bonds Before and After a Stock Market Crash

How do you know that your portfolio is out of balance? Because your Investment Policy Statement (IPS) says so.

An IPS is a document that states how you (or your financial advisor) are going to invest your money. Your IPS can be very detailed (such as elaborating on the tolerances for an increasing equity glidepath) or very simple.

At the very least, your IPS will dictate what percentage of your investments will go to globally-diversified stocks, and what percentage of your money will go to United States Treasuries.

With your IPS already in place and a market crash behind us, you’ll need to rebalance your portfolio.

What this means is, you need to sell the investments that have increased in value. (This will most likely be your United States Treasury bonds.)

From there, you need to buy investments that have decreased in value. (This will probably be your stocks.)

You need to be prepared to do this – and not just mentally, but emotionally. You need to know that, eventually, you are going to put more money into what has just decreased in value – and sell the one thing that has made money during a panic!

I know this is hard. However, this is an amazing investment opportunity. Buying low and selling high is too good an offer to pass up. You have to take advantage of stocks when they are on sale. That’s how you make money investing.

How Not to Prepare for the Next Bear Market

Now that we’ve covered how to prepare your investment portfolio for the next market crash, let’s cover some misunderstandings about this very subject.

Here’s what you probably shouldn’t be doing to your portfolio today, along with common mistakes investors make when preparing their portfolio for a market crash.

Shorting the Stock Market is Very Risky

Shorting the market is not a foolproof strategy. You never know when the market is going to correct. As such, you could be shorting the market for a very long time.

Shorting the stock market can be a very expensive proposition that likely will not payout.

Why not?

Because more often than not, stocks go up in value rather than down. If you’re shorting the market, the odds aren’t in your favor.

Inverse Funds Don’t Sense as a Long-Term Play

We’ve already covered why it simply does not make sense to short the market.

So, if shorting the market doesn’t make sense, why opt for a tool that is poorly designed for shorting the market?

Most (all?) inverse funds are designed to be held for less than a day. These are tools for day-trading. Holding an inverse fund for long periods of time (longer than eight hours) as protection against a market correction doesn’t make any sense.

Alternative Investments as a Stock Market Hedge Don’t Work

Just because an investment charges a high fee does not mean you’re safe from stock market corrections.

In fact, portfolios holding alternative investments have been shown to do worse during a stock market recovery. This is because alternative investments charge very high fees.

The fees on alternative investments are so high that managers of these alternatives investments simply cannot make up for in investment returns for the amount they charge. The numbers just aren’t there.

Not only are alternative investments very often poor performers, but their lack of liquidity means giving up the greatest opportunity that happens during a stock market crash: rebalancing.

If you can’t sell something to buy something else, you’re missing out on a basic tenet of investing we’ve already covered: buying low and selling high.

Insurance Products to Protect Against a Stock Market Crash is a Sales Pitch

Despite what an insurance salesperson might have you believe, investing in an indexed annuity, whole life insurance policy, or universal life insurance policy is not the best way to protect yourself from a market crash.

If you need insurance anyway, you can always buy term life insurance and invest the difference.

Hoarding Gold is Not a Smart Investment

In the short term – as in, the day of the stock market crash – gold may do well.

But, as a long-term investment, the numbers show that is not the case.

On a long timeline, you’re best served by holding a portfolio of diversified stocks and United States Treasuries.

Please Do Not Buy Non-Traded REITs

Non-Traded REITs have some challenges as alternatives investments. Both alternatives and non-traded REITs have high fees. This means they may likely offer poor investment returns.

Also, both are illiquid, meaning you can’t sell a portion of them to help rebalance your portfolio after a market crash.

If you believe in diversification and want to add real estate to your portfolio, consider low-cost publicly traded REIT funds.

It Doesn’t Matter if the Next Market Crash is Around the Corner

While it’s impossible to know if the next stock market crash is around the corner, you can design your portfolio so that if it happens tomorrow, you will be prepared because:

- You know to stick with your investments for the long haul

- You have diversified into U.S. government bonds, international stocks, and REITs

- You have created a portfolio that suits your appetite for risk

- You have a solid investing plan

Don’t let current market movements fool you into investing like a madman – or worse, becoming too conservative. No one knows where the stock market is headed next, and that includes you, as well as any stock market pundit.

The best investment move you can make today, tomorrow, and in the future, is to choose an investment strategy that will last for the long run, then stick with it.